How to Negotiate a Car Loan

Quick Answer

To negotiate a car loan, start by checking your credit score and getting clear on how much car you can afford. Then, research auto loans and interest rates and get preapproved. Last, leverage your preapproval by asking lenders if they can beat its terms.

If you're planning to finance a car, your loan terms will dictate how much you ultimately spend on the purchase. As a result, it's crucial that you take steps to get the best possible deal available.

While there are some limitations, it's possible to negotiate the terms of a car loan with lenders and dealers. Here are some steps you can take to save hundreds or even thousands of dollars.

1. Check Your Credit Score

The interest rates you qualify for will largely depend on your credit history, along with other factors, so checking your credit score will give you an idea of where you stand.

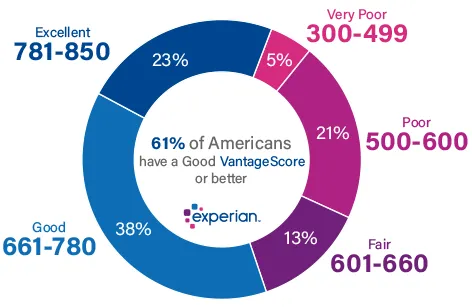

The higher your credit score, the more likely you are to qualify for a lower interest rate. To get an idea of what lenders are looking for, familiarize yourself with the different FICO® ScoreΘ ranges:

According to Experian's State of the Automotive Finance Market for the third quarter of 2023, the average interest rate for a new car was 5.61% for borrowers with the best credit scores, compared to 14.17% for borrowers with the lowest credit scores.

If your credit score isn't where you want it to be, and the vehicle purchase isn't urgent, consider taking some time to work on improving your credit before you take the next step.

2. Know How Much Car You Can Afford

Take a look at your budget to estimate how much you can reasonably spend on a new car each month. Evaluate your income and expenses, and make sure you also have room for other important financial goals, such as paying off debt, investing for retirement and saving for emergency expenses and other short-term needs.

Keep in mind, though, that your monthly loan payment isn't the only expense to consider. Be sure to factor in all the costs of ownership to determine how much car you can afford, including:

- Loan payments: What you'll pay every month depends on your loan amount, loan term and interest rate.

- Auto insurance: A lot of factors go into deciding your insurance premiums, including the make, model and age of your vehicle. Get quotes from multiple insurance carriers to find out what to expect.

- Maintenance and repairs: Every car requires maintenance and repairs over time, but the older the vehicle, the more likely it is that you'll have these expenses on a regular basis. Buying an older car may save you upfront costs, but you'll have to plan for when things go wrong.

- Fuel: Depending on how much time you spend behind the wheel, the fuel economy of your vehicle and the type of fuel the vehicle requires—regular, premium or diesel—run some numbers to determine how much you'll be paying in gas. If you have your eye on an electric vehicle, research the costs of installing a charger for your garage and the ongoing electricity expense.

Auto resource websites such as Edmunds and Kelley Blue Book can estimate a vehicle's total cost of ownership over a five-year period, which is slightly less than the average auto loan term of roughly 68 months for new cars and 67 months for used cars, according to Experian data.

Compare rates on auto refinance

Find a good auto refinance loan with today’s rates. Compare current rates and offers to find the best loan for you.

3. Research Auto Loans and Interest Rates

When you work with a dealer, their finance department can shop around for your vehicle loan, getting rates from multiple lenders so you don't have to. That said, dealers aren't legally required to offer you the best rates you qualify for. In fact, the rate you're quoted may include compensation for the dealer for arranging the financing between you and the lender.

As a result, it's a good idea to shop around and compare auto loan interest rates for yourself before you even head to the dealership. Some lenders even offer prequalification tools that can give you an estimate based on a soft credit inquiry, which won't impact your credit score.

You may also get an estimate of your monthly payment based on your creditworthiness, making it easier to determine if you can afford the model you want.

4. Get Preapproved

Prequalification can provide you with a basic estimate of how much car you can afford, but if you want a better idea of what your terms will look like, consider getting preapproved with multiple lenders for a better comparison.

While a preapproval still isn't a final offer, it typically involves a hard credit inquiry, which provides the lender with more information about your creditworthiness.

Keep in mind, though, that hard inquiries can impact your credit score. To minimize that impact, submit your preapproval applications within a short period of time—typically 14 to 45 days—and the multiple inquiries will be combined for credit-scoring purposes.

5. Negotiate the Terms

Now that you have some preapproval offers from multiple lenders, you'll have a bit more leverage with lenders and dealers.

For example, some lenders may offer to beat any rate you get from a competitor, as long as the terms of the loan are the same. If you'd prefer to work with a specific lender, but it doesn't offer the best terms, present your best offer and ask them if they can beat it.

At the dealership, having a preapproval offer in hand indicates that you're serious about buying a car. As a result, the dealer may be more motivated to negotiate a price that works for you, and a lower sales price could qualify you for a lower interest rate when you finalize your loan.

If you're willing to fill out another credit application at the dealership, you can also ask the dealer to try to beat your best preapproval offer with its network of lenders.

Other Ways to Reduce Your Auto Loan Interest Rate

The interest rate a lender offers is a reflection of the risk you pose of defaulting on your monthly payments.

If you're not satisfied with your best offer, another way to negotiate a lower interest rate is to find ways to minimize the risk you present to prospective lenders. Here are just a handful of options to consider.

Put More Money Down

The more you borrow from a lender, the more it stands to lose if you default on your payments. With a larger down payment, you'll not only reduce how much you have to borrow, but you could also qualify for a lower interest rate.

Reduce the Sales Price

Depending on your situation, it may make sense to choose a less expensive car, at least until you can manage to improve your credit score.

Alternatively, you can reduce the sales price by declining add-ons, such as service and maintenance contracts and gap insurance.

Opt for a Shorter Repayment Term

Longer repayment terms typically come with higher interest rates to account for interest rate risk—there's a greater risk of interest rates increasing during a long repayment term, which could negatively impact the lender's revenue.

If you can afford a higher monthly payment, selecting a shorter repayment term could result in a lower rate. Just make sure you don't put too much pressure on your budget, particularly when it comes to other important financial goals.

Get a Cosigner

If you have bad credit or you simply want more negotiating power, consider asking a creditworthy cosigner to apply for the loan with you. Your cosigner agrees to make payments on the loan if you can't, effectively reducing the risk of default for the lender.

Just keep in mind that if someone cosigns with you, the loan also shows up on their credit report, and payment problems will damage their credit history.

How to Lower Auto Loan Interest Rates After Getting a Loan

Even after all your efforts, it's still possible you won't qualify for the interest rate you want. Fortunately, that doesn't mean you're stuck with a high interest rate for the entire term of your loan.

You can't change your interest rate on an existing auto loan. But if you can improve your credit score later on, you may be able to refinance your car loan with a different lender and score better terms. Here are the actions you can take to improve your credit prior to applying to refinance your auto loan:

- Check your credit report: Your credit report provides a list of all your current and some or all previous credit accounts and can provide you with the information you need to know which areas you need to address.

- Dispute inaccurate or fraudulent information: In rare instances, incorrect or even fraudulent information could show up on your credit report. If you believe this has occurred, you have the right to file a dispute with the credit reporting agencies. A successful dispute will result in the details being corrected or removed.

- Pay on time, every time: If you're behind on payments with any of your credit accounts, get caught up as quickly as possible, then focus on paying on time every month going forward.

- Pay down your credit card balances: Your credit utilization rate, which is calculated by dividing your credit card balances by your credit limits, is one of the most influential factors in your credit score. In general, the lower your utilization ratio, the better, so work on paying down your credit card debt and keeping it relatively low.

As with an auto purchase loan, it's a good idea to shop around and compare refinance rates from multiple lenders. Once you find the right deal and get approved, the lender will pay off your original loan. If you have positive equity in the vehicle, you may even be able to get some cash out.

Don't Settle for High Interest Rates

If your credit isn't in stellar shape, you may have a hard time qualifying for some of the best interest rates auto lenders have to offer. But that doesn't mean you have to settle for a high-interest loan, even if you have bad credit.

Take your time to consider your options, shop around and compare interest rates, and look for opportunities to reduce the amount of risk lenders take on. If you have time before you need a new car, don't rush into anything. Be prepared to walk away if the terms of the loan don't match your budget.

If you don't have time, take what you can get now and work on building your credit, so you can qualify for a lower interest rate through refinancing in the future. Monitoring your credit can help inform your actions and make it easier to track your progress.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben