How Long After You Pay Off Debt Does Your Credit Improve?

Quick Answer

Paying off revolving debt typically increases your credit score in one to two months. Paying off installment debt can cause a temporary dip in your credit score, but scores should bounce back in a few months.

Paying off debt is a big accomplishment, but aside from the pride, you may wonder how quickly it will affect your credit score. Your credit score could improve in one to two months after you pay off revolving debt such as credit cards, and may dip, then bounce back in a few months when you pay off installment debt such as a car loan. However, your payment history, credit mix and credit history are also important factors in your credit score. Here's what to expect when you pay off debt.

How Long Does It Take for My Credit Score to Improve After Paying Off Debt?

How quickly your credit score improves after paying off debt depends on the type of debt, your overall credit mix and your history with the debt, such as whether you had late payments or always paid on time.

Revolving Accounts

Credit cards are a type of revolving credit, allowing you to borrow money up to your credit limit, repay it and borrow again as you pay the money back. Carrying a balance on a credit card can hurt your credit score if it pushes your credit utilization ratio above 30%. Your credit utilization ratio reflects how much of your available credit you're using at any given time, both on individual credit cards and across all of your accounts.

For example, if you have a card with a $2,000 credit limit:

- A $1,000 balance = 50% utilization

- A $200 balance = 10% utilization

Paying down credit card balances to achieve a lower utilization could help increase your credit score.

Your credit score will typically improve in one to two months after paying off a revolving credit account. Why doesn't it improve immediately? Lenders usually report your payment information to the national consumer credit bureaus (Experian, TransUnion and Equifax) after your billing cycle ends, which could be a few weeks after you pay off your balance. Still, paying down credit cards can be one of the quickest ways to improve your credit score.

Learn more: How Often Is My Credit Score Updated?

Installment Loans

Installment loans are repaid over a set term with fixed monthly payments. Common types of installment loans include student loans, auto loans and mortgages. Unlike revolving credit, once you make the final monthly payment on an installment loan, the account is closed.

Paying off an installment loan may not benefit your credit much, and may actually cause your scores to drop in the following situations:

- The account was your only installment loan. Having a mix of revolving and installment credit helps your credit score.

- It was your only account with a low balance. Your score might dip if your remaining active accounts are a long way from being paid off.

Any dips are usually temporary, though: Your credit score should go back to where it was within one or two months, all else being equal.

Tip: Consistently making installment loan payments on time can help improve your credit score. A paid-off loan stays on your credit report for up to 10 years after the account closes, which continues to benefit your credit score if the account was in good standing.

Learn more: Which Debts Should I Pay Off First to Improve My Credit?

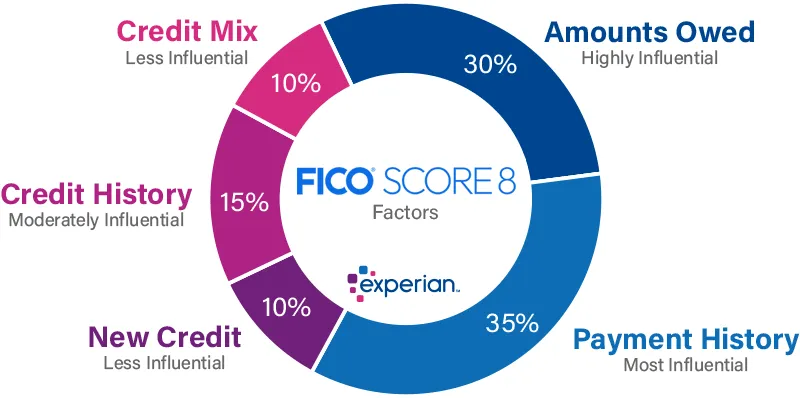

What Are the Credit Scoring Factors?

As you pay off debt accounts, it helps to understand how your credit score is calculated and how your actions may affect it. These are the top credit scoring factors to be aware of:

Payment History: 35%

The most important factor, accounting for 35% of your FICO® ScoreΘ, payment history reflects whether you pay your bills on time. A single payment over 30 days late stays on your credit report for seven years and can negatively affect your credit score.

Amounts Owed: 30%

Accounting for 30% of your FICO® Score, this factor indicates how much you owe on loans and your credit utilization rate on revolving credit. You can calculate your credit utilization by dividing your outstanding balance on each revolving account by its credit limit, then multiplying by 100 to see the result as a percentage.

Example: You have a credit card with a $20,000 limit and a $5,000 balance. Your credit utilization rate on that credit card, then, is 25%: (5,000 / 20,000) x 100 = 25.

Length of Credit History: 15%

The age of your credit accounts determines 15% of your FICO® Score. Credit scoring models consider factors such as the age of your oldest credit account, newest credit account and the average age of all your accounts. The longer you've had credit accounts in good standing, the better.

Credit Mix: 10%

Having a mix of revolving and installment credit accounts is less important to your credit score than some other factors, but it accounts for 10% of your FICO® Score, which can still make a difference. For example, if you've only had installment loans (such as student loans or auto loans), opening a credit card account can improve your credit mix. That doesn't mean you should open a new account solely for this purpose, however. It's generally best to apply for new credit only when you need it.

New Credit: 10%

When you apply for a new loan or line of credit, a hard inquiry appears on your credit report, which can temporarily lower your score a few points. Approximately 10% of your FICO® Score factors in how many new accounts you've recently opened and how many hard inquiries you have. An increase in those activities can make you appear risky to lenders.

Tip: One exception when applying for new credit is rate shopping for the best installment loan, such as a car loan or mortgage. Credit scoring models see rate shopping as a good practice, so they treat these loan applications as a single hard inquiry if they are completed in a short time frame, two weeks to be safest. This minimizes credit score impact while also helping you find the best deal.

Learn more: Credit Score Basics: Everything You Need to Know

How to Improve Your Credit Score

Paying off revolving account balances is one way to help improve your credit score relatively quickly, but there are other things you can do to help increase your score over time.

- Make payments on time. A consistent history of timely payments is key to improving your credit score. If you struggle to remember due dates or have lots of credit cards and loans, setting up autopayment can help.

- Minimize credit utilization. Lower is better; people with the highest credit scores tend to have credit utilization rates under 10%. If your credit cards have low limits, making payments throughout the month or paying the balance right before your billing cycle ends can help keep utilization rates low.

- Limit applications for new credit. Too many hard inquiries can negatively impact your credit score, so don't apply for credit unless you really need it. Many lenders allow you to prequalify for loans or credit cards, which involves a soft credit check that doesn't affect your credit score.

- Keep old credit card accounts open. Closing a credit card reduces your available credit and could hurt your credit mix if it's your only revolving credit account. If there's a high annual fee, ask about downgrading to a no-annual-fee card so you can keep the account open for free.

Tip: To make sure your timely payments are reflected accurately, check your credit report from all three credit bureaus, which you can do for free weekly at AnnualCreditReport.com.

Learn more: Tips to Improve Credit

The Bottom Line

Building and maintaining good credit is a lifetime effort that pays off in greater financial flexibility, helping you achieve big goals like buying a home. Signing up for free credit monitoring from Experian can help.

Experian's credit monitoring service is an easy way to track changes to your FICO® Score and see how your financial behaviors shape your credit score. You'll also get access to Experian Boost®ø, a free feature that adds your on-time utility, streaming, phone and eligible rent and insurance payments to your Experian credit report, which could help improve your credit scores.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen