How Can I Review My Credit Report?

Dear Experian,

What is the best way to get your Experian credit report reviewed for discrepancies?

- TTR

Dear TTR,

Reviewing your credit report for discrepancies is easy and free. You can get a free copy of your credit report by going to AnnualCreditReport.com. You can also view a free copy of your Experian credit report on our website any time.

What's in a Credit Report?

Your credit report will include:

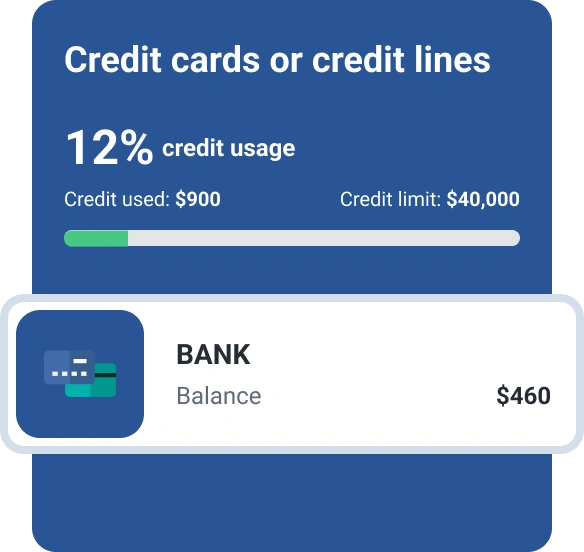

- Account information, such as credit cards and installment loans, and any other credit-related information, such as bankruptcies or collection accounts.

- Personal identification information, such as names, addresses, and date of birth, plus any phone numbers or employers that have been reported by your lenders. This information has no impact on credit scores.

- A list of any requests for your credit history, also called inquiries. You will see two sections of inquiries on your credit report: requests viewed only by you, and requests viewed by lenders and others viewing your report. Keep in mind that inquiries viewed only by you are not seen by others checking your credit report and will not affect your credit scores.

When you receive your report, review each section carefully. Experian always strives to maintain accurate and complete information. If you feel there is an inaccuracy, you can submit a dispute online, by phone, or by mail.

How to Dispute Inaccurate Information

To make things easier for consumers, Experian recently redesigned its online Dispute Center, where you can:

- Review and manage your credit report on an ongoing basis by logging in to the dispute portal at any time.

- Sort and view the accounts listed in your credit report either by alphabetical order, date opened or status, and filtered by categories such as collections or installment loans.

- Dispute inaccurate information by selecting the item to dispute, following the prompts, uploading any supporting documentation, and clicking submit.

- Receive timely alerts updating them on the current status of their active disputes

- Get answers to commonly asked questions by accessing the Dispute Center FAQ page.

Checking your credit reports regularly is very important. Doing so helps to ensure that your credit history is up-to-date and accurate. It can also help you detect potential fraud and identity theft sooner. If you are planning to make a major purchase, such as applying for a home or car loan, you should check your credit reports at least 3-6 months in advance.

Thanks for asking,

Jennifer White, Consumer Education Specialist

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jennifer White brings nearly two decades of knowledge and experience to Experian’s Consumer Education and Awareness team. Jennifer’s depth of knowledge about the FCRA and how to help people address complex credit reporting issues makes her uniquely qualified to provide accurate, sound, actionable advice that will help people become more financially successful.

Read more from Jennifer