At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our Editorial Policy.

Credit Card Basics

A credit card is a simple plastic card equipped with a special security chip that allows the holder to borrow money from a financial company. It's a form of short-term financing that can be used to pay a bill or make a purchase, either online or in-person at a store, restaurant or another point of sale. Credit cards are considered unsecured debt because you're borrowing without putting up any property as collateral.

When you use a credit card, you don't have to repay the full amount right away as you're borrowing from the card issuer. There's no "pay by" date for when the debt must be repaid. If you do pay the balance within a grace period — usually 25-30 days from the time of purchase — you won't pay any extra. If you don't pay the balance in full during that time, you'll have to pay interest on the unpaid balance. The interest is based on your card's terms and will continue to accrue and add up until you've repaid the amount you originally borrowed.

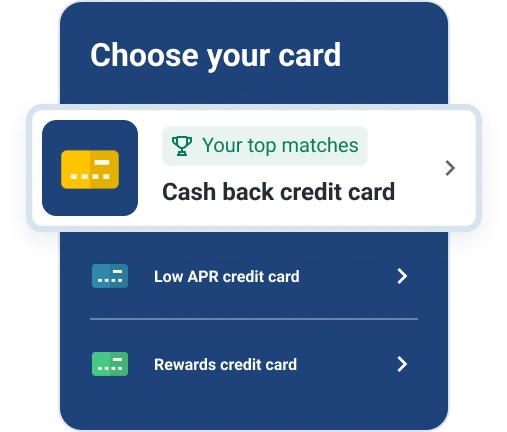

Compare top credit cards matched for you

Benefits of Using a Credit Card

Credit cards can help you make large purchases that you might not immediately have enough cash for since you can stretch the cost over time to make it more manageable.

Using a credit card for purchases can also provide you with a number of protections depending on the issuer. For example, if you use a credit card to purchase an item and learn that the item you bought is defective or damaged, some issuers could refund your purchase up to a set amount. Also, some issuers will protect you against fraudulent charges made to your account. Reading the terms and conditions of any credit card product will inform you of any protections afforded to you.

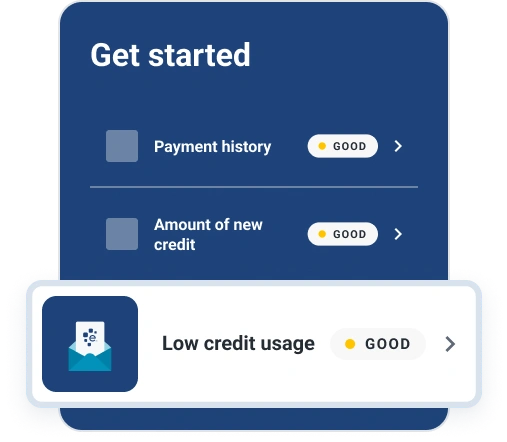

Finally, using a credit card wisely can help you build a solid credit history. When you use a credit card to make a purchase and pay your credit card bill on time every month, those actions will appear on your credit report. Payment history is a significant factor in determining credit scores with the most commonly used credit scoring models. Additionally, lenders or creditors often consider a clean payment history as a positive factor when you apply for new credit or a loan, so that a healthy history of on-time payments can help you get approved with lower interest rates than if you have had one or more missed payments.

Risks of Using a Credit Card

Credit cards can make it easy to spend money you don't have, sending you into debt. Each month you don't pay your credit card balance, interest accumulates and increases that debt. To avoid this, try to only use your credit card in cases when you'll quickly and easily be able to repay the debt. For some purchases, it might make more financial sense to apply for a personal loan instead of using a credit card, since personal loans usually carry lower interest rates. (And if you have more credit card debt than you can handle, you can consider a debt consolidation loan.)

Additionally, while having a credit card can help you build your credit history, it also carries the risk of harming of your credit score. Making late payments or missing payments, carrying too high of a balance, applying for new cards frequently, and closing credit cards can all have adverse effects on your credit score.

Credit Card Terms You Should Know

Reading a credit card agreement can feel like you're trying to understand a totally different language — and in a way, you are — especially when it's all new to you. However, it's important to read your agreement and understand how a credit card works.

- When you use your card to make a purchase, the amount you've spent becomes part of your balance. The balance is the amount you owe on a credit card at any given time.

- If you don't pay off your entire balance in full every month, you'll pay interest. The APR (annual percentage rate) is a factor in determining the amount of interest you pay on revolving balances.

- Some credit cards charge an annual fee that's separate from any interest you may pay. Think of it as the fee you pay just to have the card, whether you actually use it and carry a balance, or don't use it at all.

- The average daily balance is used to help calculate interest charges. By adding together the balance you owe each day in a billing cycle, and then dividing that total by the number of days in the cycle, the card issuer arrives at the average daily balance. That number, multiplied by the interest rate, determines how much interest you pay each month.

- The date on which the card issuer expects you to make a payment is the payment due date. Many card issuers will allow you to request a specific date of the month as your payment due date.

- Credit cards allow you to carry a balance from month to month. When you carry a balance, a minimum payment will be due every month. This is the least amount you can pay on the balance to keep the account in good standing. Typically, the minimum payment is 2% of the balance. Be careful with only making a minimum payment; interest will continue to add up and the amount you owe will increase the longer you wait to pay off a balance.

- If you charge something on your credit card, you have a certain number of days in which to repay the debt without incurring interest charges. This is called the "grace period." Federal law dictates grace periods must be at least 21 days, and many card issuers allow 30-45 days.

What is a Secured Credit Card?

They may look similar to regular credit cards, but secured credit cards have a fundamental difference that makes them a good credit starting point for many. With a regular credit card, the money you spend is money you borrow from the card issuer. A secured credit card works the same way, but the money you borrow is secured against a deposit you make in a checking or savings account. Some issuers will also put this deposit into an interest bearing account, such as a CD.

The deposit funds are typically required by the bank that issued you the secured card before you're able to spend. Unlike a debit card, where the money you spend is withdrawn from a banking account, secured credit cards can carry a balance and act like a normal credit card. Debit card transactions are typically not reported to credit reporting bureaus, but secured credit cards typically are, so you're building credit activity, and that's a valuable step in building your credit history and improving your credit score. Also, not all secured cards may be reported to the credit reporting bureaus. Before applying, finding this out will only help you move forward with your credit.

Secured cards are especially helpful in one of two situations:

- You're creating new credit

- You're recovering from some past credit mishaps

Credit Utilization: What is it?

Simply put, credit utilization is a measure of how much of your available credit you're using at any given time. It's measured as the sum of your credit card balances divided by your total credit limit. Using 100% of your available credit means you've maxed it out. Credit utilization is a big factor in many credit scoring models: if you're using over a certain percentage, lenders may think you're trying to overspend, and that can ding your scores.

Just how much credit can you use without seeing a drop in your scores? Conventional wisdom suggests avoiding a credit utilization rate of above 30%, and, generally, lower balances are better. Paying off your cards every month is ideal. Also, credit utilization only includes your revolving credit accounts, such as credit cards. It doesn't consider other types of credit like auto loans or mortgages.

It's also worth noting that credit scoring models consider both your overall utilization (across all of your cards) and the individual utilization on each card, so having just one card maxed out could do damage to your scores, even though your overall utilization is low.

Can Closing a Credit Card Hurt Me?

It might seem like an easy call: close the credit cards you're not using, especially if you're trying to really keep a handle on your credit. However, make sure you carefully evaluate the outcome before choosing to close a card, since doing so can change your credit picture and end up dinging your credit scores.

Your credit utilization ratio you've just learned about does impact your credit scores. So when you pay off a credit card, it has a 0% utilization rate — something that can contribute to good scores. If you terminate that account by closing that card, its zeroed-out balance can't help your credit scores any longer because it no longer has a current, open status.

On top of that, lenders usually like a long period of successful financing and on-time payments to feel good about extending you more credit. If the card you choose to cancel is one that contributes positively to your credit history because you've held it for a long time, closing it could mean you're shaving off years of good credit history.

Late and Missed Payments

Late payments can carry a hefty penalty. Many credit card companies charge fees for late payments. Additionally, late payments are shown on your credit report for seven years and payment history is a significant factor in many credit scoring models, so it's an area that's important to keep an eye on for many reasons. Especially when you're new to credit and starting your credit history, just a few late payments can stick with you for a while.

What About Joint Credit Card Accounts?

As a joint account holder, you share full responsibility for payment of the debt under the credit card contract. The account will appear on both your credit report and the other person's.

Be cautious upfront and ensure you discuss whose responsibility it is to take care of which account and when — and what to do if something serious happens and that person isn't able to take care of those things anymore. Accounts shared and items such as late payments or high balances will appear on the credit reports of all joint account holders.

Before You Apply for a Credit Card

Credit card use, credit history, and credit scores can all be connected. When you apply for a credit card, the issuer will review your credit history and request your credit score. The information on your credit report and the credit score they look at will affect whether or not you're approved for a credit card as well as the terms, conditions and interest rate offered to you. Before you apply for a new card, you can check your own credit report and FICO® Score☉ to see the things a credit card company could see.

Likewise, applying for a credit card can affect your credit scores. That's because the card issuer's request to review your credit report and score is considered a "hard inquiry" — which indicates you're applying for actual credit. Hard inquiries appear on credit reports, and too many hard inquiries in a short span of time can negatively affect credit scores. Prequalification on the other hand would be a soft inquiry, since it is not firm approval, and provides an estimation of what you could qualify for. Not all prequalifications will lead to approval, since other factors such as income would be additional factors for the approval process.

Building Your Credit Skills without Learning the Hard Way

Using credit cards wisely can help you make big purchases and put you that much closer to those big goals that credit can help make happen when you're ready to claim them, like your next car, a first home, or that dream vacation.

Learn More About Credit Cards

- Pros and Cons of Credit Cards

Credit cards offer benefits including convenience, rewards and can even save money on interest, but they also come with risks that are worth considering. - 6 Tips to Get the Most out of Your Credit Cards

Credit cards offer many benefits, such as helping you improve your credit and earn rewards on purchases. Here are 6 ways to get the most from your cards. - Is There a Limit on Credit Card Interest Rates?

When rates are trending upward, pay attention to the credit card interest rates you’re paying, as well as national averages and rates on new card offers.