In this article:

The time has finally come: You're ready to kick your mom's hand-me-down clunker to the curb and buy your first car. But before you race over to the auto dealership, cool your engines long enough to make a plan. These tips to know before buying a car will help ensure you get the vehicle you want at a price you can afford.

1. Know Your Budget

The first step in buying a car is to set a budget. This will help you narrow your focus to cars within your price range before you fall in love with one that'll break the bank.

To create a budget, start by adding up all your monthly income and all your monthly expenses. Be sure to categorize your expenses as either fixed (such as your rent, utilities or student loan payments) or discretionary (such as going out to eat or buying new clothes). Once you've got an accurate idea of your expenses, you're likely to see several areas where you could cut back, which could leave you more money to put toward your monthly car payment.

In general, it's best to keep your car payment below 10% of your monthly take-home pay. But your monthly payment isn't the only factor to take into account when budgeting for a car. You'll also need to consider the ongoing expenses of owning a car, such as insurance, gas, repairs and maintenance.

Loan terms are another factor to consider. Auto loan terms generally range from 36 to 84 months. The longer the loan term, the smaller your monthly payment will be, but the more you'll pay in interest over time. By choosing a less expensive car and putting down a larger down payment, you can opt for a shorter loan term and still keep your payments manageable.

2. Do Your Research

Once you have an idea of your budget, do some research to see what vehicles in your price range fit your needs. Researching online at local dealerships' websites or at automotive sites such as Edmunds.com, Autotrader or Kelley Blue Book will give you a good idea of the price you can expect to pay.

While doing this research, you'll undoubtedly be tempted by great deals on car leases. Many drivers may prefer to own their car outright, but there are plenty of appealing advantages to leasing one. After all, you'll get a brand-new car, typically for a lower down payment and monthly payment versus buying. But limitations can be restrictive, and you may balk at putting money into a vehicle you'll eventually have to return. Ultimately, it's a decision that depends on your personal preferences and needs.

3. Explore Your Financing and Purchasing Options

When you've narrowed down your dream car list, it's time to think about how you'll finance the purchase. Unless you've saved up enough money to buy a car outright with cash, you'll need an auto loan to finance the purchase. According to Experian's State of the Automotive Finance Market from the fourth quarter of 2019, 84.6% of new cars and 54.6% of used cars were financed.

You can get financing through an auto dealership or through a third party such as a bank or credit union. However, because auto dealers will tack on additional fees for handling the loan, you can often get better terms from a bank or credit union. Getting preapproved for a loan through a third-party lender can also give you negotiating power to see if the dealer will match the loan terms.

If you're applying to multiple lenders to get the best loan terms, be sure to apply to all of them within a short time period. Applications made within a 14- to 45-day period (depending on the scoring model) will only count as one hard inquiry in your credit score. Once you're approved, the lender will give you proof of the loan terms and amount to show the dealership.

When it's time to buy, your options for where and how to do it are greater than ever before. Depending on whether you're seeking a new or used car, you can buy from dealerships, dealership websites, online car-buying sites or private sellers. Some services will even have the car delivered right to your door.

4. Improve Your Credit Score

Knowing your credit score before you seek financing for your purchase will give you an idea of which loan terms you're likely to qualify for. Start by getting a copy of your credit report and checking to make sure it's accurate. Then check your credit score.

Having good to exceptional credit (which lenders generally consider a FICO® Score☉ of 700 or above) makes it easier to qualify for favorable loan terms. Consumers with the highest credit scores financing a new car pay $522 a month on average while those with the lowest credit scores pay $562 on average, a $40 a month difference, according to Experian data.

If your credit score isn't in that range, and you don't need the car right away, consider postponing your purchase. In the meantime, you can work to improve your credit score and potentially earn access to loans with lower interest rates, which will save you money.

To help improve your credit score, continue to pay all your bills on time, pay down your debt and reduce your credit utilization ratio. For a quick boost to your credit score, consider Experian Boost®ø, a free service that adds your on-time utility and telecom bill payments to your credit history.

5. Save for a Down Payment

How big does the down payment on a car need to be? Just as with buying a home, most lenders like to see a down payment that's at least 20% of the car's price. (If you're buying a used car from a dealership, a 10% down payment is generally sufficient.)

There are several reasons a 20% down payment makes sense:

- New cars typically lose a portion of their value in the first year of ownership, so a down payment of 20% helps make sure you never owe more than your car is worth.

- The bigger the down payment, the smaller the loan you'll need.

- A bigger down payment generally earns you more favorable loan terms, which saves you money in the long run.

Many dealership, automaker and automotive websites have online payment calculators you can use to arrive at the best down payment amount. By putting in various car prices and loan terms, you can estimate how different down payment amounts might affect your monthly payment and the amount of interest you'll ultimately pay.

6. Consider Buying Used

Is your heart set on a shiny new car? You may have second thoughts when you discover just how much that new-car smell will cost you. According to Experian data, the average monthly payment for a new car is $161 dollars more than the average monthly payment on a used car ($554 vs. $393).

Buying a used car is often a better option for first-time car buyers on a budget. Cars less than five years old typically have many of the same safety features and technological bells and whistles newer models do, but at a much lower cost. If a five-year-old car is too "vintage" for you, look for dealers selling two- to three-year-old cars that are coming off leases.

You can buy used cars from auto dealerships or from private sellers. Many car dealers and manufacturers sell "certified pre-owned" (CPO) cars. These are used cars that have undergone through inspections and reconditioning; they often come with limited warranties and other extras. When buying a CPO car, make sure you fully understand whether the car is covered by a warranty and, if so, what it covers.

7. Get the Car Inspected

Whether you're buying a used car from someone you know or from a dealership, you should always have a trusted mechanic inspect it first. This is called a pre-purchase inspection and is a service most auto repair shops offer. You may have to pay a few hundred dollars for this service, but that's money well spent if it keeps you from buying a car with major issues under the hood.

Even a CPO car should undergo an independent inspection before you buy it. CPO inspections tend to focus on major systems and obvious problems. Independent mechanics can point out smaller issues, poorly done repairs and potential future problems. If the car has been inspected by the dealership, get a written report of the inspection to give your mechanic.

To find a mechanic, ask your friends and family for recommendations or look at online review sites for highly rated mechanics near you. Mobile mechanics who come to you to inspect the car are also an option, but taking it to an auto repair shop allows the mechanic to inspect it more thoroughly. If the seller objects to an independent inspection, consider that a red flag.

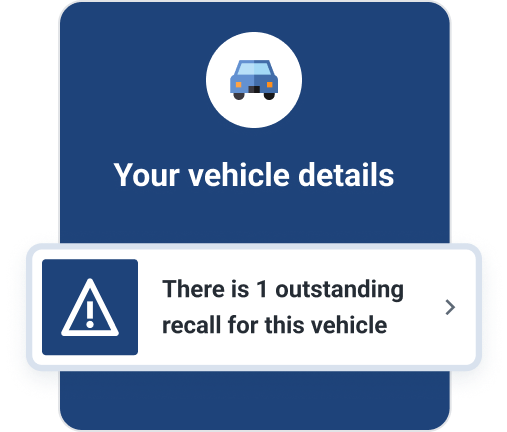

Manage all of your vehicles in one place

8. Negotiate the Price

Both dealerships and private sellers expect you to haggle over the price of the car. You'll have more wiggle room with a used car, since it doesn't have a set MSRP (manufacturer's suggested retail price). Even with a new car, you can generally negotiate your way to a significant savings off the sticker price.

To drive a hard bargain, find out how much the car is worth by researching its value on automotive websites. Be sure to take into consideration any "extras" the car has, such as leather seats or a top-of-the-line entertainment system. When you arrive at an estimated average price, take 10% to 20% off that figure and make the seller an offer. You'll have more leverage if you are preapproved for a loan or if you're paying in cash.

Timing can help you get a better deal too. If you're buying new and don't need the car right away, try waiting until the last few months of the year to go shopping. That's when dealerships typically offer special incentives such as cash back or promotional 0% APR financing so they can clear cars off the lot to make way for next year's models. Can't wait that long? If you can hold out until the end of the month, salespeople eager to make their monthly sales quotas are often quite willing to bargain.

9. Read the Contract Carefully

Buying a car can be a lengthy and stressful process. By the time you have a contract in hand, you're probably so eager to get behind the wheel that you're ready to sign the contract without even glancing at it. Unscrupulous car dealers count on this and may pad contracts with extra charges you never agreed to or change the terms you discussed.

When you sign a contract, you're entering into a legal agreement with the seller—and once you put your name on the dotted line, it's often very difficult or impossible to renege (and if you can, you'll almost certainly pay a fee). Whether you're buying from a dealer or a private party, take as much time as you need to read the contract in full before you sign. Don't be shy about asking questions or calling a trusted friend or advisor if there's anything you don't understand.

10. Enjoy Your New Car

Congratulations—you're a car owner! Buying your first car may be the first major purchase you ever make. There's a lot to consider, but following the simple steps above can help ease the stress. With some careful budgeting, research and planning, you'll have the confidence to negotiate the best deal and get the car of your dreams without getting taken for a ride.