Credit Report Basics

A credit report provides detailed information on how you have used credit in the past, including how much debt you have and whether or not you've paid your bills on time. You can view your credit report for free at any time, without impacting your credit report or credit score.

There are three credit reporting agencies, or credit bureaus, in the United States: Experian, Equifax, and Transunion. Each of these credit reporting agencies compiles your credit information from various reporting sources, such as lenders, into a credit report.

When you apply for credit, including credit cards, student loans, auto loans, and mortgage loans, lenders check your credit report to make decisions about whether or not to grant you credit and about the rates and terms you qualify for.

What Does a Credit Report Include?

The information that appears on your credit report includes:

- Personal information: Your name, including any aliases or misspellings reported by creditors, birth date, Social Security number, current and past home addresses, phone numbers, and current and past employers.

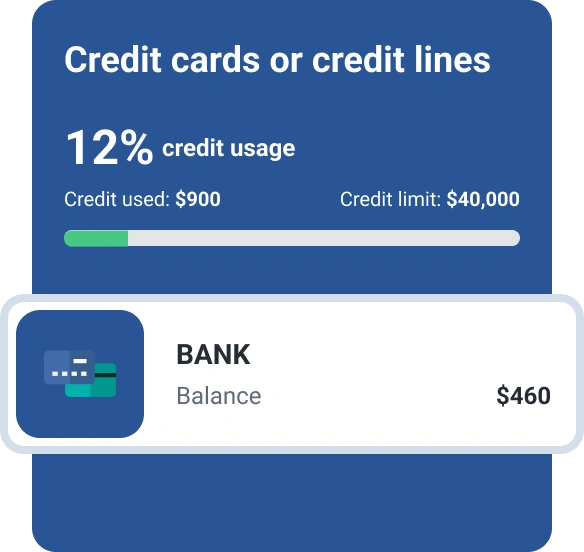

- Accounts: A list of your credit accounts, including revolving credit accounts, such as credit cards, and installment loans, such as mortgages or auto loans. The list includes creditor names, account numbers, balances, payment history and account status (including whether or not the account is past due).

- Public records: Bankruptcies.

- Recent inquiries: Who has recently asked to view your credit report and when.

Note that your credit report does not include information about your marital status (married or divorced), income, bank account balance, or level of education. Your credit report could include your spouse's name if reported by a creditor. After a divorce though, the only way to remove a spouse's name from your credit report is to dispute the information.

Each of the three credit bureaus may also have different information about you. Creditors are not required to report information and may not furnish data at all, and if they do, it may only be to one or two of the credit bureaus.

How to Check Your Credit Report

It's easy to check your credit report:

- Request your free credit report from Experian at any time.

- Check your credit reports from all 3 bureaus at any time

- Visit annualcreditreport.com to request one free credit report from each of the 3 major credit reporting agencies every week.

Who Can Check My Credit Report?

The Fair Credit Reporting Act (FCRA) limits who can view your credit report and for what reasons. Generally, the following people and organizations can view your credit report:

- You: You are entitled to review the information on your credit report. Viewing your own credit report does not affect your credit score.

- Lenders: When you apply for credit from a credit card company, mortgage company or auto lender, that potential creditor can ask to review your credit report. These are considered "hard inquiries" and can affect your credit score. Lenders must have your permission to check your credit report for your applications on new credit. (Note that when lenders view your credit report to make pre-approved offers, your credit score is not affected.)

- Landlords: When you apply to rent an apartment or home, you're essentially asking the landlord to trust that you will pay your rent on time every month. You're asking him or her to extend you a kind of credit, which allows them the right to ask for a copy of your credit report and score. Landlords must have your permission to check your credit report.

- Insurers: An application with an insurance company is a kind of financial account, and insurers can ask to review your credit report when you apply with them for coverage. Insurers must have your permission to check your credit report.

- Employers: Employers may request to view your credit report to make hiring decisions. However, no employer can review your credit report without your written consent.

- Other businesses: Other types of businesses may have a valid need to see your credit report, but they'll still need to get your permission to do so.

How Often is My Credit Report Updated?

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it's important to also know that most lenders report changes in account status, such as payments you've made or whether you've fallen behind, on a monthly basis. If you make a payment on one of your accounts, it's possible that the payment won't appear on your credit report for up to 30 days.

Monitoring Your Credit

Credit reports can be important tools for detecting identity theft and fraud. When someone uses your personal information to commit fraud, such as opening a new credit account in your name, your credit report is often the first place where the signs of the fraud will appear. Monitoring your credit can help you catch these signs sooner and take faster action to remedy the situation.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required