How Much Should You Deposit for a Secured Card?

Quick Answer

Secured credit cards generally require a minimum $200 security deposit, but you can deposit more. Your choice will likely hinge on how much you will want to charge each month and how much money you can comfortably afford to have tied up as a deposit.

Secured credit cards, as their name suggests, require a security deposit. The amount of that deposit typically is equal to the card's credit limit, or a significant portion of it. Required deposits can start low ($49, for example) but a minimum of $200 is more common. If you have the cash, you can choose to deposit $5,000 or more if the card in question allows it.

The right security deposit amount for you will depend on your goals, your savings and the cards you qualify for. Read on to learn more.

What Is a Good Security Deposit Amount?

A good security deposit amount will vary depending on your financial resources and how you plan to use the credit card. When you are deciding how much to deposit, it's smart to consider:

- How you plan to use the card: If you need to use a credit card to make travel reservations or get reimbursed for expenses, you may need a credit limit higher than the typical minimum deposit of $200. However, if you are applying for a secured credit card solely to build your credit, a small deposit may help you achieve your goals without requiring you to tie up a larger amount.

- Your financial resources: You will need to consider whether you can do without the cash needed to make a large deposit. If it leaves you so depleted that you have trouble paying off charges, then the security deposit is too high.

- How and when the security deposit will be refunded: Some secured credit cards offer an automatic upgrade to an unsecured card after a certain number of consecutive on-time payments. Be sure you understand fees and the process for getting your security deposit back, whether it's closing the card or qualifying for an unsecured credit card from the same issuer.

How to Choose a Secured Card

Think about your reason for wanting a secured credit card as well as how much money you can comfortably afford to put down as a deposit. A secured credit card can be a good way to build or rebuild credit when you can't qualify for an unsecured card because you have little or no credit history, or because you have bad credit.

Consider the following questions before you apply.

What Credit Limit Do You Need?

If you are getting a secured credit card to get yourself on the credit radar and start building credit, you may be fine with the smallest deposit you can get, charging little and paying it off either when the charge posts online or when the bill arrives. But if you need to make bigger charges, and you can afford a bigger deposit, look for a card with a higher maximum deposit.

Can You "Graduate" to an Unsecured Card?

Some cards that are specifically marketed to credit newbies offer an automatic upgrade to a secured card, without having to apply for one or request a deposit refund.

Does the Card Offer Features You Need or Want?

Some secured credit cards have foreign transaction fees while others do not. They may have different policies on when late fees or penalty interest rates are imposed. Some have annual fees, and some don't. Some even offer rewards.

How Long Do You Plan to Keep the Card?

Secured cards that allow you to graduate to unsecured credit cards can make this question irrelevant. But if you're getting a card to increase the number of on-time payments in your credit reports, you may want to keep it on your record a little longer. This is especially true if that card doesn't have an annual fee. It can be a good idea to have some timeline in mind for when you will replace a secured card with an unsecured one and get your deposit back.

Is an Unsecured Card a Better Choice?

You may be able to get an unsecured card even if you've never had credit in your own name before. Some card issuers now use alternative data, such as rent and other payments, to make credit decisions. Or, you may already have a credit report and score based on the credit history of someone who added you as an authorized user.

Both unsecured and secured credit cards are reported to credit bureaus as revolving credit. That means the credit is available again after you have paid the outstanding balance, and as long as you cover the minimum payment, you can choose how much of the balance to pay.

The Bottom Line

Secured credit cards can be a great way to help build or rebuild your credit. The required security deposit means that lenders can afford to issue cards to people who might otherwise not qualify for a credit card.

A minimum security deposit tends to be around $200, with maximums as high as $5,000. The right amount depends on how much you have available and how you plan to use your credit card. You do not want to put down more than you can comfortably afford.

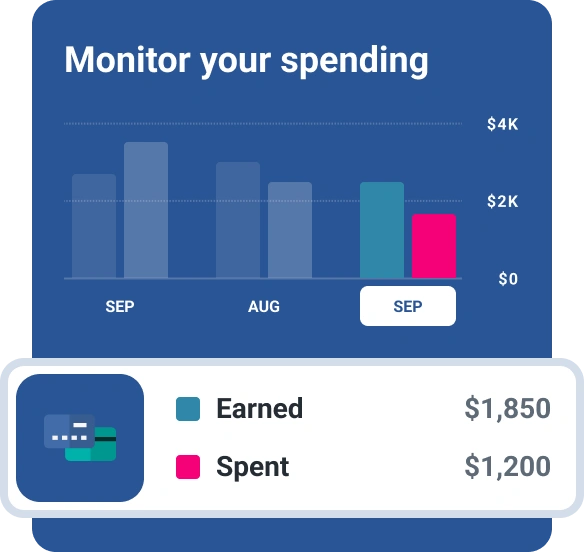

Choosing a secured credit card involves matching up your needs and resources to those of cards on the market. Experian's card comparison tool, a free service, can help you save time in finding a credit card with a security deposit you can afford that is likely to help you accomplish your goals.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Bev O'Shea is a Georgia-based freelance journalist specializing in personal finance and consumer credit. Most recently, she was a staff writer at personal finance website NerdWallet, where she was an authority on credit reports, credit scores and identity theft.

Read more from Bev