733 Credit Score: Is it Good or Bad?

A FICO® ScoreΘ of 733 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 714, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores "acceptable" borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

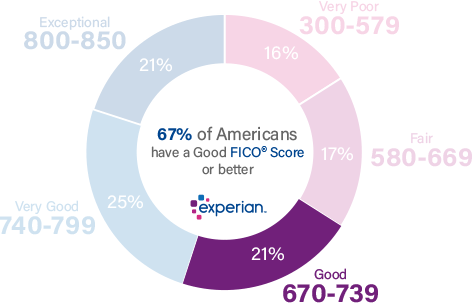

21% of U.S. consumers' FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

How to improve your 733 Credit Score

A FICO® Score of 733 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 733 FICO® Score is on the lower end of the Good range, you'll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

45% of consumers have FICO® Scores lower than 733.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you'll receive information about ways you can boost your score, based on specific information in your credit file. You'll find some good general score-improvement tips here.

What’s so good about a good credit score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments (past due 30 days) appear in the credit reports of 38% of people with FICO® Scores of 733.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Staying the course with your Good credit history

Your 733 credit score puts you solidly in the mainstream of American consumer credit profiles, but some additional time and effort can raise your score into the Very Good range (740-799) or even the Exceptional range (800-850). To keep up your progress and avoid losing ground, steer clear of behaviors that can lower your credit score.

Factors that affect your credit score include:

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It's pretty straightforward, and it's the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

Credit usage rate. To determine your credit utilization ratio, add up the balances on your revolving credit accounts (such as credit cards) and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you "max out" your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Length of credit history. Credit scores generally benefit from longer credit histories. There's not much new credit users can do about that, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans (i.e., loans with fixed payments and a set repayment schedule, such as mortgages and car loans) and revolving credit (i.e., accounts such as credit cards that let you borrow within a specific credit limit and repay using variable payments). Credit mix can influence up to 10% of your FICO® Score.

56% of individuals with a 733 FICO® Score have credit portfolios that include auto loan. 39% have a mortgage.

Recent applications. When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well). A hard inquiry typically has a short-term negative effect on your credit score. As long as you continue to make timely payments, your credit score typically rebounds quickly from the effects of hard inquiries. (Checking your own credit is a soft inquiry and does not impact your credit score.) Recent credit activity can account for up to 10% of your FICO® Score.

How to build up your credit score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good (740-799) or Exceptional (800-850) credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO ScoreFICO® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High credit utilization, or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with a 733 FICO® Score have an average of 3.7 credit card accounts.

Try to establish a solid credit mix. The FICO® credit-scoring model tends to favor users with multiple credit accounts, and a blend of different types of credit, including installment loans like mortgages or auto loans and revolving credit such as credit cards and some home-equity loans. This doesn't mean you should take on debt you don't need, but it suggests you shouldn't be shy about prudent borrowing as appropriate.

Make sure you pay your bills on time. Avoiding late payments and bringing overdue accounts up to date are among the best things anyone can do to increase credit scores. Establish a system and stick to it. Whether it's automated tools such as smartphone reminders and automatic bill-payment services or sticky notes and paper calendars, find a method that works for you. Once you've stuck with it for six months or so, you'll find yourself remembering without being nagged (but keep the reminders around anyway, just in case).

Learn more about your credit score

A 733 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.