Can Opening a New Account Hurt My Credit Score?

Quick Answer

A small drop in your credit score is a normal result of opening a new credit account, but the effect is temporary and lessens over time through responsible credit use.

When you apply for and accept a new loan or credit account, your credit scores typically decline a few points. This impact is short-lived, however, and scores typically rebound within a few months. Eventually, they may even wind up better than before as you demonstrate your ability to responsibly manage your new debt. Here's an overview of how a new credit account can impact your credit score.

How New Credit Impacts Your Credit Score

Your credit scores are based on a statistical analysis of your credit usage patterns to determine the risk that you'll miss a payment in the future. When new information is added to your credit reports, credit scoring systems such as the FICO® ScoreΘ and VantageScore® may reflect it in your credit scores based on the level of risk it represents.

Your scores may drop when you open an account because it's not yet clear how well you will manage your new debt. Your scores should rebound within a few months, however, once you show your finances are stable by continuing to pay your bills.

Credit scoring systems track new credit by detecting new inquiries and accounts on your credit reports at the national credit bureaus (Experian, TransUnion and Equifax). There are two types of inquiries:

- Hard inquiry: A hard inquiry is recorded in your credit report when a lender performs a credit check related to a new credit application. With exceptions for rate shopping (see below), each hard inquiry may be accompanied by a credit score drop, usually of five points or less.

- Soft inquiry: In comparison, soft inquiries are credit checks that are unrelated to new credit, and they have no impact on your credit scores. Soft inquiries may result when you or a monitoring service you've authorized checks your credit scores; when lenders you do business with monitor your credit for account management purposes; and when lenders check your score for marketing purposes (such as to send you a loan or credit card offer).

How to Reduce the Score Impact of Credit Applications

The hard inquiries that result from applying for multiple credit cards or other revolving accounts in quick succession can have a compounding negative impact on your credit scores. A good approach to comparison shopping for credit cards is to seek preapproval to compare estimated offers.

With installment accounts, including mortgages and auto loans, you're able to submit multiple loan applications to compare interest rates to find the best loan product. Rate-shopping, as it's called, is a smart practice that credit scoring systems are designed to accommodate. They treat hard inquiries for multiple loans of the same type as one event if they occur within a relatively short timeframe.

Current versions of the FICO® Score treat applications made within a 45-day window as a single hard inquiry; older versions of the FICO® Score still used by some lenders apply a 14-day window. The VantageScore applies a "rolling two-week window," that prevents score reductions on comparable installment loan applications submitted in succession at intervals of two weeks or less.

How to Manage New Credit Responsibly

The key to a quick rebound from a drop in credit score related to a new account is to make sure your credit reports reflect stability and steady credit management.

- Make timely payments. Payment history is the single biggest factor that contributes to credit scores, and credit scoring systems view paying your bills on time every month as a sign of good credit health. Do everything you can to avoid missing payments, from setting calendar reminders or phone alarms to using autopay options available from creditors and your financial institution.

- Keep utilization rates low. To promote credit score improvement, avoid running up high balances on new credit card accounts—and all other accounts as well. Experts advise keeping your utilization rate—the percentage of a card's borrowing limit represented by its outstanding balance—below about 30% to avoid more severe damage to your credit scores. Individuals with exceptional credit scores tend to keep utilization below 10%.

- Pace yourself on new credit. Taking on additional loans or credit soon after you open an account can depress your credit scores before they have time to rebound from the previous new debt, creating a compound reduction in your scores. The total score drop could be less than five points per new account but, depending on what your score was to begin with, that could shift your eligibility for certain credit products, or prompt a lender to charge you a higher interest rate. Waiting at least a few months between seeking new loans or credit cards will allow your scores to recover and, potentially, increase thanks to the benefits of additional on-time payments and an expanded credit mix.

The Bottom Line

A small drop in credit score is a normal result of applying for and taking on new debt. A rapid score recovery is an equally normal consequence of managing that new obligation wisely by keeping up with payments, maintaining prudent credit balances, and refraining from taking on too much new debt in a short timeframe. When the time is right for a new credit card, preapproval is your best bet for comparing deals. Experian's card comparison tool can streamline the process by showing you multiple preapproval offers at once.

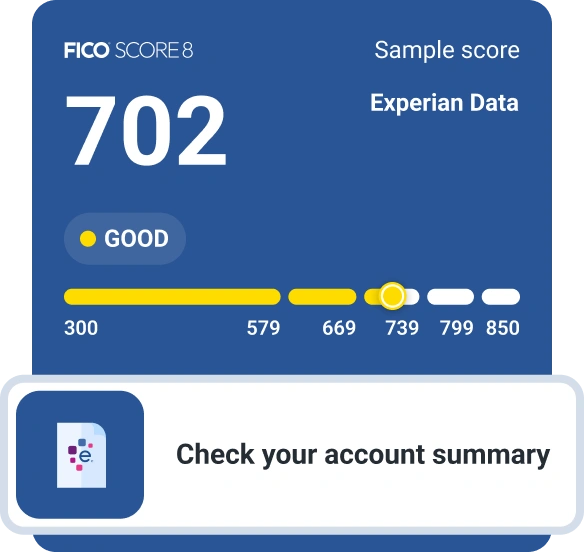

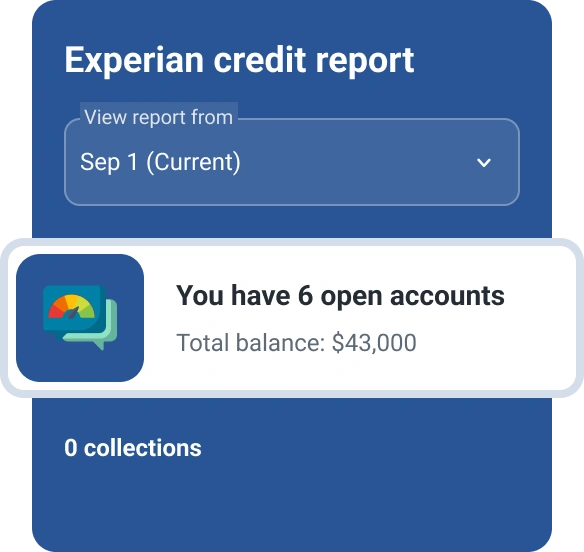

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim