Does a Mortgage Hurt Your Credit?

Taking out a mortgage is a huge milestone for you—and your credit. For starters, building and maintaining the credit necessary to secure a mortgage is a big win. Responsibly managing a mortgage demonstrates your ability to pay loans on time, handle different credit types and maintain a large, long-term account, all of which can contribute to positive gains for your credit score over time.

Along the way, though, there are times when a mortgage could possibly hurt your credit, either causing a minor bump or more serious turbulence if you encounter difficulties in paying your loan. Here are a few of the ups and downs you and your credit might encounter when you get a mortgage.

A New Mortgage May Temporarily Lower Your Credit Score

When a lender pulls your credit score and report as part of a loan application, the inquiry can cause a minor drop in your credit score (usually less than five points). This shouldn't be a concern, though, as the effect is small and temporary, and on its own shouldn't cause significant damage to your credit score or affect a lender's decision. In addition, credit scoring models recognize rate shopping for a loan as a positive financial move, and typically regard multiple inquiries in a limited time period as just one event.

That said, this is not the time to apply for credit you don't strictly need, such as new credit cards or a student loan refinance. Save those applications for later, after the mortgage loan has closed and the house is yours.

If you aren't submitting a formal loan application yet but want to get prequalified so you'll know how much house you can afford, your lender will likely base its prequalification on a "soft" inquiry. This type of inquiry does not affect your credit scores.

Once you've been approved for a mortgage and your loan closes, your credit score may dip again. Good news: Since you've already been approved for your home loan, this temporary drop may not matter much.

Why does your score drop when you get a new mortgage? Your mortgage is a big loan and it's brand new. Credit scoring models don't have evidence yet to show you'll be successful at making your payments on time. A new account also lowers the average age of your accounts, a factor that accounts for a small part of your credit score. This temporary drop in your credit score should begin to resolve after a few months of paying your loan on time, all other things being equal.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

How a Mortgage Can Benefit Your Credit Score

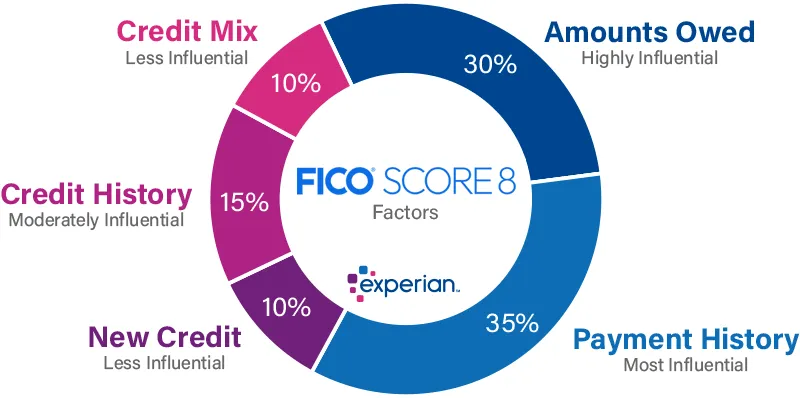

These early dips in your credit score are minor compared with the potential upside a mortgage can have for your credit. To understand this more clearly, consider the factors that go into calculating your FICO® ScoreΘ:

- Payment history: A typical mortgage provides the opportunity to make 30 years' worth of on-time, credit-building payments.

- Credit mix: By managing a mix of installment loans like mortgages and auto loans as well as revolving credit card accounts, you show your ability to handle different types of credit.

- Length of credit history: Although a new mortgage works against this metric, over the life of the loan, your mortgage becomes a long-term account that shows longevity.

The sheer size of a typical mortgage can also play in your favor. Make on-time payments over the life of the loan, and the positive influence your mortgage has on your credit will be long-lasting.

How a Mortgage Can Hurt Your Credit

There is, of course, the other side to the story. If you have trouble repaying your mortgage on time, your credit score will almost certainly suffer. Although it's always a good idea to make your mortgage payment on or before the due date, the real trouble for your credit begins about a month after you miss a payment. Most mortgage lenders extend a grace period of 15 days before they'll penalize you with a late fee. If a payment is 30 days or more past due, they will report it as late to the credit reporting agencies.

Even one 30-day late payment can have a lasting effect on your credit. Payment history accounts for 35% of your credit score and is the biggest factor in its calculation. A late payment will appear on your credit report for seven years, though its effect diminishes over time. An isolated 30-day late payment is less damaging than multiple late payments or one that extends to 60 or 90 days past due.

An unpaid mortgage that goes into foreclosure creates its own set of problems. In a foreclosure, multiple missed payments cause your mortgage to go into default. As part of your loan agreement, your lender has the right to seize your property and sell it to recover their money. The missed payments that lead up to foreclosure—120 days or four successive missed payments is typical—will seriously damage your credit. The foreclosure itself also becomes a negative item on your credit report. Worst of all, you lose your home and any financial stake you have in it.

Clearly, the best course of action is to avoid late payments and foreclosure. If you think you may be unable to make a loan payment at any time, contact your lender to see if anything can be done to minimize the damage and help you get back on track.

Optimizing Credit in the Future—and Now

Getting a mortgage is a positive opportunity to build your credit, accumulate wealth and live in your own home. Checking your credit score before you begin the application process can help you determine whether it might be a good idea to take time to improve your credit score before submitting your applications.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle