What Is My Credit Score?

Quick Answer

Your credit score is a three-digit number that provides a snapshot of your overall credit health. Understanding what goes into your credit score can help you develop good credit habits and save money on loans, insurance policies and more.

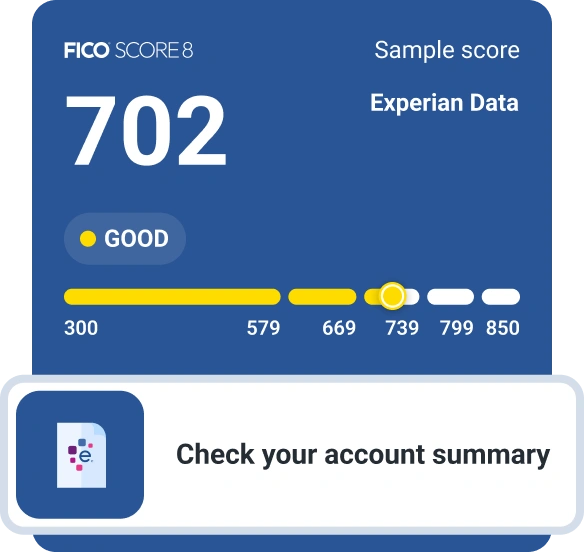

Your credit score is a key factor of your financial well-being, providing a glimpse into how well you manage your financial obligations. You can check your FICO® ScoreΘ 8 for free through Experian to get an idea of where you stand, and also get some insights into how you can improve your credit.

As you evaluate your credit health, here's what you need to know about why your credit score is so important, which factors influence it and how to monitor your credit regularly.

What Does My Credit Score Mean?

Simply stated, your credit score represents your ability to repay debts and how risky you are as a borrower.

When you apply for a credit card or loan, a lender's top priority is making sure the debt is repaid on time. While it's impossible to know the future, lenders use credit scores as predictive models to assess the likelihood that you'll pay your bills on time.

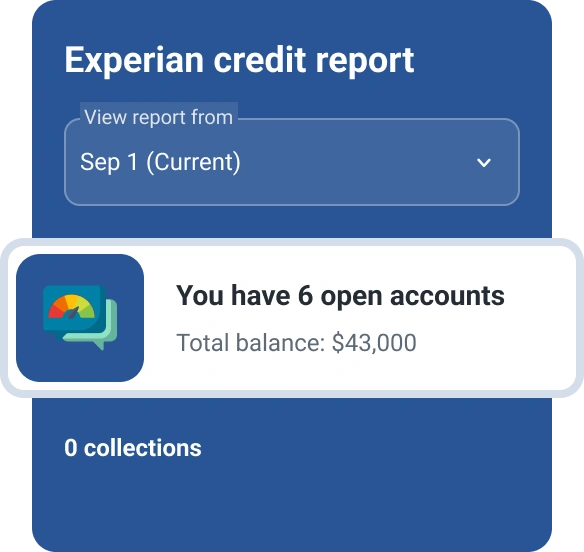

Your credit scores are based on information found in your credit reports. Credit reports contain key details about your past and current dealing with credit, such as the status of both open and closed accounts, loan and credit card balances, payment history and credit inquiries—more on those in a minute.

Credit scoring models use algorithms to analyze the information found in your credit reports and convert it into a simple score. So, while your credit score doesn't tell the full story, it can give lenders a basic understanding of how risky you are as a prospective borrower.

The base FICO® Score 8, the score most widely used by lenders, ranges from 300 to 850. The following FICO® Score ranges can help you evaluate how you're doing:

| Range | Rating |

|---|---|

| 300 — 579 | Poor |

| 580 — 669 | Fair |

| 670 — 739 | Good |

| 740 — 799 | Very good |

| 800 — 850 | Exceptional |

How to Check My Experian Credit Score

When lenders review your credit, they use a credit score based on your credit report from a single credit bureau: Experian, TransUnion or Equifax. They may even check your credit scores with two or all three bureaus. To get an idea of what your credit profile looks like, you can check your FICO® Score powered by Experian data for free. Here's how:

- Get started. Visit Experian's website and click on "Check your FICO® Score for free." You'll then provide the last four digits of your Social Security number and your phone number.

- Verify your personal details. You'll receive a confirmation link in a text message. Click on the link, then return to your browser. You'll then enter or confirm your personal information, including your name, date of birth, full Social Security number and address.

- Create your account. After entering your personal information, you'll create login credentials using your email address and a password. You can then proceed to create your account.

- View your dashboard. Your FICO® Score 8 appears on your main dashboard when you log in to your account. If you click on your score, you can get more details about the factors that are impacting it, as well as a summary of your debt. This allows you to track changes and trends over time.

Note that you can also download the Experian mobile app and register there instead of through your desktop browser.

If you want to view your FICO® Scores based on your reports from all three credit bureaus, as well as have access to industry-specific scores, identity theft insurance, bill negotiation services and many other features, you can upgrade your account with a paid premium membership from Experian.

It can make sense to check all versions of your FICO® Score if you're planning to apply for an important loan, such as a mortgage to buy a house.

Understanding the 5 Credit Score Factors

There are five main factors that impact your FICO® Score. While FICO assigns a percentage to each one, the math isn't necessarily cut and dried. That said, they can give you a good idea of which factors are more influential than others. Here's a quick summary of each one.

Payment History: 35%

Paying your bills on time is crucial for establishing a positive payment history. If you miss a single payment by 30 days or more, it could have a significant negative impact on your credit score—and the longer it goes unpaid, the more damage it'll do.

Other major negative events can also severely damage your payment history. Examples include loan default, charge-offs, repossession, foreclosure, collection accounts and bankruptcy.

Amounts Owed: 30%

With this category, FICO looks at a handful of factors to get an idea of how your debt balances may impact your ability to add another credit account. Factors include:

- Credit utilization, or the percentage of available credit you're using on revolving accounts such as credit cards

- The overall amount owed on all of your accounts combined

- The amount owed on individual accounts

- Current installment loan balances compared with their original amounts

- The number of accounts that have a balance

Length of Credit History: 15%

Being able to use credit responsibly over a long period of time can help you build and maintain good credit. For the length of credit history category, FICO looks at the age of your oldest open credit account, the age of your newest account and the average age of all of your accounts. It'll also consider how long specific accounts have been open.

New Credit: 10%

Each time you apply for credit, the lender will typically run a hard inquiry on one or more of your credit reports. FICO will consider these inquiries, as well as how long it's been since you've opened a new account, to evaluate your most recent credit activities.

Credit Mix: 10%

Being able to manage different types of credit responsibly can help improve your credit score. As you naturally open new accounts, such as credit cards for everyday spending or auto loans and mortgage loans for larger purchases, diversifying your credit mix could help you take your FICO® Score higher.

That said, this factor likely won't make or break a lender's approval decision, so you don't necessarily need to open different types of accounts just to improve your credit.

How to Check What Factors Are Affecting My Experian FICO® Score

As previously mentioned, your free Experian account can provide you with key information about which factors are influencing your FICO® Score. You can review these factors through your online account or the Experian mobile app.

In both cases, you can click or tap on your FICO® Score or the Credit menu, then scroll down to the Score Ingredients section. You'll get a rating for each of the five FICO® Score factors, and you can select each one to get more details about how you're performing. This information can also help you pinpoint areas where you can improve.

How to Use Your Credit Score

Whether you're trying to build credit or maintain a good credit score, it's a good idea to monitor your credit regularly. Here are some things you can do with your Experian FICO® Score:

- Track your progress. Credit scores can fluctuate in the short term, but you can track trends in your FICO® Score over time to determine how well you're doing with your goals.

- Determine your next steps. Breaking down your score ingredients can help you understand exactly which areas are holding you back from seeing the improvements you want. Once you know what could be hurting your score, you can take concrete steps to change your credit behaviors and improve your credit.

- Spot inaccuracies. As you review your FICO® Score and credit reports, you can also look for potentially inaccurate information that could be hurting your score. If you find something, such as an incorrectly reported late payment by one of your creditors, you have the right to file a dispute with the credit bureaus or contact the company that provided the information to have it corrected.

Get More Help With Free Credit Monitoring

In addition to your Experian FICO® Score, you'll also get free access to your Experian credit report when you register. Experian also provides customized alerts when changes are made to your report, making it easier to stay on top of your credit health and address potential issues as they develop. Experian's credit monitoring service is free and can give you an advantage as you work to build and maintain a strong credit profile.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben