How to Remove an Authorized User From Your Credit Card

To remove an authorized user from your credit card, call the card issuer or update your account on the company's mobile app or website. Since the authorized user's credit may be affected, make sure they know the change is coming so they can understand and prepare for its potential impact.

An authorized user on your credit card can make charges but isn't legally responsible to the credit card company for paying them off. That can make being an authorized user useful to those eager to build credit—and a potential headache for the primary account holder.

When you decide it's time to remove an authorized user, either because the arrangement isn't working or the user has strong enough credit to manage on their own, here's how to do it.

What Is an Authorized User?

Many credit card issuers offer the option for cardholders to grant charging privileges to another person on their account. That person, called an authorized user, may get their own card they can use to make purchases and earn rewards like any other cardholder. Their purchases will show up on the primary account owner's credit card statement, but the authorized user is not obligated to make payments. Only the primary cardholder is required to pay the card's balance, and their credit can be affected by high balances and late payments.

If you have a credit card of your own, you can add an authorized user—perhaps a partner who is eager to improve their credit—to your account online. In many cases, their credit will also benefit not just from low balances and on-time payments on the card now, but from the account's entire positive credit history. That's only if the card issuer reports authorized-user activity to the credit bureaus, however.

It's a smart idea to come up with a payment schedule with your authorized user wherein they send you money each month to cover the charges they made. But only you have the legal responsibility with the card issuer to make payments—for your charges and for the authorized user's.

How Does Having an Authorized User Affect Your Credit?

When managed appropriately, an authorized-user arrangement shouldn't affect your credit. Have a direct conversation with a potential authorized user about your expectations for their usage of the card before adding them to the account.

Ideally, the authorized user will make charges to your account only sparingly—up to a monthly amount that you've specified—and pay you for those charges by the end of the month. That will keep your debt balance from growing, which will limit your credit utilization rate, or the proportion of available credit you're using. Credit utilization is a major component in your credit score, and so is payment history. When your authorized user pays you on time, that allows you to make your total credit card payment on time, keeping your payment history spotless and your credit score strong.

When to Remove an Authorized User From Your Credit Card

There may be times when having an authorized user on your account does more harm than good. In these circumstances, consider removing an authorized user from your credit card:

- The authorized user is not respecting the spending limit you've set.

- The authorized user does not pay you for their charges as agreed upon.

- Your relationship with the authorized user changes and you would benefit from ending financial ties.

- The authorized user's credit has improved to the point at which they can qualify for their own credit card, potentially with more perks.

- You are concerned about your finances and would like to limit the potential for debt to grow.

There may be other options besides removing the authorized user from the account. You may choose not to provide the authorized user with their own credit card, which means they'd benefit from your good credit habits without being able to make purchases on their own. Some credit card issuers let you put a hard limit on the spending authorized users are able to do. You can also suggest credit-building alternatives that they can apply for individually instead, such as a credit-builder loan or a secured credit card.

How to Remove an Authorized User From Your Credit Card

When you've decided that removing the user is the right move for you, let them know as soon as possible. That's because they may experience a credit impact. For example, if they had very little credit or poor credit before they became an authorized user, and they no longer benefit from your credit history, their credit score could dip again.

The process of requesting an authorized user be removed varies by card issuer. You can start by calling the issuer's customer service number. Some companies also let you make the change by logging in to your account online or using the company's mobile app. In general, the change will take effect right away.

The Decision to Remove an Authorized User

It's often not an easy decision to remove an authorized user from your credit card, especially because the person is likely a close friend or relative. But it's crucial to protect your finances and maintain control of your debt balances. That may mean having an honest and upfront conversation with the authorized user about your intentions and feeling empowered to make the call that's best for you.

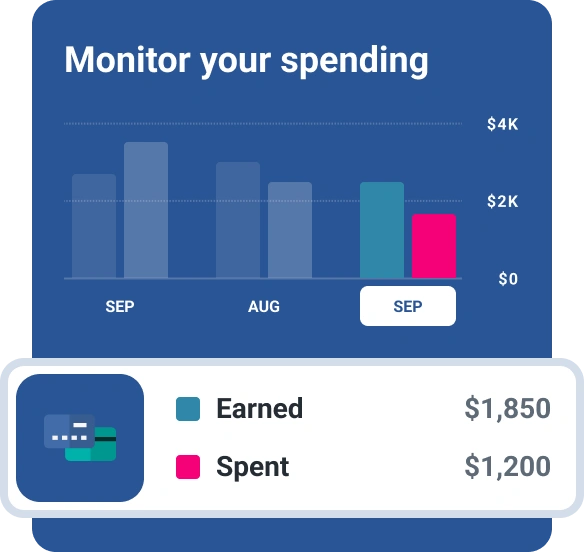

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna