How Do I Get My Real FICO Score?

You can get a real FICO® ScoreΘ from many sources, including credit bureaus, lenders, credit card issuers and other financial institutions. There are many versions of the FICO® Score, and they may have different uses, but they're all real. When you're reviewing your score, you'll want to know which type of FICO® Score it is, and whether it's the best version to be looking at in your situation.

What Is a FICO® Score?

A FICO® Score is a credit score that's developed and offered by FICO®. The company, originally named Fair Isaac Corporation, released its first credit bureau-based credit score in the 1980s. Since then, FICO® has created different types of credit scores and released new versions of its scores that have updated how calculations are made.

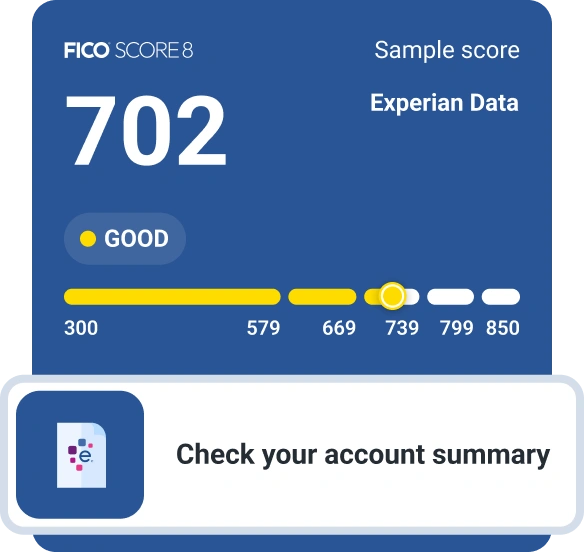

For example, FICO® offers base FICO® Scores, such as FICO® Score 8, FICO® Score 9 and, its latest, FICO® Score 10. These are general-use scores designed for use by multiple types of lenders for a wide range of credit products. FICO® also publishes industry-specific credit scores, such as the FICO® Auto Score for auto lenders and FICO® Bankcard Score for use by credit card issuers.

The base scores range from 300 to 850, while industry-specific scores range from 250 to 900. Both types of scores are intended to predict the same thing: the likelihood that someone will be 90 days late on a payment within 24 months. FICO® does this by analyzing the information within your consumer credit reports from either Experian, TransUnion or Equifax.

FICO® builds different scoring models to align with how each bureau stores your information. Earlier versions of FICO® Scores even had different names based on the bureau, including the models that are still commonly used for mortgage underwriting:

- Experian/Fair Isaac Risk Model v2 (FICO® Score 2)

- Equifax Beacon 5.0 (FICO® Score 5)

- TransUnion FICO® Risk Score 04 (FICO® Score 4)

Since the release of FICO® Score 8, each new base model has used the same version number across all three bureaus, but the models are still customized with the bureau in mind. VantageScore®, another credit scoring company, uses a tri-bureau model that scores credit reports from Experian, Equifax and TransUnion using the same methods.

FICO® and VantageScore credit scores are the most widely used credit scores, but other credit scoring companies are out there. For example, large creditors may use custom-built credit scores to help them evaluate new and current customers, and companies may publish educational credit scores for their customers to refer to. Educational scores may accurately assess your creditworthiness, but they shouldn't be relied on when making a decision to apply for credit since they can differ significantly from the scores used by lenders.

Which Credit Score Should You Check?

When you check your credit, you'll likely receive either a FICO® or VantageScore credit score. Your score will depend on which scoring model is being used and which credit report is being analyzed (because your credit reports likely aren't identical).

The type of score might not matter if you're looking for an estimate of where you stand or want to track whether your score is going up or down. Fortunately, credit scores tend to move in a similar direction as they all analyze your credit reports with the same general goal in mind.

Creditors can choose which score to use, and they don't have to disclose which of your credit reports or which score they are going to request ahead of time.

Knowing at least one of your general-use FICO® Scores, such as FICO® Score 8, could be helpful as creditors often use a FICO® Score when evaluating new credit applications. Also, many mortgage lenders use the earlier FICO® models mentioned above to comply with federal regulations. Knowing those three FICO® Scores could be helpful if you're shopping for a mortgage.

How to Get Your FICO® Score

There are several ways to get your FICO® Scores, both for free and at a cost.

You can get your FICO® Score for free from hundreds of financial services companies, including banks, credit unions, credit card issuers and credit counselors that participate in the FICO® Score Open Access program and offer free scores to customers.

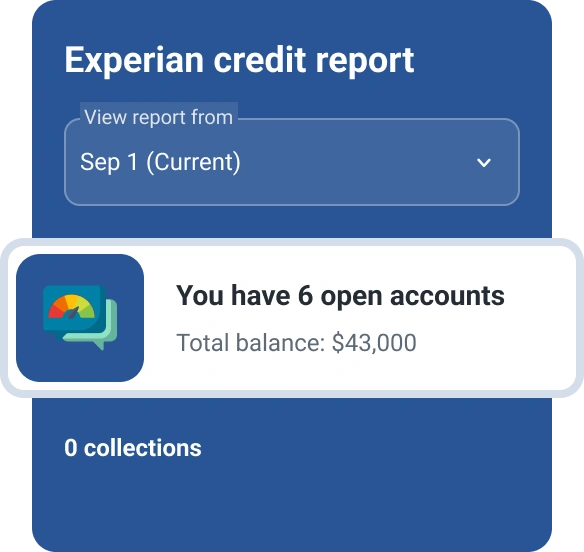

For example, if you sign up for a free credit score from Experian, you'll get a FICO® Score 8 along with a copy of your credit report. Unlike some services that only track and show you your score, you'll then be able to review the underlying information (the credit report) that led to the score. Signing up for the Experian Premium membership will provide access to your base FICO® Score 8 as well as your FICO® Score 2, FICO® Auto Score 2 and FICO® Bankcard Score 2.

FICO® also sells scores on myFICO.com and authorizes "FICO® Score retailers." These companies may offer free or paid access to FICO® Scores to consumers, and sometimes include additional products or services with your score. Checking with your bank or current credit card issuers is another option you may have.

Keep an Eye on Your Credit

Your real FICO® Score can be had for free in several ways, but if you want to check multiple FICO® Scores, you'll generally need to opt for a paid service. You can look for services that come with more than just your credit scores, such as an Experian Premium membership. Experian's service also includes free credit report and score monitoring with notifications if there are any suspicious changes. Additionally, you get a wide-range of identity theft monitoring and protection services, including dark web surveillance and up to $1 million in identity theft insurance.

You can also match your score checking or monitoring with your current needs. A free score tracking service can help you keep an eye on one of your FICO® Scores and give you a sense of if your credit is improving. But a paid service may make more sense if you want identity theft protection, or if you're planning to buy a home and want to check the FICO® Scores that mortgage lenders commonly use.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis