Can I Get a Credit Card After Bankruptcy?

Quick Answer

You can get a credit card after bankruptcy, but damage to your credit scores may limit your options. If you can’t qualify for a traditional card, a secured card could be a good choice.

It's possible—and advisable—to get a credit card after bankruptcy, although your options may be limited by your credit scores and card issuers' qualification standards. Read on to find how bankruptcy affects your ability to get credit cards and what you can do about it.

How Bankruptcy Affects Credit

Bankruptcy may be the single most severe negative entry that can appear on your credit reports. It will lower your credit scores for as long as it remains, although its impact will lessen over time. How long it takes to expire depends on the type of bankruptcy protection you seek.

- A Chapter 7 bankruptcy, in which you surrender property in exchange for eliminating many debts, stays on your credit report for up to 10 years.

- A Chapter 13 bankruptcy, which establishes a three- or five-year payment plan for making full or partial restitution to your creditors, remains on your credit report for up to seven years.

After you file for bankruptcy, your creditors may recoup only a fraction of the money you owe them (or none at all), so that can make other lenders wary of working with you. Some lenders turn down any applicant with a bankruptcy on their credit report. Others consider applicants with older bankruptcy entries but may charge high interest rates and fees.

How to Get a Credit Card After Bankruptcy

- Check your credit reports. Check your credit report at one or all three national credit bureaus (Experian, TransUnion and Equifax) to keep aware of the many credit updates that coincide with bankruptcy, and to check for accuracy. For example, within three to six months after you file bankruptcy, it should appear on your credit reports, and any accounts discharged through bankruptcy should update within a few months to show zero balances. If you see any inaccuracies on one of your credit reports, you have the right to dispute it and have the report corrected.

- Check your credit score. You can check your credit scores for free from a variety of sources, including Experian. Doing so can give you an idea where you stand when researching credit cards' approval requirements.

- Look for cards that target borrowers with less-than-ideal credit. Struggles preceding bankruptcy often include missed debt payments, accounts placed in collections, and other events that can pull credit scores down to the poor range even before the blow of bankruptcy. If this is your situation, you'll need to look for credit card offers aimed at applicants with lower credit scores. These cards often come with relatively high interest rates and fees, but if you pay your balance in full each month, you can avoid finance charges.

- Use prequalification to gauge likelihood of acceptance. Each time you apply for a credit card, a credit check known as a hard inquiry appears on your credit report and typically lowers your credit scores by a few points. To avoid multiple reductions to your already-depressed scores, take advantage of the free prequalification option offered by many card issuers. This process lets you know if you're likely to qualify for a given card and, if so, how large a borrowing limit you're likely to get. An affirmative prequalification isn't a guarantee—you'll need to submit a full application to get a final decision—but if you're declined at the prequalifying stage, you can save the trouble of applying and racking up a hard inquiry. Experian's card comparison tool can show you which cards you may qualify for based on your credit profile.

- Consider a secured credit card. If you don't qualify for a traditional credit card, a secured credit card can help you rebuild your credit by generating a positive payment history in your credit reports if you make on-time payments. With a secured card, you put down a deposit, which typically serves as the card's credit limit. (The lender will keep your deposit if you stop making payments on the card.) Regular, responsible use of a secured card can lead to credit score improvement.

Tips for Using Credit Cards After Bankruptcy

Getting a credit card as soon as possible after a bankruptcy filing, even if it's only a secured card, can help you demonstrate to creditors that you're on a path to responsible credit management. Here are some tips for doing so that will also promote credit score improvement.

- Avoid excessive balances. Lenders view maxed-out credit cards as a red flag, and even balances that exceed about 30% of your borrowing limit can hurt credit scores. Keeping that percentage, known as your credit utilization ratio, below 10% is best for your credit scores.

- Pay your balance in full when possible. If you make a habit of limiting card purchases to amounts you can pay in full each month, you'll avoid interest charges on most cards, demonstrate good credit management and keep utilization down. This can help you build credit and save money.

- Always pay your credit card bill on time. Payment history is the most significant factor that determines your FICO Score, the credit score used by 90% of top lenders, so regular on-time payments will help your scores, while late or missed payments can significantly lower them.

How to Rebuild Credit After Bankruptcy

Opening a new credit card account and managing it responsibly is a good first step toward rebuilding your credit after bankruptcy. Here are few more:

- Become an authorized user. If you don't qualify for an unsecured credit card, and can't afford a secured card, you may be able to begin logging a positive payment history as an authorized user on a friend's or family member's credit card account. The account will appear on your credit reports, but the primary cardholder is responsible for making payments to the card issuer. If the primary user keeps their balance low and makes timely payments, your credit scores are likely to improve.

- Consider a credit-builder loan. Offered by many credit unions and some other financial institutions, a credit-builder loan can help you save a little money as you work to improve your credit. The lender loans you a small sum (usually less than $1,000), but instead of handing you the cash, it places it in a special savings account that's off limits to you. If you make all required monthly payments on the loan—typically over a term of 24 months or less—the money, plus any accumulated interest, is yours to keep. (If you fail to make your payments, the lender can keep the money). On-time loan payments can help your credit—just make sure any lender you're considering reports payments to all three credit bureaus.

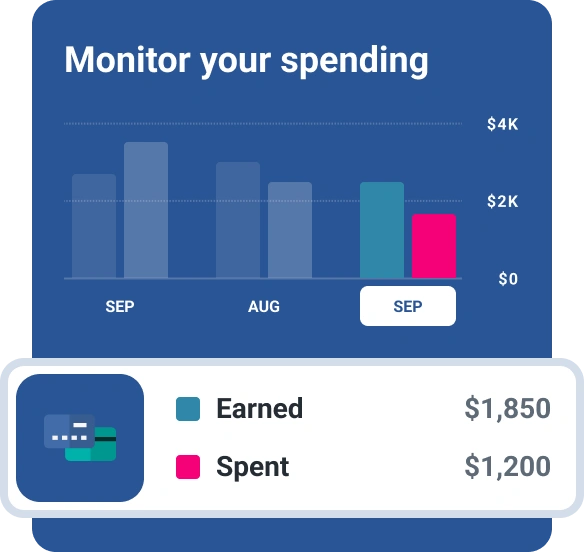

- Monitor your credit reports and scores. Checking your credit regularly to track improvement over time can reinforce good credit habits. It can also alert you to suspicious activity on your credit accounts—a possible warning sign of fraud and identity theft. You can check your credit reports from all three credit bureaus for free at AnnualCreditReport.com. You can also sign up for free credit monitoring with Experian, which allows you to check your Experian credit report and FICO® ScoreΘ from Experian and alerts you when new activity appears on your report.

The Bottom Line

Bankruptcy can have negative consequences for many years, but millions have successfully moved past it, and you can too. Reestablishing credit and a positive payment history as soon as possible after your bankruptcy can help you begin rebuilding your credit and get back on your feet. Regularly checking your FICO® Score from Experian is a great way to track your progress back to credit health.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim