How to Build Good Credit After College

Quick Answer

As a new graduate, you can build good credit by making consistent, on-time payments toward loans and credit cards. It’s also important to check your credit report regularly and understand how credit scores work so you can make wise financial choices.

To build credit as a new graduate, check your credit report, review what goes into a good credit score and make timely payments toward loans and credit cards.

Now is an excellent time to develop strong credit habits, since your credit will impact many aspects of your life—from qualifying for an apartment to enjoying the benefits of a rewards credit card. Your credit will be especially important if you decide to buy a car or home in the coming years.

Below we'll cover what you need to know about how credit works, what affects your credit scores and the steps you can take to build good credit.

1. Check Your Credit Reports

Your credit history lives within your credit reports, records of your loan and credit card accounts and whether you've paid those bills on time. There are three major credit reporting companies that collect and organize the information that goes into credit reports: Experian, TransUnion and Equifax.

If you have taken out a student loan in your name, have a student credit card or have a credit card with your name on it that's connected to your parent's account, you probably have a credit report already.

On the other hand, if you've never had a credit card or loan, you might not have a credit report yet. To build credit, you can apply for a credit card or loan and begin making payments, which are then reported to the credit bureaus and appear on your credit reports. We'll review some loan and credit card options below.

Reviewing your credit reports is important because creditors, landlords and employers may look at your credit report before approving your credit, rental or job application. Check your credit report to make sure everything is correct and be prepared to explain any negative marks, such as a late payment or collection account.

Tip: If you don't have an Experian credit report, you can use Experian Go™ to establish an Experian credit file and begin building credit.

How to Check Your Credit Reports

There are several ways to check your credit reports:

- Go to the credit bureaus' websites. Each of the three credit bureaus gives you the opportunity to access your credit reports from their websites, usually by registering for an account.For example, you can check your Experian credit report for free and also get free credit monitoring that will notify you of changes in your report.

- Go to AnnualCreditReport.com. You can also request free weekly copies of each of your credit reports at AnnualCreditReport.com, a website run by the three credit bureaus. This allows you to view each report without having to register individually with the three companies. But you won't be able to view your credit scores this way, which are calculated based on the information in your credit reports.

- Use a third-party tool. Other websites and personal finance platforms offer the opportunity to check your credit for free, including some credit card issuers and lenders with which you may already have a credit card or loan account. That's not the same as closely reviewing your detailed credit report. But third-party credit score providers may show you which elements of your report are most impacting your credit score (such as payment history or your average account age) so you can address them.

Learn more: Understanding Your Experian Credit Report

2. Understand How Credit Scores Work

To make choices that will improve your credit score, understand the factors that influence your credit scores, and which ones carry the most weight. FICO® ScoresΘ are used by 90% of top lenders; here's how they're calculated.

Payment History: 35%

The most important contributor to your credit score is your payment history, or whether you've paid your credit card or loan bills on time. A payment will be noted as late on your credit report if it's more than 30 days past due, and that negative mark will remain for seven years.

Amounts Owed: 30%

The amount of debt you owe, and the amount of available credit you're using, also contribute significantly to your credit score. Available credit is the total amount of your credit limit on individual credit cards and across all cards. For example, if you have two credit cards with respective credit limits of $2,000 and $5,000, your total available credit is $7,000.

Your credit utilization ratio, or rate, is a calculation that credit reporting companies use to determine how much of that available credit you're using—and the lower your rate, the better. If you have a $1,000 balance across the two cards and $7,000 in available credit, your overall credit utilization rate is 14%. Often, those with the highest credit scores have credit utilization rates below 10%. That's a good reason to pay off your entire credit card balance every month, which will get you to 0% credit utilization and $0 in amounts owed—and could save you a lot in interest.

Length of Credit History: 15%

Another factor that affects credit scores is the amount of time you've been using credit. Potential creditors like to see that you are experienced with the credit landscape, which could mean you're more likely to pay back debts on time. As a result, generally, the longer your credit history, the better. The credit bureaus also take into account both the average age of your accounts and the age of your oldest account, as well as the length of time since you last opened a new credit account. Try to keep your oldest accounts open rather than closing them, even if you only use them sparingly, to prevent a potential drop in your credit score.

Credit Mix: 10%

A less important element of your credit score is the variety of credit types you're using, such as credit cards and loans, which is known as credit mix. Credit cards are considered revolving credit, since you get one credit line and can borrow from it as you need. Loans are considered installment credit, since you pay them back in equal installments over time. Creditors like to see that you can manage both types, so your score may benefit if you have a range of accounts at once.

New Credit: 10%

Applications for new credit cards or loans lead to hard inquiries on your credit report, which show that a lender or creditor has requested to view your report. Hard inquiries can have a negative impact on your score, since having more credit accounts can make it more likely that you'll fall behind on payments. Limit your credit applications overall, but especially when you want your score to be as strong as possible, such as when you're applying for a mortgage. Generally, it's best to only apply for credit when you really need it.

What Are the Credit Score Ranges?

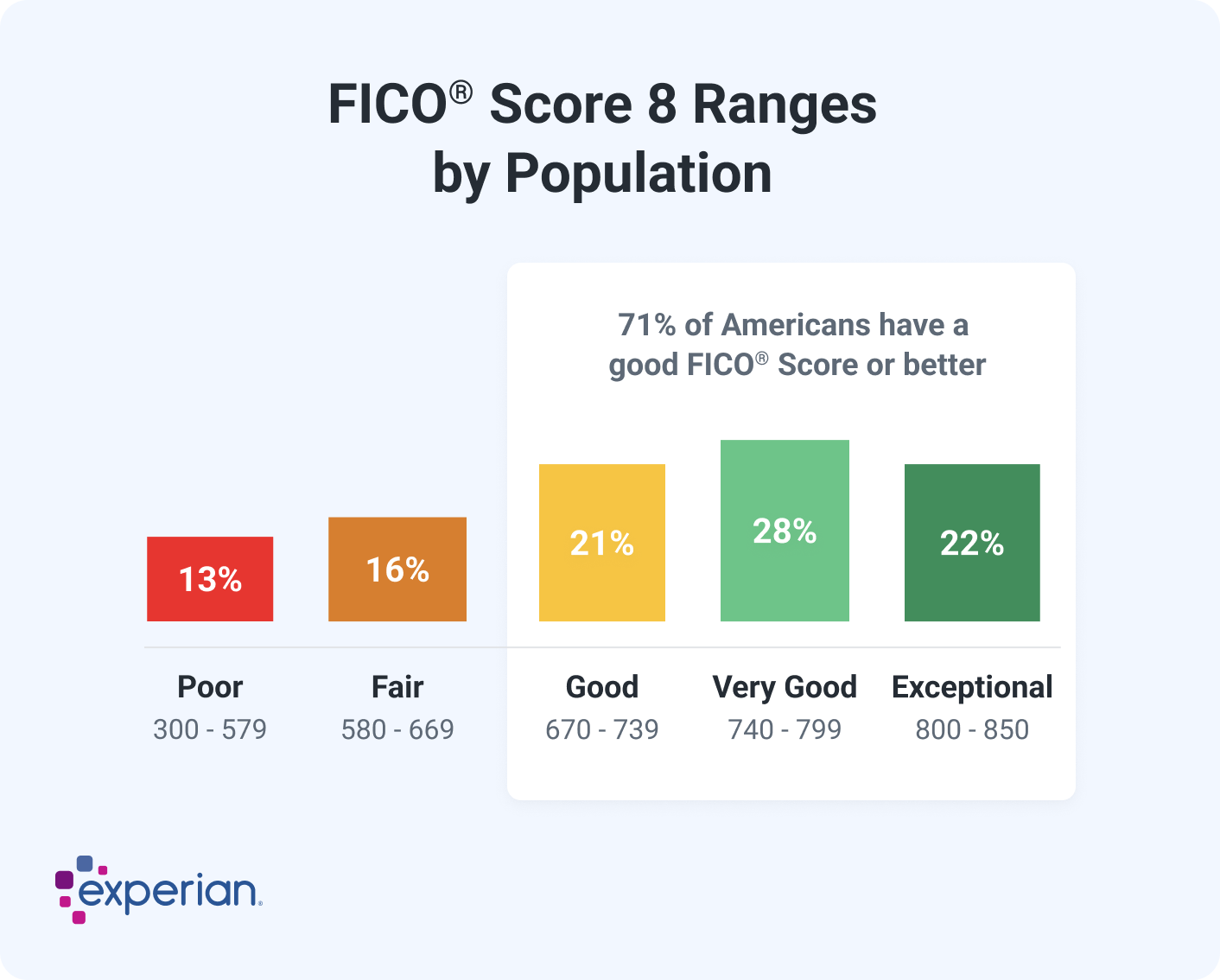

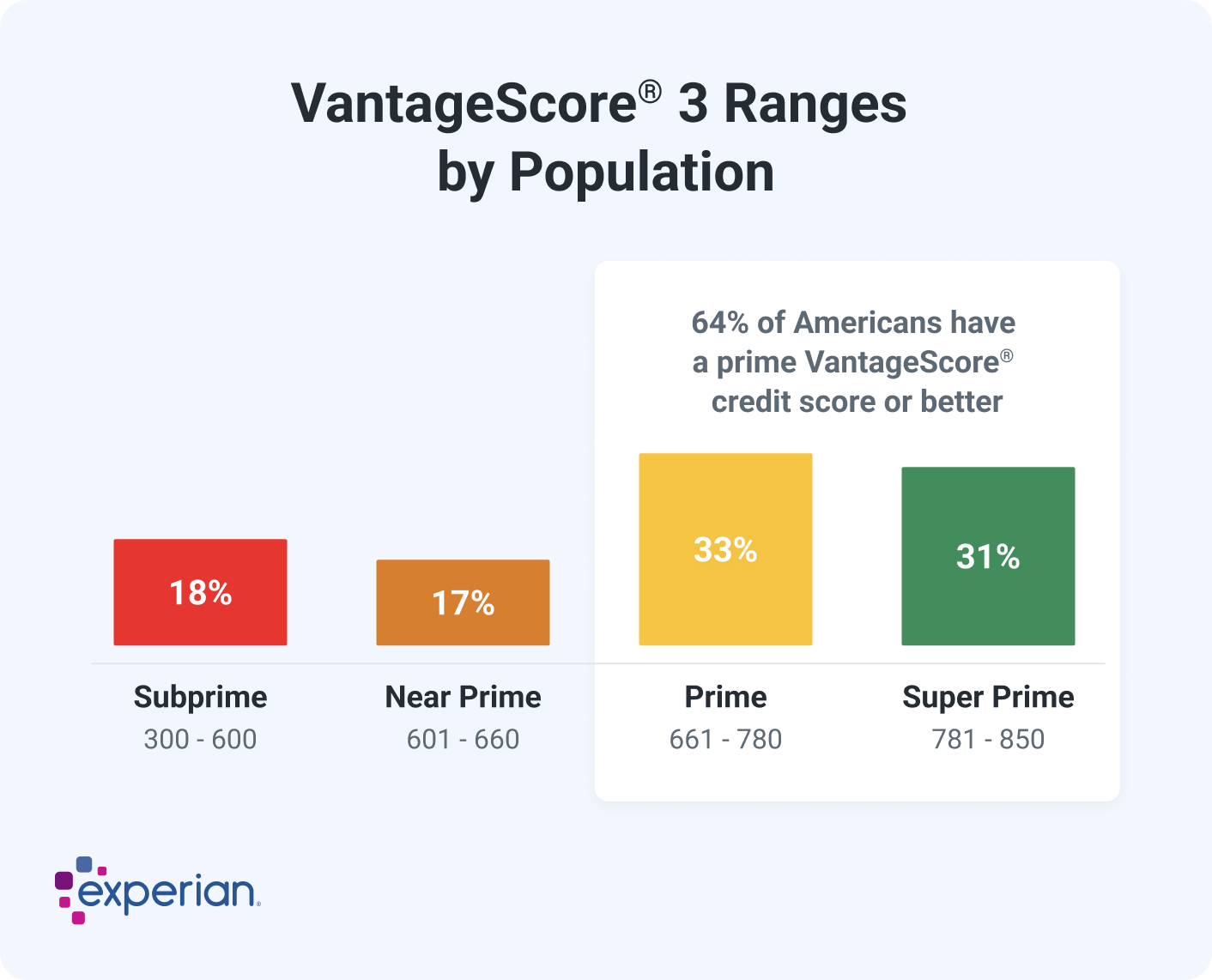

There are two main types of credit scores: FICO® Scores and VantageScore® credit scores. The two types have slightly different ranges, shown below, that describe where your score falls from a minimum of 300 and a maximum of 850.

There are also several different versions of each score, such as the FICO® Score 8 and Score 9, which are both widely used by lenders. Common VantageScore credit score versions include the VantageScore 3.0 and 4.0.

Below, you can see the ranges for FICO® Score 8 and VantageScore 3.0 credit scores and their breakdown by population.

3. Start Paying Off Your Student Loans

If you're like millions of other college graduates, you're leaving school with student loan payments to make. As of the third quarter of 2024, Experian found the average student loan balance was $35,208.

Your student loans can help you establish and build your credit history, even if deferment allowed you to pause payments while in school and for the six months after graduation. But once student loan repayment starts, paying your bills on time is crucial for building good credit.

Stay in contact with your student loan servicer, the company that manages your student loans, to understand how much you owe per month, how to make payments and how to reduce your bills if necessary.

Tip: If you're struggling with student loan payments, review your repayment plan options and see if switching plans might make your monthly payment more affordable.

4. Apply for a Credit Card

Another way to strengthen your credit score is to apply for a credit card—especially if so far, you only have student loans (a type of installment loan) on your credit report. It's key to use your credit card strategically to build credit; for example, to make small purchases that you can immediately pay off.

Make sure you set aside cash in an emergency fund, ideally in a high-yield savings account, so that you don't have to rely on a credit card for unexpected expenses like car repairs or medical bills.

Here are some types of credit cards to consider:

- Secured credit cards: A secured credit card is an excellent option for a first or early credit card. You'll make a cash deposit that will usually equal your credit limit, and you'll make payments and add credit history to your credit report without the potential for going into steep debt. You can convert the secured card to a traditional credit card via an automatic upgrade after a certain number of months or after applying for one with your card issuer.

- Store credit cards: Retail stores also offer their own credit cards, which may come with discounts or rewards points you can redeem for purchases at the store. They also may not require a good or excellent credit score like traditional rewards credit cards do, making them an accessible choice for those new to credit. But they also typically have higher interest rates than other types of credit cards, making it even more important to plan to pay off your balance every month.

- Rewards credit cards: While you'll need good credit to qualify for a rewards credit card, working toward getting one can be a worthwhile goal if you plan to make use of the perks. When you use the card, you can earn cash back, miles or points that you can then redeem for cash, flights, hotels and more depending on the card's offerings.

- Intro 0% APR credit cards: Credit cards that come with an introductory 0% APR period also generally require good to excellent credit. These cards allow you to make purchases or transfer a balance from another card and pay no interest for, typically, 12 to 21 months. You can use that time to pay down your balance at a slower pace—but make sure to get your balance to zero by the time the intro 0% APR period ends, or you'll suddenly pay a much higher APR after the introductory offer is over.

Tip: When using a credit card, especially if your goal is to build credit, aim to pay off your entire balance every month. That will keep your credit utilization low and will save you money on interest. Also, set up autopay so you never miss a credit card bill payment and you can enjoy the credit score benefits of consistent, on-time payments.

5. Get Credit for Other Monthly Payments

Typically, the majority of the payment history on credit reports comes from loan and credit card payments. But sometimes you can add other types of payments to your credit report. Experian Boost®ø, for example, can connect your bank and credit card accounts and then add eligible rent, utility, cellphone, insurance and some streaming service payments to your Experian credit report. These on-time payments could improve your payment history—boosting your resulting credit scores.

The Bottom Line

Building credit happens over time. As a new graduate, you have a valuable opportunity to begin the process early, starting with understanding the foundational elements of how credit reports and scores work. The more financial decisions you make with the potential credit impact in mind, the more you'll benefit from your choices—in the form of easier access to credit and lower interest rates—later on.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna