How Does a Credit Score Simulator Work?

Quick Answer

Credit score simulators are interactive tools that predict how credit decisions will affect your credit score, based on the factors that impact scores.

A credit score simulator is an interactive digital tool that predicts the effects that various scenarios can have on your credit score. These scenarios are related to your debts and payment decisions, such as paying down credit balances, placing a specific charge on one credit card or another, or opening a new loan or credit card account.

Using a credit score simulator can help you predict the credit impact of actions you might take and aid in your decision making. Here's how they work.

How a Credit Score Simulator Works

Some credit score simulators take the form of questionnaires: They ask for information and use your answers to estimate a credit score. For instance, you can see the impact certain actions could have on your FICO® ScoresΘ Estimator with the FICO® Scores Estimator. This simulator estimates your score by asking 10 questions that cover the number of loans and credit card accounts you have, how long they've been open (or paid off), and your history of repaying them.

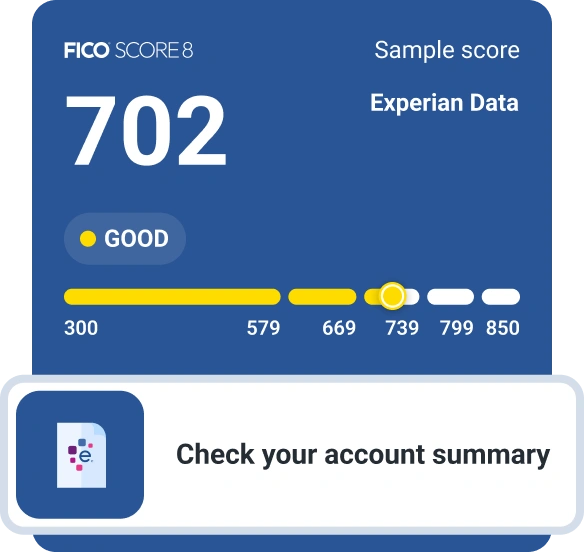

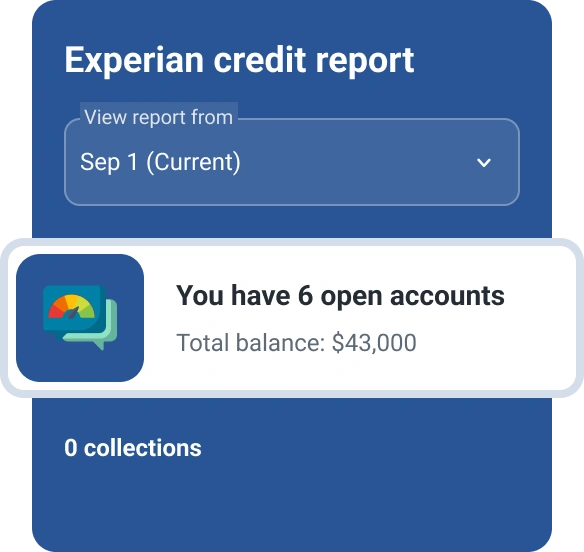

Other simulators, such as those featured on websites that provide credit scores for free, base their estimates on an actual credit score, and then estimate how that score would change in various scenarios.

The Experian FICO® Score Simulator, available through an Experian membership, bases its calculations on your FICO 8 Score based on Experian data and shows how actions including the following might affect your score negatively or positively:

- Applying for a new credit card or loan

- Projecting your current debt history ahead two years (to show the influence of age of accounts)

- Making a bill payment 30 days or more late

- Closing out one (or all) of your credit cards

- Maxing out one (or all) of your credit cards

- Filing bankruptcy

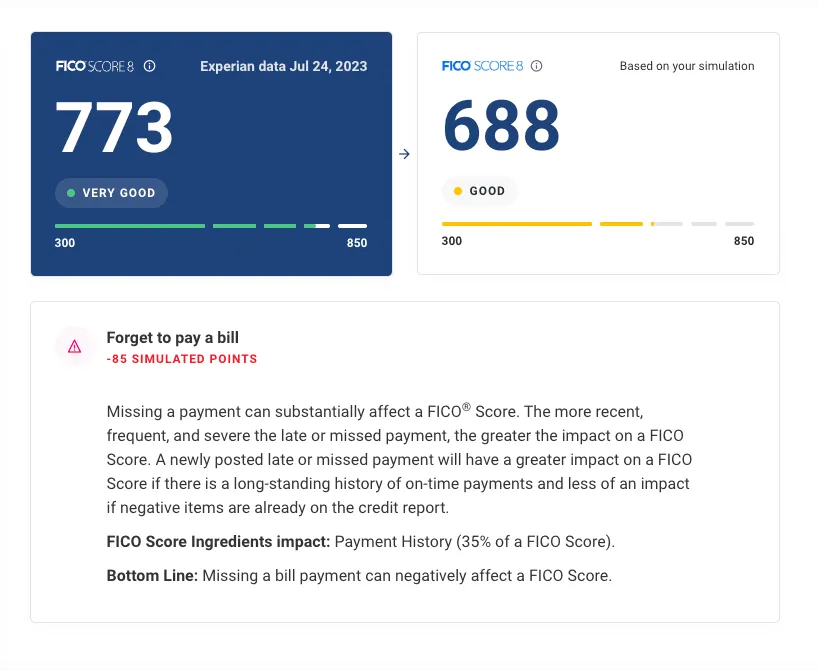

For example, this is what Experian's FICO® Score Simulator might show you if you give it the scenario of missing a bill payment:

How Your Credit Score Is Calculated

The accuracy and sophistication of credit score simulators can vary, but all of them consider the multiple factors that influence your credit scores:

- Payment history: A track record of making debt payments on time benefits your credit scores—and just one payment that goes unpaid for 30 days or longer can do significant harm to your scores. Payment history is responsible for about 35% of your FICO® Score.

- Amounts owed: The amount of outstanding debt you carry and your credit utilization—the percentage of credit you're using on revolving accounts represented by outstanding balances—account for about 30% of your FICO® Score. Carrying a balance on your credit cards can reduce your credit scores, with a 30% utilization on any credit card or other revolving account having a more severe effect. Individuals with excellent credit scores tend to keep utilization below 10%.

- Length of credit history: A documented history managing credit can enhance your creditworthiness. All other factors being equal, your credit score will improve over time as the length of your credit history grows. Credit scoring systems factor in the age of your oldest loan or credit account, the age of your newest account and the average age of all accounts. Length of credit history is responsible for about 15% of your FICO® Score.

- Credit mix: Evidence that you can handle multiple debts and different forms of credit will tend to benefit your credit scores. Credit scoring systems favor a blend of credit types, such as installment debt (student loans, auto loans and mortgages, for instance) and revolving accounts (credit cards and lines of credit). Credit mix accounts for about 10% of your FICO® Score. However, this doesn't mean it's a good idea to apply for new credit accounts with the sole justification of improving your credit mix.

- New credit: Taking on new debt increases the statistical likelihood you'll fall behind on your other bills. Credit scoring systems track new credit by noting hard inquiries—credit checks associated with credit applications that are recorded in your credit reports. Credit scores typically dip a small amount after a hard inquiry appears and can rebound within a few months if you keep up with your bill payments. New credit is responsible for about 10% of your FICO® Score.

Why Can Your Credit Scores Differ?

Credit scores from different scoring companies, such as the FICO® Score and VantageScore® credit score, can differ from one another, even though both assign scores on a scale from 300 to 850. Furthermore, the credit report data scoring tools analyze is continually being updated. Even when operating on identical data, however, different versions of the FICO® Score can generate different scores.

Since there are dozens of different versions of the FICO® Score (and four different versions of the VantageScore credit score) in use, there's no way to know ahead of time which any given lender will use. For that reason, even simulators that operate on an actual credit score may not reflect exactly what a lender will see when they check your credit.

Still, the factors that can affect your scores are more or less the same across scoring models, so making a concerted effort to improve your credit scores can yield results. By continuing to pay bills on time, keep credit card balances low and avoid applications for new credit, your scores have the potential to grow regardless of how they are calculated.

What Credit Score Simulators Can and Can't Do

Credit score simulators can:

- Give you a general sense of whether a single action you take will have a positive or negative impact on your credit scores.

- Estimate with reasonable accuracy the amount by which a given action will change your credit score.

Credit score simulators cannot:

- Account for the credit score impact of multiple events that occur simultaneously or in close succession. The credit score impact of, say, taking out a new mortgage and putting a bedroom set on a credit card could affect credit scores more significantly than might be suggested by running each event through a simulator separately.

- Fully anticipate and account for all the activity occurring across multiple credit accounts in a given month. This is why a simulated score should be taken as general guidance, not a precise forecast.

When Does It Make Sense to Use a Credit Score Simulator?

Situations in which a credit score simulator can help with sound decision making include the following:

- When you're trying to choose which of several credit card balances to pay down first to achieve the fastest possible increase in your credit scores.

- Before you submit a formal loan application, a simulator can give you an idea how much your credit scores might be affected by the new debt.

- If you plan to take out a mortgage in the next year or two and know the credit score range you need to qualify, you can see how various actions you take today will help you achieve (or exceed) that target range—or move your score further away from it.

The Bottom Line

Credit score simulators can help you gain greater understanding of factors that affect credit scores and how your actions can influence them. Consulting a simulator to help think through a credit decision can be helpful. You can see your FICO® Score 8 based on your Experian report for free, directly through Experian.

Note: Experian FICO® Score Simulator image is shown as an example for educational purposes and may not reflect typical results.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim