How Many Credit Cards Should a College Student Have?

How many credit cards should you have while you're a college student? One? None? A dozen? There's no one answer that's right for every student. Instead, the number of credit cards a student should have depends on their ability to make their payments on time, manage their money and avoid overspending. Here's a closer look at the factors that college students should consider before applying for credit cards.

Should a College Student Get a Credit Card?

Getting a credit card while you're in college is a good idea for a couple of reasons. If you ever shop online, a credit card offers stronger fraud protection than a debit card, limiting your liability to $50. A credit card can be a safety net in case of large, unexpected expenses, such as a costly car repair. Perhaps most important, using a credit card responsibly will help you build a credit history, which is one of the first steps of "adulting." You'll need a credit history to rent an apartment or get a loan to buy a car, for instance. (If you don't have a credit card yet, find out how to get your first credit card.)

How Many Credit Cards Is Considered too Many?

You're ready to add some new credit cards to your wallet—but how many? There's no specific right number of credit cards that applies to everyone. However, having several cards can help you build your credit history in a couple of ways.

If you only have a few accounts on your credit report (say, a student loan and one credit card), you have what's called a thin credit file. In other words, there's not a lot of evidence that you're good at managing your credit. Adding more credit accounts (such as new credit cards) helps create a better picture of how you handle credit.

In addition to the number of credit accounts you have, the amount of credit you're using compared with the total credit you have available is another factor in your credit score. This measure is called your credit utilization ratio.

Suppose you have one credit card with a credit limit of $1,000. If you have a balance of $600, you're using 60% of your available credit (1,000 divided by 600). Since credit scoring models like to see 30% utilization or less, using this much can hurt your credit score.

However, if you have three credit cards with a total credit limit of $3,000 and you have a total balance of $600 on all three, you're only using 20% of your available credit (3,000 divided by 600). That's much better, in creditors' eyes.

OK, now you're convinced you need more credit cards. Before you hop online to apply, stop and ask yourself: Can you handle the urge to splurge? A wallet full of shiny new credit cards might tempt you to treat all of your friends to pizza every Friday or book a spring break trip you really can't afford. If you're still struggling to manage one credit card, or if you have a tendency to overspend in general, you should probably wait to get more credit cards until you're better at managing money. After all, you want these credit cards to help improve your credit score, not hurt it.

How to Manage Multiple Credit Cards

Once you've decided to take on multiple credit cards, follow these tips to handle them responsibly.

- Pay your credit card bills on time. Keeping track of due dates for multiple cards can get tricky. Use calendaring apps, alerts and reminders to stay on track, and set up auto pay to keep you on schedule.

- Check your credit activity regularly. Go online to look at your statements at least once a month and check for anything unusual. The faster you catch a fraudulent charge, the faster it can be removed from your record.

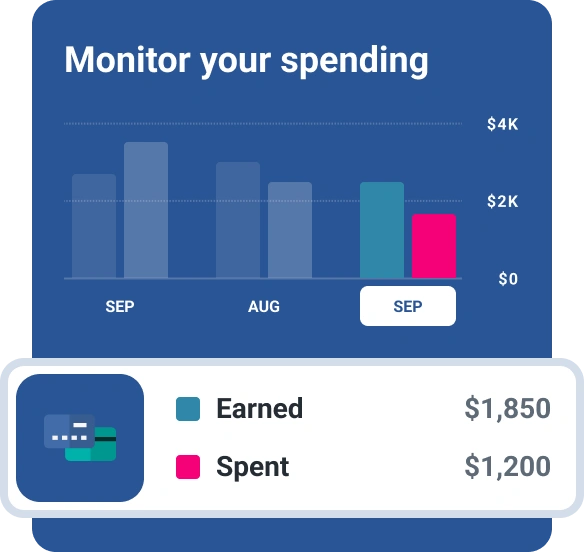

- Spend only what you can afford. Don't carry a balance; charge only as much as you can pay in full each month. Using a free budgeting app like PocketGuard can help you keep track of your spending.

- Use all of your cards. If you have three credit cards but only use one of them, you're not improving your credit scores as much as you could be. To keep all your cards active, alternate purchases from one card to the other, or put a small, recurring charge (like your Netflix account or cell phone bill) on each card.

- Know the terms of your credit card agreements. These include:

- Balance: the total amount you owe at any given time. If you don't pay off the balance in full, you'll be charged interest on the remaining amount.

- Annual percentage rate (APR): indicates the interest you'll pay on balances. The same credit card can have different APRs, such as a lower APR for purchases and a higher one for cash advances. Learn more about APR.

- Minimum payment: the minimum amount you must pay that month to remain in good standing.

- Late fees: fines for late payments. Your APR may also be adjusted upwards if your payment is late.

- Annual fees: Cards that offer rewards, such as airline miles, often charge annual fees.

- Grace period: The amount of time you have to pay off a purchase without incurring interest.

How Applying for Multiple Credit Cards Affects Your Credit Score

Be aware that when you apply for several credit cards over a short period of time, your credit scores might be affected. Why? You're potentially taking on more debt, which is inherently risky. In addition, every time you apply for a credit card, the card issuer makes an inquiry into your credit report. (An inquiry is just a record that a lender has checked your credit report because you applied for credit.) Both of these factors can lower your credit score a bit. The good news: This dip should only last a few months.

Speaking of credit scores, it's a good idea to get a free credit report before applying for any new credit cards so that you know what your credit file looks like and can correct any mistakes.

College is a time to learn. By getting more than one credit card and using your cards wisely, you can learn one of the most important life skills there is: how to manage your money.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Karen Axelton is Experian’s in-house senior personal finance writer. She has over 20 years of experience as a journalist and has written or ghostwritten content for a variety of financial services companies.

Read more from Karen