In this article:

While car insurance typically does not cover personal belongings in your car, your homeowners or renters insurance policies will cover personal items if your car was stolen or broken into. Let's review some steps you can take to make sure your stuff is protected if it's stolen or destroyed in an accident.

What Does Auto Insurance Typically Cover?

Most car insurance policies include several types of coverage, with each type designed to pay for different expenses that may come up following an accident. Each type of coverage also has a limit, which is the maximum amount your policy will pay after an accident.

Some things aren't covered at all under an auto insurance policy, however. Personal belongings, such as items stolen from your vehicle, fall under that category.

Knowing what car insurance covers—and what it doesn't—can help you pick the right coverage for your needs. Here are some the various types of auto insurance and what the policies will typically cover:

Liability Insurance

This type of insurance pays for expenses that come up because of an accident the driver causes, and is the minimum required coverage in almost every state. It pays for medical expenses for the other driver, as well as property damage, but not on your own vehicle.

For example, liability insurance would cover hospital bills for an injury another driver suffers in a car accident that was your fault. It may also help pay the costs to repair damage to your car if you're in an accident where the other driver was at fault. If an accident was your fault, liability insurance doesn't cover any medical costs for injuries you suffer or damage to your car.

Comprehensive Insurance

Some things that can damage your vehicle are out of your control, and comprehensive insurance helps cover those costs. Comprehensive insurance pays for damage caused by weather-related events, like flooding or a tornado, as well as unexpected events, like hitting a deer, falling objects or car theft. If your car is stolen and not recovered, comprehensive insurance coverage will reimburse you for the value of your car.

While personal belongings aren't covered, comprehensive coverage can help minimize costs if your car is stolen or vandalized. It may entitle you to a rental vehicle depending on your policy details, but you may need rental reimbursement coverage to get a rental car while the police look for your vehicle.

Collision Insurance

Collision insurance covers damage caused when your car collides with another vehicle or an object, such as a building, telephone pole or tree. It also covers your car against damage caused by potholes or if you roll your car. It's important to note that collision coverage only kicks in if the event occurred when you were driving. For example, if a tree branch falls on your car while it's parked in your driveway, the damage to your car would be covered by comprehensive insurance. Lenders usually require you to get comprehensive and collision insurance when you lease or finance a car. But these types of coverage aren't mandated by law, and you can opt out of it if you own your vehicle outright.

What isn't included in your auto insurance policy? If any personal belongings, like your phone or laptop, were damaged or stolen from your car, they're not covered by car insurance. It is possible, however, to list the personal belongings you tend to keep inside your car on a homeowners or renters policy with many insurance companies. Most policies of this kind cover property stolen from your home as well as your vehicle.

How Homeowners or Renters Insurance Can Fill the Gap

Homeowners insurance covers loss of or damage to the property in your home, such as furniture, housewares and electronics. What you might not know is that the personal property coverage in a homeowners or renters insurance policy may help cover your belongings if they're stolen from your car or other location outside your home.

There are usually limits on coverage for higher-priced items such as jewelry, collectibles, sports equipment, fine art and computers. If you need additional coverage for more valuable items, you'll have to buy a "floater" policy for those items.

Items not in your home may have a lower coverage limit. Your homeowners policy should detail how much coverage it provides for personal property in a different location. Purchasing a floater, also known as an endorsement, is a way to raise the coverage limits of specific high-value items. When raising coverage limits, your company may require you to have the items appraised.

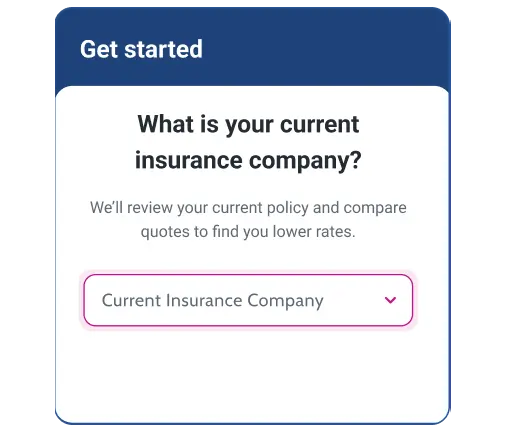

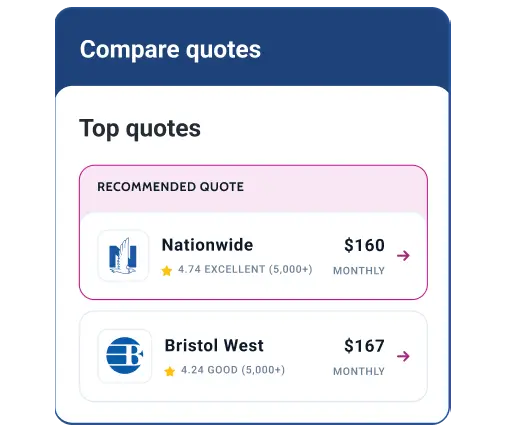

Stop overpaying for insurance

Get startedResults will vary and some may not see savings.

What to Do if Your Vehicle Is Broken Into or Stolen

Discovering that your car was broken into—or even worse, stolen—is certainly a headache, but try not to panic. Here are steps you should take to minimize the damage.

1. Call Local Law Enforcement

Make a note of the items that were stolen. It might also be helpful to take pictures of any parts of the car that were damaged. Your insurance company will likely also want a copy of the police report if you file a claim for a break-in.

2. Gather Your Information

If your car was stolen, gather documentation related to your vehicle and auto loan. This will make the process easier as you speak with the police and your insurance company. Some of the information you'll need includes: your license plate number, the title showing you're the owner of the car, any recent photos of the car, recent mileage and service records.

3. Let Your Insurer Know

Whether you think you'll have coverage for the theft or not, it's important to inform your insurer that your car was stolen. This is to protect you from being liable for any actions the thief may take while they have your car.

If you have comprehensive coverage, you can begin a claim to get compensated for the loss of your vehicle. This starts the process of getting a payout for the car if it's never recovered or paying for repairs if it is. Comprehensive coverage, for instance, could help pay for a window that was broken when the thief was breaking in if the car is ultimately returned to you.

If there were personal items in your car when it was stolen, you may also need to file a claim with your renters or homeowners insurance company as you would if items were stolen in a break-in.

4. Contact Your Lenders and Bank

If any credit or debit cards were taken, contact the card issuers or bank immediately to block access to the accounts and get new cards to protect yourself from identity fraud. You also have the right to place a temporary security alert on your credit reports. This alert asks creditors to take extra steps to verify the identity of the applicant before approving new credit. If you request an alert with one of the three national credit bureaus (Experian, TransUnion or Equifax), it will notify the other two.

The Bottom Line

Car insurance provides crucial financial protection in the event of an accident. It typically pays for injuries and property damage you cause, and additional coverage options may be available. But there are some things car insurance doesn't cover, including personal belongings. If personal items are damaged or stolen from your car, your homeowners insurance policy might fill the coverage gap.