Auto Loan Refinancing: Options and Rates

Quick Answer

The average rate for refinanced auto loans is 8.45% according to Experian data. However, your rate will vary based on your credit score, loan amount, repayment term and other factors.

The average rate for refinanced auto loans is 8.45%, according to Experian's State of the Automotive Finance Market report from June 2025. That's 2 percentage points lower than the average 10.45% rate borrowers were paying before refinancing.

If you're thinking about refinancing your car loan, here's what you need to know about how it works, when it makes sense and how interest rate trends can impact your potential savings.

Compare rates on auto refinance

Find a good auto refinance loan with today’s rates. Compare current rates and offers to find the best loan for you.

Refinancing Your Car Loan

Refinancing your car loan involves replacing your existing auto loan with a new one, usually from a different lender. The primary goal of refinancing is often to obtain better loan terms. It can make sense if your credit score has improved, market rates have dropped or you want to lower your monthly payment by extending your loan term.

Refinancing may also help if you need to remove or add a co-borrower, you want access to some of your vehicle's equity or you want to switch lenders for better customer service.

Average Auto Loan Refinance Rate vs. Original Loan Rate, 2022-2025

Since peaking at 9.89% in December 2023, the average auto loan refinance rate has been on a steady decline, reaching 8.45% in June 2025, according to Experian data.

Following the Federal Reserve's September 2025 rate cut, and with additional reductions anticipated, borrowers should expect interest rates to continue trending downward.

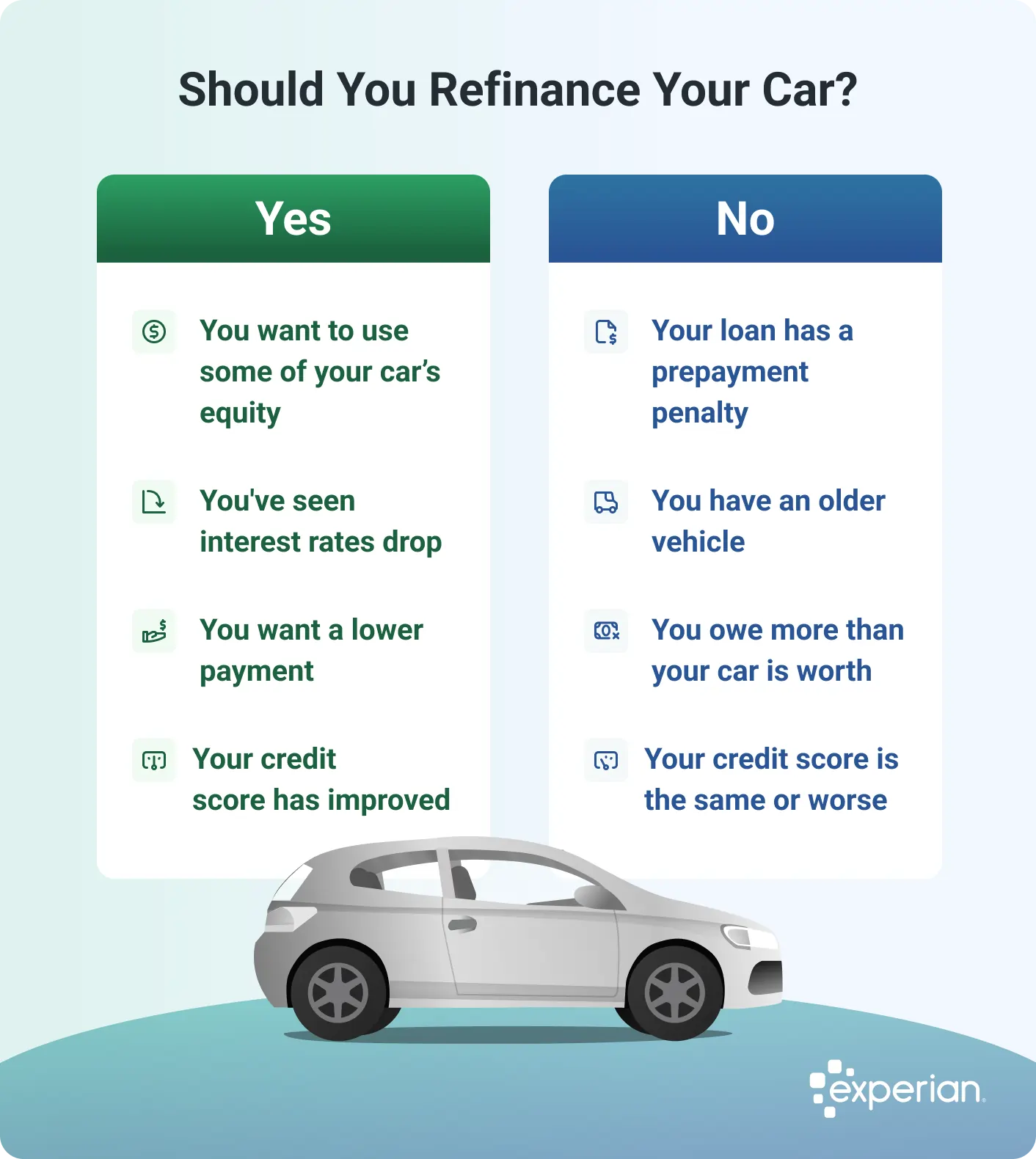

When Should You Refinance Your Car Loan?

Refinancing your car loan can potentially save you money and provide some budget relief. However, it's important to know your situation before pulling the trigger. Here are some situations where it makes sense to refinance.

You Want to Use Some of Your Vehicle's Equity

If you made a sizable down payment or you've paid down a significant amount of your loan, you may have a lot of positive equity in your vehicle. In this event, you might be able to tap some of the equity in the form of a cash-out auto refinance.

If interest rates are favorable, tapping your car's equity could be an affordable way to consolidate high-interest debt, pay down medical bills, bolster your emergency savings or make some home repairs or renovations. However, be sure to look at the new monthly payment and overall interest costs to determine whether it's the right move.

You've Seen Interest Rates Drop

If interest rates have gone down since you took out your auto loan, refinancing could save you money. A lower rate means you'll pay less in interest over the life of the loan and may be able to reduce your monthly payment without extending your term. Even a small rate decrease can make a noticeable difference in your total cost.

Learn more: What Is a Good Auto Loan Interest Rate?

You Want a Lower Payment

Scoring a lower interest rate can help you secure a lower monthly payment, but it's not the only way. When you refinance your car loan, you may also have the option to extend your repayment term.

Of course, this will result in more interest charges over the long run. However, if you're on a tight budget and you're worried about not being able to make your monthly payments, it can be a worthy tradeoff.

Learn more: What to Do if You Can't Afford Your Car Payment

Your Credit Score Has Improved

If you've taken steps to build your credit since you first bought your car, you may be eligible for a lower interest rate than what you're currently paying. This can be the case even if market rates haven't budged.

Before you consider refinancing, get free access to your Experian credit report and FICO® ScoreΘ to see where your credit stands. In addition to evaluating your credit health, look for opportunities to make additional improvements to maximize your chances of saving money.

When Not to Refinance Your Car Loan

Although there are some clear advantages to refinancing your car loan, it's not always the best choice. Here are some situations where it may not make sense.

Your Loan Has a Prepayment Penalty

You typically don't have to pay closing costs on an auto refinance loan. However, some auto lenders charge a prepayment penalty if you pay off your loan too early. In most cases, it'll be roughly 2% of your outstanding loan balance.

Lenders aren't allowed to include the penalty on loans with repayment terms of 61 months or longer. If your loan's original term was shorter than that, though, review your loan agreement to see if there's a penalty and what the terms look like.

You Have an Older Vehicle

Refinance loans tend to be more expensive if your car is more than a few years old. But, if it's 10 years or older or has more than 100,000 miles, you may have a hard time finding a lender willing to work with you at all. In this scenario, it may make more sense to focus on paying off your existing loan.

You Owe More Than Your Car Is Worth

If you have negative equity in your vehicle, you may have a hard time finding a lender willing to approve a refinance loan. Even if they do, you may need to pay the difference to your original lender before you can complete the process.

You can get an idea of your car's value by using an online valuator tool, such as Kelley Blue Book, J.D. Power or Edmunds.

Your Credit Score Is the Same or Worse

If your credit score hasn't increased�—or worse, it's gone down—since you took out your existing loan, you may have a hard time securing a lower interest rate, even if market rates have declined.

Fortunately, some auto lenders allow you to get prequalified with just a soft credit check, which won't negatively affect your credit scores. This can be a great way to evaluate your options before moving forward.

Alternatives to Refinancing

If you've determined that an auto refinance loan isn't your best option, here are some other potential options to consider.

Trading In or Selling Your Car

If you're struggling to keep up with your monthly payments, trading in or selling your car and getting a less expensive model may be more financially sound.

Start by getting an estimate of how much your car is worth, and then evaluate whether it's better to sell it or trade it in.

Consider Leasing

If you have a new car but want a lower monthly payment, you could consider leasing instead of owning. According to Experian data, the average monthly lease payment as of June 2025 is $612, while the average payment for a new car loan is $749.

Before you make that decision, however, carefully consider all the pros and cons of buying versus leasing.

Request a Loan Modification

If your credit score is in poor shape, buying or leasing another vehicle may not be an option. In this case, consider reaching out to your lender to see if you can get your loan modified.

A loan modification may extend your repayment term, reduce your interest rate, reduce your monthly payment or provide short-term forbearance as you manage your financial obligations.

Build and Maintain Good Credit to Maximize Your Savings

Even if you don't have time to improve your credit score right now, it's a good idea to prioritize good credit habits to make it easier to qualify for favorable financing terms the next time you need a loan.

With Experian's free credit monitoring service, you'll get access to your FICO® Score and Experian credit report, along with real-time alerts when changes are made to your report. Regularly monitoring your credit can help you better understand how to make improvements and protect yourself from potential issues before they get out of hand.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben