What Are the Different Credit Score Ranges?

Quick Answer

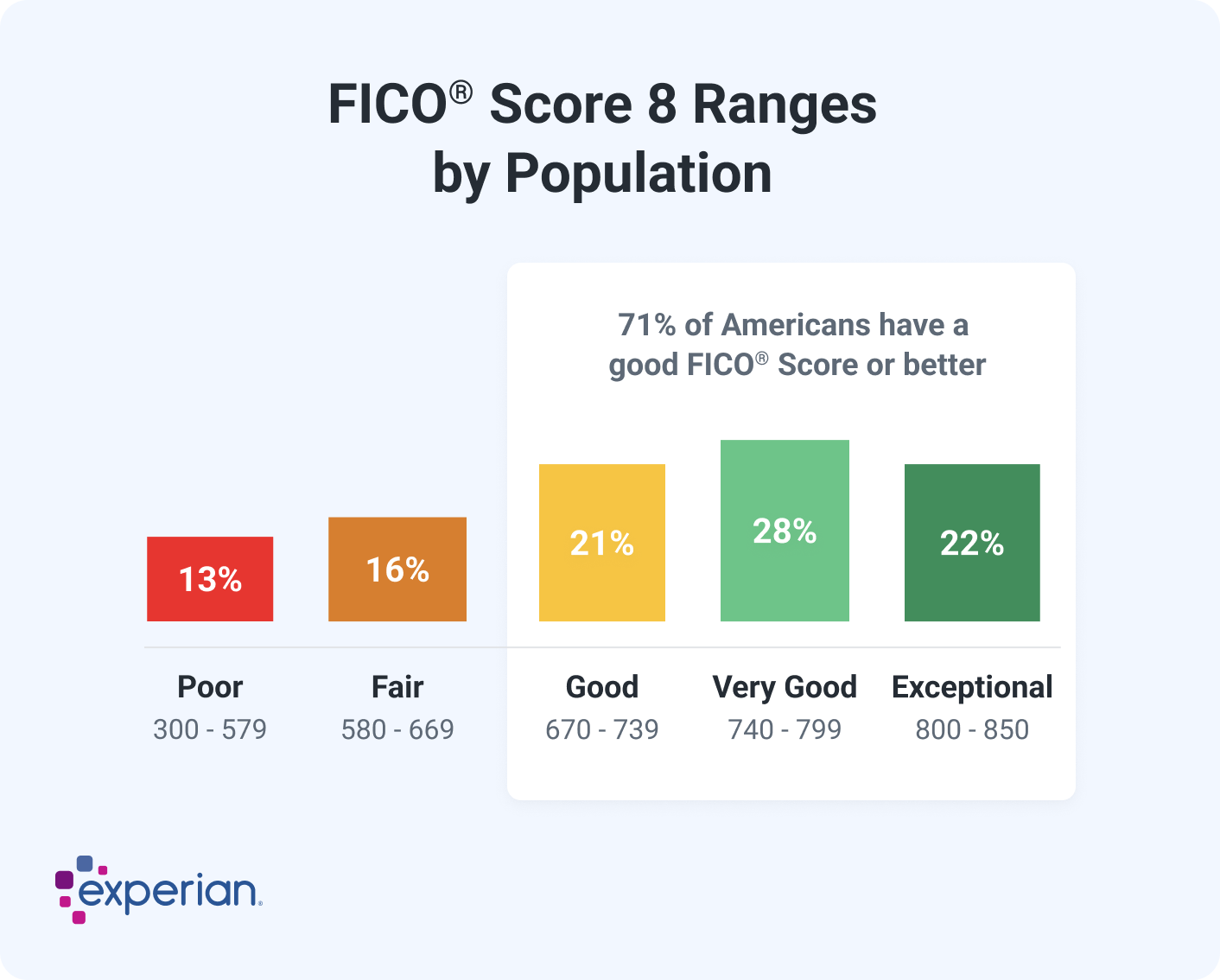

Credit score ranges vary across creditors and score types. For base FICO® Scores, the credit score ranges are:

- Poor credit: 300 to 579

- Fair credit: 580 to 669

- Good credit: 670 to 739

- Very good credit: 740 to 799

- Exceptional credit: 800 to 850

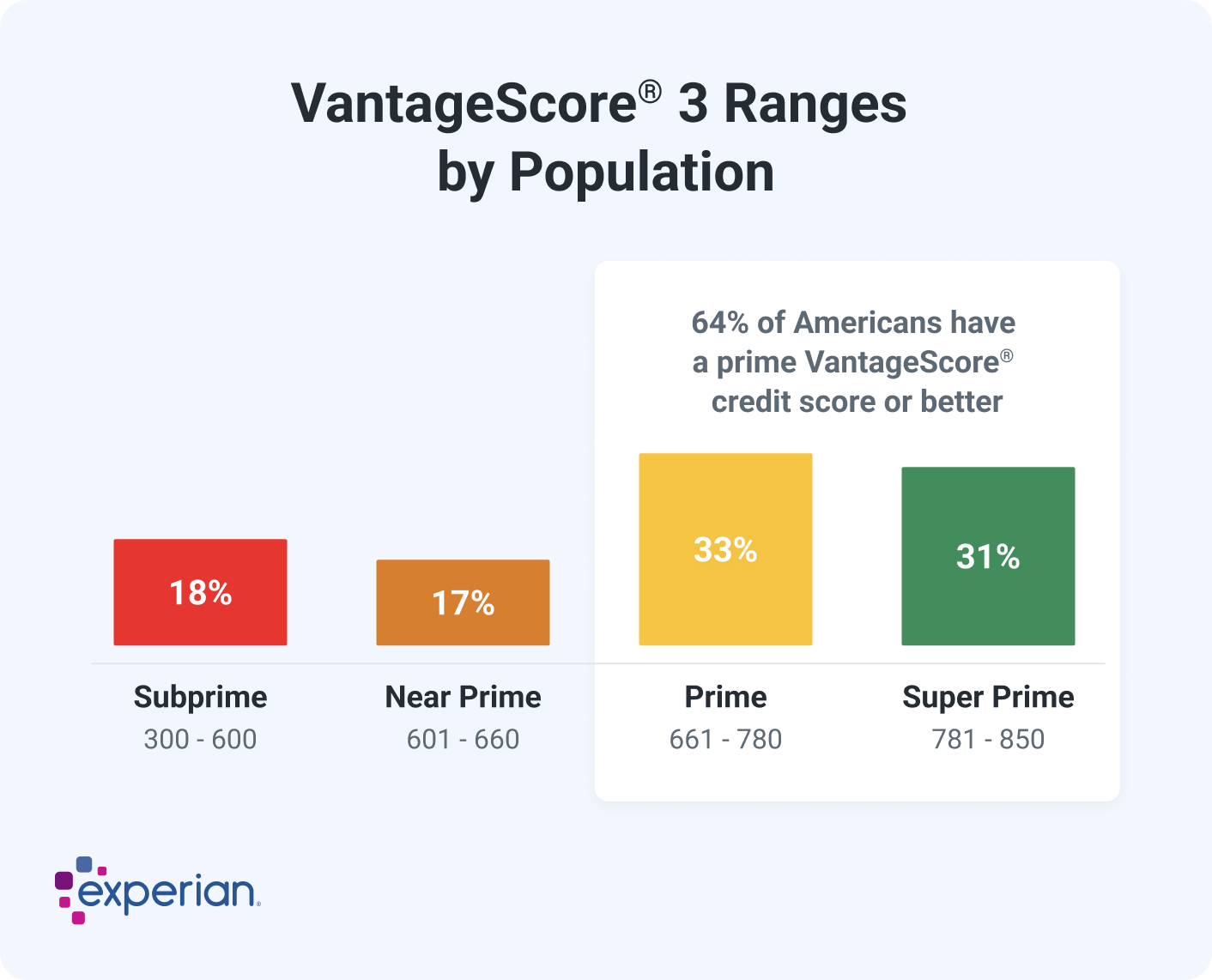

There are many models used to calculate your credit score, but most of the ones published by FICO and VantageScore® have a score range of 300 to 850. A higher credit score indicates you are statistically less likely to fall behind on a bill payment and can make you more appealing to lenders and landlords.

Within the wider range of credit scores, there are also smaller ranges or groupings that may indicate whether someone has poor or good credit. And, different types of credit scores may have different ranges. Here's what you need to know about credit score ranges, what factors impact credit scores and how you can improve your credit.

What Are the Credit Score Ranges?

Credit score ranges vary depending on the type of credit score.

| Range | Credit Score Types | |

|---|---|---|

| Recent VantageScore credit score models | 300 to 850 | VantageScore 3.0, 4.0 and 4plus™ credit scores |

| Base FICO® ScoresΘ and VantageScore credit scores models | 300 to 850 | Base FICO® Scores, such as FICO® Score 8, 9, 10 and 10 T |

| Industry-specific FICO® Score models | 250 to 900 | FICO Bankcard Scores and FICO Auto Scores (versions of the base scores for auto lenders and credit card issuers) |

Learn more: Why Do I Have So Many Credit Scores?

Creditors often break a given credit score range into smaller groupings. These can be helpful for creating general categories for evaluating applicants and managing customers' accounts. Creditors can set their own groupings, but FICO and VantageScore also have general credit score ranges and definitions. Below are the ranges for FICO® Scores, used by 90% of top lenders.

Poor Credit: 300 to 579

You may have trouble qualifying for a loan or credit card with a poor credit score. And, if you do qualify, the account could have higher fees and interest rates compared to accounts of borrowers with better credit.

Fair Credit: 580 to 669

You may have an easier time qualifying for loans and credit cards with decent terms if you go from poor credit to fair credit, especially if your score is in the top half of this range.

Good Credit: 670 to 739

With good credit, you can likely qualify for many loans and credit cards with low fees and interest rates.

Very Good Credit: 740 to 799

Once you have very good credit, you qualify for most lenders' credit accounts and could receive the lowest advertised interest rates.

Exceptional Credit: 800 to 850

You might already receive the best-available offers if you have a very good credit score, but excellent credit might give you a little more wiggle room if your score changes.

How Are Credit Scores Calculated?

Credit scores are calculated based on the underlying information in one of your credit reports from the major credit bureaus: Experian, TransUnion or Equifax. The various types of scores might consider and weight information differently, including the different base FICO® Scores and VantageScore credit scores.

The exact formulas are company secrets, but both FICO and VantageScore share some general information on how they calculate your credit scores.

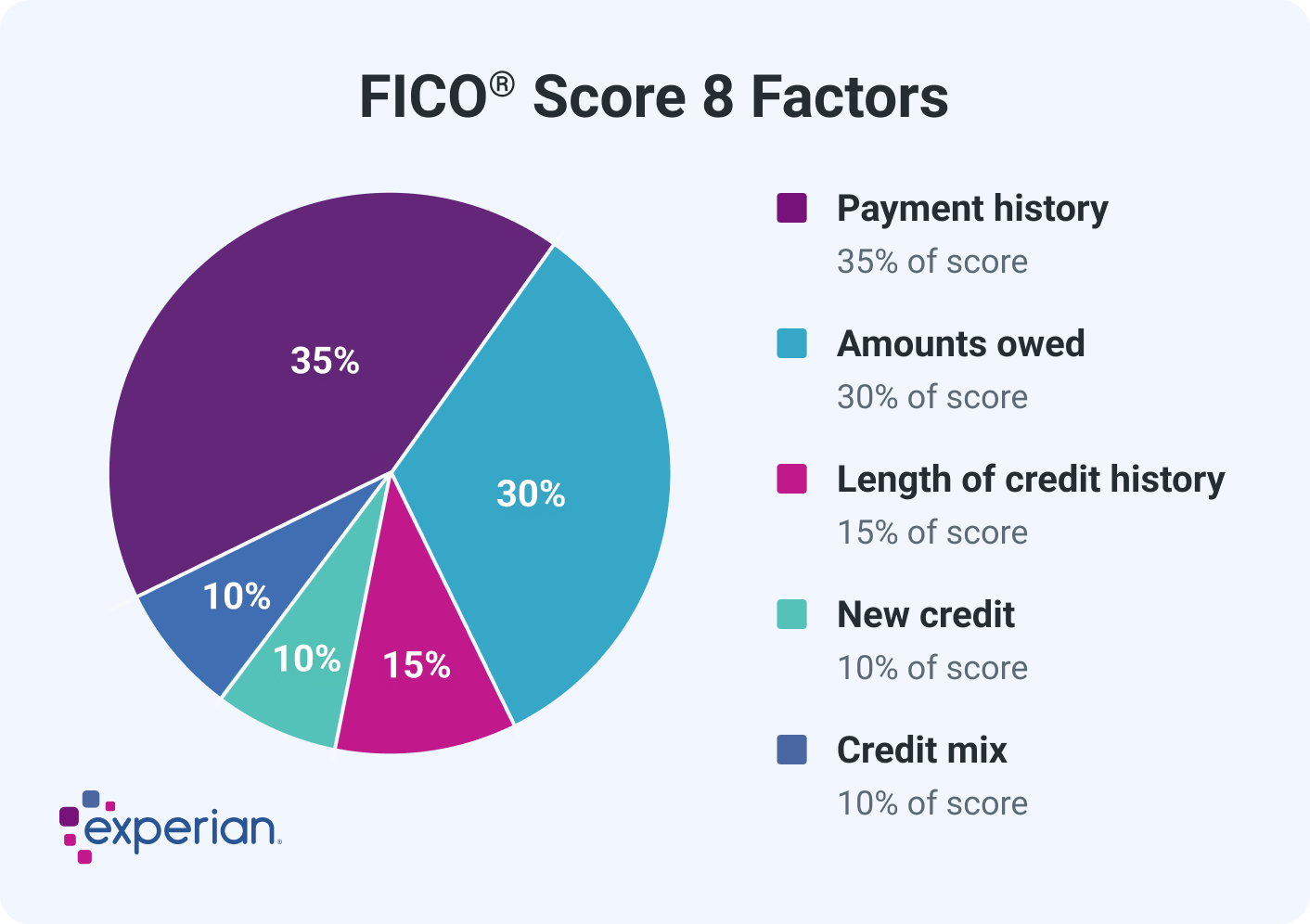

Key FICO® Score Factors

FICO breaks its credit scoring factors into five groups and publishes how important each factor is for an average consumer. But the exact importance of each category could depend on what's in your credit report.

- Payment history: 35%. Your payment history is the most important factor in your credit scores and reveals whether you've paid your loans and credit cards on time or missed payments. If you fall far behind on bills and your accounts are sent to collections, or if you file for bankruptcy, that can also affect the payment history in your credit report and hurt your credit scores.

- Amounts owed: 30%. Your outstanding balances, how much you owe relative to how much you borrowed and how many accounts you have with balances can all affect your FICO® Scores. Your credit utilization ratio is an important part of this category and compares your credit cards' balances and credit limits as they appear in your credit reports. Lower credit utilization is better for your scores.

- Length of credit history: 15%. The average age of the accounts in your credit report and the age of the newest and oldest accounts are considered here. Having more experience with credit could help your scores.

- Credit mix: 10%. Having a mix of revolving and installment credit accounts with balances can show that you can manage different types of credit and may help your scores.

- Recent credit applications: 10%. Applying for new credit accounts can lead to hard inquiries, records of when creditors request a copy of your credit report to review an application. Hard inquiries might hurt your credit scores a little temporarily.

Key VantageScore Credit Score Factors

VantageScore considers the same general scoring factors that FICO does. Instead of using percentages, however, it prefers to share how influential different factors can be on the average person's VantageScore credit score.

- Payment history: extremely influential. Again, this shows whether you're repaying accounts as agreed or paying late (or not at all). Making all your payments on time can help your scores, while falling behind in payments, having accounts sent to collections and filing for bankruptcy can damage your scores.

- Total credit usage: highly influential. Your credit utilization rate on credit cards and how much you still owe on loans relative to the original loan amount can have a big effect on your VantageScore credit scores.

- Credit mix and experience: highly influential. Experience managing different types of credit accounts and having a long credit history can help your scores.

- New accounts opened: moderately influential. Recent hard inquiries and the number of recently opened new accounts can affect your scores, especially if you open lots of new accounts at once.

- Balances and available credit: less influential. How much you owe on various accounts and overall can affect your score, but not as much as other factors.

| Scoring Factor | Impact |

|---|---|

| Payment history | 35% |

| Amounts owed | 30% |

| Length of credit history | 15% |

| Credit mix | 10% |

| Recent credit applications | 10% |

| Scoring Factor | Weight |

|---|---|

| Payment history | Extremely influential |

| Total credit usage | Highly influential |

| Credit mix and experience | Highly influential |

| New accounts opened | Moderately influential |

| Balances and available credit | Less influential |

How to Check Your Credit Scores

You can check your credit scores from many sources, and the score you receive could depend on the credit scoring model and the credit report that it analyzes.

You can get a FICO® Score 8 from Experian for free, and your account will tell you the factors that are helping and hurting your scores the most. You can also track your score over time for free—and get free access to your Experian credit report with monthly updates.

If you want to check other scores, a paid premium membership from Experian offers FICO® Scores based on your credit reports from all three credit bureaus with quarterly updates.

Learn more: Facts About Credit You May Not Know

How to Improve Your Credit

Although credit scores may have different ranges and factors, they almost all depend on what's in your credit report. By focusing on that underlying information, you can take steps to improve all your credit scores at once.

- Pay all your bills on time. The on-time payments that get reported to the credit bureaus help you build credit and can increase your scores. Even if the company doesn't typically report payments to the credit bureaus, missing payments and having the account sent to collections could still hurt your credit.

- Pay down your loan and credit card balances. Try to pay off debts and pay down balances quickly. Also, learn how credit scores calculate your credit card utilization rates and why making payments early can be important even if you pay your monthly bill in full.

- Look for credit accounts that don't require good credit. You might have trouble qualifying for new credit accounts if you have poor or fair credit. And it can be difficult to build credit if you don't have credit accounts. Look for options that don't require good credit and still have low fees and interest rates, which could include secured credit cards and store credit cards. If you manage the cards responsibly (making payments on time and keeping balances low), they could help you build credit.

- Add on-time payments with Experian Boost®ø. Experian members can use the Experian Boost feature for free to add eligible rent, utility, phone and certain streaming services payments to your Experian credit report. These could improve your credit scores from the recent FICO® Score and VantageScore credit score models.

Learn more: How to Improve Your Credit Score

Frequently Asked Questions

Keep the Big Picture in Mind

It can be tempting to focus on where you are in the credit score range and how your scores vary depending on which score you check. But remembering that all your credit scores depend on what's in your credit reports is important. Monitoring your credit and working on improving your credit over time can help you increase all your scores and get you closer to the top of the range.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis