Do Credit Cards Require Citizenship?

You don't need to be a U.S. citizen to qualify for a credit card in the U.S. However, credit card companies must verify your identity, and some companies choose to only offer cards to U.S. citizens or permanent residents who have a Social Security number (SSN).

What Roadblocks Could Non-Citizens Face When Applying for Credit?

Whether you're new to the U.S. or have been here for years but aren't a citizen, you may face several issues when applying for a credit card:

- Some cards are only available to legal permanent residents. Most credit card companies offer credit cards to legal residents and U.S. citizens alike. Undocumented immigrants may have fewer options, but there are credit card issuers, banks and credit unions that offer credit cards to applicants regardless of citizenship status.

- You might not have or be eligible for an SSN. Card issuers may ask for your SSN on the application. If you can't get an SSN, you may be able to apply for an Individual Taxpayer Identification Number (ITIN) from the IRS and use it instead. ITINs are issued to people who need to file federal income tax returns in the U.S. but don't qualify for an SSN.

- You might not be eligible for an ITIN, either. If you don't qualify for an SSN or ITIN, you can apply for certain credit cards using other identification documents, such as your passport. However, you may need to submit your application in a branch or apply over the phone rather than online.

- You don't have any credit history in the U.S. Whether or not you're a citizen, getting approved for a new card can be difficult without a good credit history. But you may have more options than U.S. citizens if you've established credit or banking relationships in your home country.

With these roadblocks and detours in mind, you can start identifying which credit cards you might be able to get before submitting your application.

Finding a Card That Meets Your Needs

Figuring out which card is best can depend in part on your citizenship status and credit history outside the U.S.

For example, if you're a permanent resident with an SSN and no credit history, a secured card could be a good fit—these are also popular for U.S. citizens who are building credit for the first time.

Those studying in the U.S. on a student visa may alternatively qualify for a student credit card. Some cards were even created with international students in mind. You can apply with a copy of your passport, student visa and immigration forms, although you'll also need an eligible U.S. bank account to link to your account during the application.

If you've established credit elsewhere, you may be able to use that to get a card in the U.S. Some international banks and credit card issuers have programs for professionals who are relocated to the U.S.

If you're moving for work, you could also ask your employer if it has any relationships with U.S. financial institutions that offer credit cards to its international employees.

What You'll Need to Apply

For the most part, the application process will be the same regardless of your citizenship status. You can often fill out and submit the application online in a few minutes, and it may ask for your:

- Name and date of birth

- U.S. address

- Contact information

- SSN or ITIN

- Citizenship status

- Country of citizenship

- Employment status and income

- Monthly housing payments

- Whether you have a bank account

If you're applying with a foreign passport, you may need your passport number and visa information. You also likely won't be able to apply online.

Once you submit your application, you could receive a response within a few minutes. If your application isn't approved right away, you can call the credit card issuer to ask why. Your application may have been denied, in which case you could try for a different card. Or, the company may need additional information or documents before making a decision.

Using Your New Card to Build Credit in the U.S.

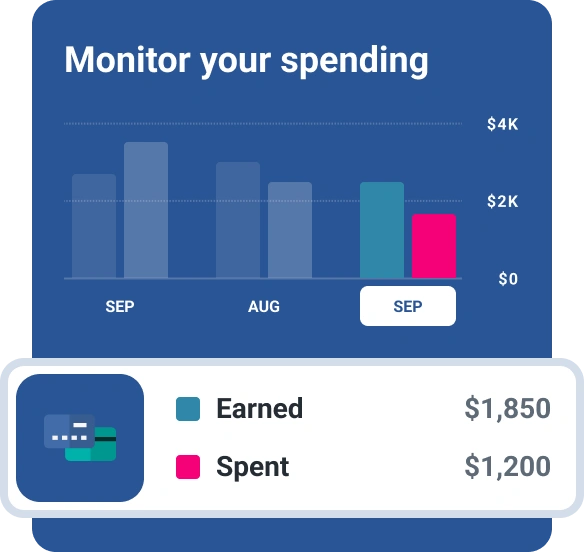

Most major credit issuers will report your new credit card to the major U.S. credit bureaus—Experian, Equifax and TransUnion. As a result, getting and using the card can help you establish or build your credit in the U.S. because your on-time payments will be reflected on your credit report.

The card issuer can send your information to the credit bureaus even if you don't have an SSN. And the bureaus can establish and track your credit based on other identifiers, such as your name and ITIN.

If you get an SSN later, you can contact your issuer and update your credit card account with your SSN. The card issuer can then send your updated information to the credit bureaus, tying all your information together.

But building good credit requires responsible credit use. Having an account with a history of on-time payments can help, as will only using a small portion of your card's credit card limit, since the amount of credit you're using is an important credit scoring factor.

As you establish and build your credit, you can also sign up for free credit monitoring with Experian to track your credit report and credit score if you have an SSN. Or, you can use your ITIN and mail a request for your credit report to each of the credit bureaus using the form from AnnualCreditReport.com.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis