At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our Editorial Policy.

In this article:

Transferring a credit card balance to another account can be a good strategy to help you pay down debt and save money at the same time. When you initiate a balance transfer, the card issuer will send a payment to the other card account, effectively moving the debt from one account to another.

Often, borrowers use balance transfer credit cards that offer a promotional 0% annual percentage rate (APR) to save on interest costs. By using one of these balance transfer promotions, you may be able to pay off your debt without incurring any additional interest.

But before you apply for a balance transfer card, be sure to learn about the process, exclusions and fine print to see whether the money-saving plan will work.

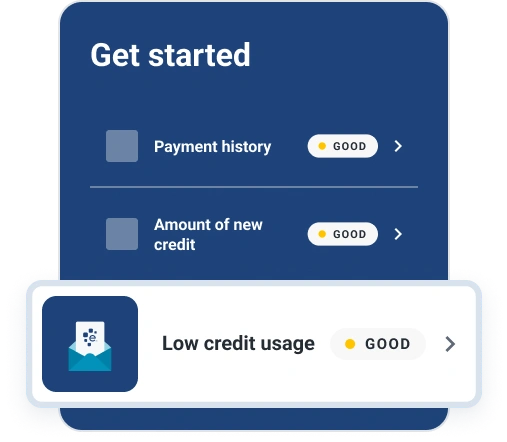

Check Your Credit Score

A balance transfer credit card is simply a regular credit card that offers a promotional interest rate on transferred balances. As with other types of cards, you'll likely need a good to excellent credit score to qualify for the best balance transfer cards.

You can check your credit score before applying to better understand your likelihood of getting approved. Even if you get a balance transfer card with poor credit (which is possible), you might wind up with a low credit limit and may only be able to transfer a few hundred dollars to the card.

If you have poor credit, you might want to consider a secured credit card that has a low promotional APR, even if it's not 0% APR. Or, if you already have several credit cards, it might be worth transferring balances to the card with the lowest interest rate. Calculate how much the balance transfer fee will cost and compare that with your interest savings before making a transfer.

If neither of those options sound like a good course of action, focus on improving your credit and then apply for a balance transfer card. The good news: Paying down your credit card balances in the meantime can help your score.

Review Your Current Credit Cards

After checking your credit, make a list of your credit cards, their balances and their interest rates. These are important to know because:

- You generally can't transfer balances between cards from the same issuer.

- You might not get approved for a credit limit that's high enough to take on all your credit card debt.

You'll want to reference the list as you determine which balance transfer card to apply for. Once you get your new card, you can also use the list to decide which balances to transfer based on your current balances and interest rates.

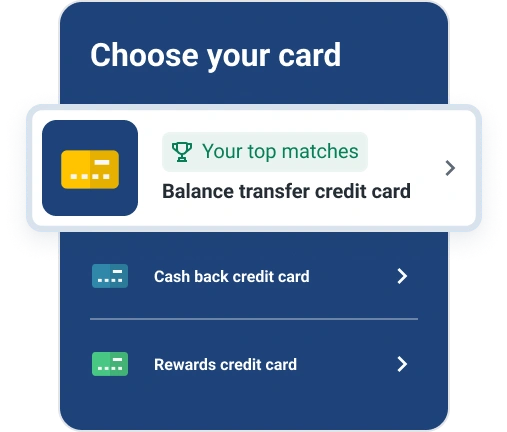

Find the Right Balance Transfer Card for You

With your credit card list in hand, eliminate the balance transfer cards that are from the same banks or credit card issuers as your current credit cards. To choose the best card for your situation, also look for (and compare) the following features:

- Promotional period: A longer promotional period will give you more time to pay off your balance before the standard APR kicks in.

- 0% APR promotion on purchases: If you plan on using the card to make additional purchases, make sure it also offers a 0% APR on purchases.

- Balance transfer fee: Some cards don't have this fee or will waive it. If the card you choose has one, you'll need to pay a fee (often 3% to 5%) based on how much debt you transfer.

- Annual fee: Some of the best rewards cards have annual fees, but you'll likely want a card that doesn't have an annual fee if you're focused solely on paying off balances.

- Rewards program: If the card has a 0% purchase APR promotion and you use it for purchases, you may be able to earn rewards and then use them to help pay down your balance.

Keep these criteria in mind as you review best-of lists and read reviews of different cards. Ideally, you'll find a credit card that offers a long 0% APR on balance transfers and doesn't have an annual fee or balance transfer fee.

Save with an intro 0% APR balance transfer

Understand the Fine Print

Before applying for a balance transfer card, carefully read the fine print to better understand the exclusions and process.

For example, you may only receive a 0% APR on transferred balances if you request the transfer (or if the transfer is completed) within a certain number of days of account opening. Some cards also waive or lower the balance transfer fee during an initial period. However, you could lose the promotional rate during the promotional period if you're late with a payment.

You may also learn that the card issuer has a balance transfer limit that's lower than your card's credit limit. Sometimes this is listed in the fine print. Unfortunately, as with the card's credit limit, you might not know the balance transfer limit until after you're approved.

Apply for a Balance Transfer Card

Once you've narrowed down your list of top picks, it's time to apply for a balance transfer card. Start by applying for the card you want the most, because submitting an application will result in a hard inquiry on your credit report showing a lender checked your credit file, which could hurt your credit score a little.

You could also start with a prequalification, which will result in a soft inquiry that doesn't affect your credit scores. Although only a few card issuers offer this option, it can help you rule out cards you won't get approved for without impacting your credit.

Or, you could use Experian's card comparison tool to compare cards and offers from different issuers. The results take your credit into consideration, but using the tool won't impact your credit score.

Transfer Your Balances

You might be able to add the transfer details when you submit your card application. Otherwise, you can start requesting balance transfers after you're approved.

To do so, you can log in to your online account (or call the card issuer) and share the other accounts' information and the amount you want to transfer. If your new card's credit limit isn't high enough to accommodate all your debt, prioritize the credit cards with the highest interest rates to save the most money.

It can take several weeks for a balance transfer to be processed and completed. To avoid accidentally missing a payment during this period, continue making your payments on your other accounts until you see the balance transfer has gone through.

Some credit cards also come with balance transfer checks or let you transfer money directly into a checking account. These options could be helpful if you need cash or want to transfer a different type of debt.

Pay Down Your Debt During the Promotional Period

After you transfer your balances, focus on paying down the balance transfer credit card before the promotional period ends. If you can pay it off completely, you'll avoid paying any interest on the balance. Even if you can't pay it off, the promotional rate could help save you money.

Often, it's best to avoid using your new credit card for purchases while you focus on paying off the balance. But if you control your spending, make a budget and have a plan, you might be able to earn rewards with the card and then apply them to the balance.

However, consider taking advantage of a credit card's rewards program only if the card also has a promotional 0% APR on purchases. Otherwise, your purchases may accrue interest daily because the transferred balances can void the card's grace period.

Also, consider what you're going to do with your other credit cards now that you have available credit. Keeping the cards open may be best for your credit scores. But you might want to close the cards if you'll be tempted to use them for purchases you won't be able to pay off, or they have high annual fees that will harm your ability to pay off your debt.

Success Requires Follow-Through

Using a balance transfer offer, you can move high interest balances onto a card with a 0% APR promotional period and save money while you pay off your debt. Researching your options and finding the best offer can help set you up for success. Then all you have to do is follow through with the plan and pay off the balance during the promotional period.

In the meantime, you can monitor your credit report and FICO® Score☉ through Experian to see how opening the new account, moving balances and paying down your debt impacts your credit. It might not be an immediate upswing, but paying your bills on time and decreasing your credit card balances can help improve your credit over time.