Can I Get a Car Loan With a 600 Credit Score?

You've wanted to own a cherry-red convertible since you were 6 years old. Now you've found the exact model you want; you even took it for a test drive to feel the wind in your hair. There's just one thing you worry might stand between you and the open road: Your credit score is 600.

So will a score like that be a stop sign or just a speedbump? You may be able to get an auto loan with a 600 credit score, but there are other factors lenders will look at to determine your eligibility for a loan. Taking these steps before you apply for an auto loan can help you get approved for the car of your dreams.

Learn more: Compare Current Auto Loan Rates

Is 600 a Good Credit Score?

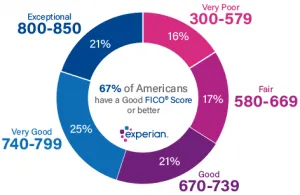

Just how good (or bad) is a 600 credit score? Credit scores typically fall within a range of 300 to 850. Higher credit scores tell lenders that you have a history of responsibly managing your credit and debt. Lower credit scores can indicate that you pose more of a borrowing risk, which may cause a lender to charge higher loan interest rates.

There are dozens of credit scoring models, and each one uses slightly different criteria to calculate your credit score. This means what is considered "good" can vary from model to model. In the FICO® ScoreΘ, a VantageScore® credit score model, for example, a credit score of 600 is considered "fair." In the VantageScore 3.0 model, a credit score of 600 is considered "poor." Both models use a range of 300 to 850, and a 600 credit score with either model is below what lenders tend to view as good credit.

What Credit Score Do You Need to Get an Auto Loan?

The credit score you need to get a car loan isn't set in stone. That's because auto lenders can use any credit scoring model they choose when assessing your creditworthiness. They might use a version of the FICO® Score, a VantageScore credit score or a specialized score such as the FICO® Auto Score. Designed specifically for auto lenders, this score more heavily weights the credit behaviors auto loan issuers are concerned about.

The credit score required to qualify for a car loan will also vary depending on the specific lender's tolerance for risk, how much money you want to borrow and perhaps even the vehicle you're buying. For example, some lenders cater to borrowers with less-than-perfect credit, while others have much stricter standards. You may be able to get a smaller auto loan with a lower credit score, but have more difficulty getting a larger one.

Your credit score isn't the sole factor that lenders will assess when reviewing your loan application, either. Your credit report, employment history and debt-to-income ratio all could play a role, and potentially help compensate for your 600 credit score.

But no matter which credit scoring model your chosen lender uses and what other factors they consider, having a poor credit score generally makes it more difficult to get a car loan. For example, you may need to make a bigger down payment to shrink your loan amount and reduce the lender's risk. If you do get approved for an auto loan despite a lower credit score, your loan will probably have a higher interest rate than it would if you had a good credit score. A higher interest rate could add thousands of dollars to the cost of your car over the life of the loan, so it definitely pays to get it as low as possible.

Compare rates on a new auto loan

Find a good auto loan with today’s rates. Compare current rates and offers to find the best loan for you.

Check Your Credit Report Before Applying for an Auto Loan

Before accepting your loan application and setting loan terms, auto lenders will take a close look at your credit report. They'll be on the lookout for red flags such as late payments, high credit card balances, account default, bankruptcy and foreclosure. These warning signs could indicate you'll have problems repaying your loan.

To keep such unpleasant surprises from derailing your loan application, it's a good idea to check your credit report a month or two before you apply for an auto loan. Get a free copy of your credit report and review it to make sure all the information is accurate, including your personal data, account information and inquiries into your credit. If you see anything that's incorrect or looks suspicious—for example, if a credit card that you never applied for recently checked your credit report—contact the credit bureau to dispute the information and have it corrected before you apply for your car loan.

How to Improve Your Credit Score Before Applying for an Auto Loan

You may not know which credit scoring model an auto lender will use when reviewing your application, but they all tend to reflect credit behavior in similar ways. Checking your credit scores as well as your credit report will give you a sense of whether lenders will view you as a good borrower or a credit risk. If you discover that your score is 600 or lower, and have some time, take these steps to improve your credit score before you apply for a car loan.

- Bring any late accounts current right away. Going forward, make sure to pay all your bills on time. If you tend to forget due dates, set up automatic payments to help you stay on track. Payment history accounts for about 35% of your FICO® Score.

- Pay down existing debt. Your credit utilization ratio reflects how much of the credit available to you you're actually using. Aim to get this ratio to 30% or less, but the lower, the better. Keep your credit card use to a minimum and pay off your balances in full every month.

- If you pay off a credit card, don't close the account. Keep it open, even if you don't plan to use it in the future. This can help to reduce your credit utilization ratio, increase the length of your credit history and improve your credit mix, all of which contribute to a good credit score.

- Don't apply for new credit. Every application for credit creates a hard inquiry on your credit report. Hard inquiries on your credit report negatively affect your scores slightly, but will drop out of your score calculations after a year.

- Sign up for Experian Boost®ø. This free service adds your on-time phone, utility and similar payments to your Experian credit history. These payments aren't normally included on your credit report, but including them can help to raise your credit score.

- Monitor your credit. Keeping a close eye on your credit can help you spot any issues before they start to drag down your scores. Experian's free credit monitoring services can alert you if you start charging too much on your credit card or if you've potentially been defrauded.

Get the Best Car Loan

No matter what your credit score is, shopping around for a car loan and comparing what each lender has to offer is a smart move. Knowing your credit score before you start researching makes it easier to narrow down the types of loans you may qualify for. A credit score of 600 won't necessarily keep you from getting an auto loan, but it's likely to make that loan more expensive. Taking steps to improve your score before you apply for a car loan can put you in the driver's seat and make it easier to negotiate the best possible loan terms.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen