How Does Length of Credit History Affect Credit Score?

Quick Answer

Your length of credit history directly impacts your credit scores, but it’s not necessarily as important as other scoring factors like payment history and how much you owe on your accounts.

The length of your credit history and age of your credit accounts directly impacts your credit scores. While not necessarily the most important scoring factor, a long history of managing credit, like loans and credit cards, can help you build excellent credit. This is especially true if your credit history also shows a long track record of on-time payments.

What Is Length of Credit History?

Length of credit history refers to the age of the accounts that show up in your credit reports, like personal loans or credit cards. Credit scoring models look at your length of credit history to evaluate your experience with credit.

When calculating your credit scores, scoring models analyze numerous credit age-related metrics, including:

- Average age of your accounts

- Age of your oldest account

- How long it's been since you last opened a new account

Credit scoring factors can also be interdependent, so the length of your credit history may also directly impact other important scoring factors, like payment history. If you have a credit account that's been open for 10 years and you've faithfully made payments each month, for example, your credit report and credit scores will reflect that long history of on-time payments.

Tip: Credit scoring models get your length of credit history by analyzing your credit reports from the three national credit reporting companies (Experian, TransUnion and Equifax). If you get your free credit report from Experian, you'll see the average age of accounts and the age of your oldest account.

Length of Credit History vs. Credit Age

Your length of credit history refers to how long an individual account has been open.

Credit age, on the other hand, typically refers to the average length of time all your accounts have been open.

Example: Say you have the following accounts shown on your credit reports:

- Credit card one: Five years

- Credit card two: Two years

- Mortgage: 15 years

The length of credit history of each account is five years, two years and 15 years, respectively. The cumulative credit age of all the accounts is roughly seven years and four months.

When looking at the key FICO® ScoreΘ factors, length of credit history is one of the key factors in determining your credit score. In this case, "length of credit history" is a cumulative measure of the age of your oldest account, the age of your newest account and the average age of all your credit accounts.

What Is a Good Length of Credit History?

As a general rule of thumb, the longer your credit history, the better it is for your credit. So a "good" length of credit history needs to be built up over time. This means if you're new to building credit, your length of credit history will naturally be shorter than someone who has been using credit for years. But as you continue to use credit responsibly, like loans or credit cards, your length of credit history can grow and potentially raise your score.

Learn more: How "Short Account History" Affects Your FICO® Score

What Happens When You Close an Account?

Accounts don't stay on your credit reports forever. When you close an account, such as a credit card, or pay off a loan in full, the payment history is capped and the account shows up your credit reports as closed. But, for the purposes of calculating length of credit history, the age of the account won't immediately be cancelled. Additionally, when you close an account in good standing (meaning with no late payments), the account can remain on your credit reports for up to 10 years.

Learn more: Does Closing a Credit Card Hurt Your Credit?

How to Improve Your Length of Credit History

There are steps you can take to improve your length of credit history—which can in turn help your credit scores. If you already have credit cards, keeping them open can help you maintain your credit history. But if you're tempted to overspend or the card comes with an annual fee, it may be worth closing.

If you're brand new to building credit, or currently don't have any credit accounts on your credit file, you can consider applying for new credit, like a secured credit card. Be sure to research credit products that best fit your financial situation and needs before you apply. Asking to be added as an authorized user on the credit card of a family member (or trusted loved one) is also a good option to start building your length of credit history.

What Other Factors Affect Your Credit Scores?

Credit scoring systems, like the FICO® Score and VantageScore® credit scoring systems, analyze credit report information to predict how likely you are to pay your debts as agreed. Numerous underlying factors are considered and weighted to calculate your scores using advanced algorithms.

In addition to length of credit history, which makes up 15% of your FICO® Score, here's a closer look at the factors and percentage weights FICO considers:

- Payment history (35%): Your payment history is the most influential factor in your FICO® Score calculation. Missing even a single payment by 30 days or more could hurt your score drastically. And the longer your debt goes unpaid, the more damage it does—especially if the account goes into collections.

- Amounts owed (30%): FICO also heavily weighs the total amount you owe, along with the current balances compared to original amounts when calculating your score. Your credit utilization is a key element of this factor since it indicates how much you rely on debt to cover everyday spending.

- Credit mix (10%): Your credit mix shows how diverse your credit accounts are and can indicate how effectively you manage both revolving and installment credit. Having different types of credit can help boost your credit score.

- New credit (10%): Your score may be dinged a small amount when a hard inquiry shows up on your credit report. Lenders typically run hard inquiries every time you apply for credit. And opening new credit accounts also results in new tradelines on your credit reports. It's generally a good idea to avoid applying too frequently to avoid overextending yourself and these small hits to your score.

The Bottom Line

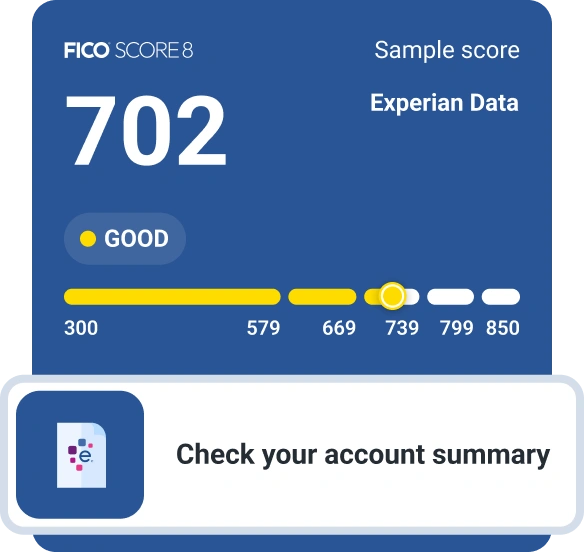

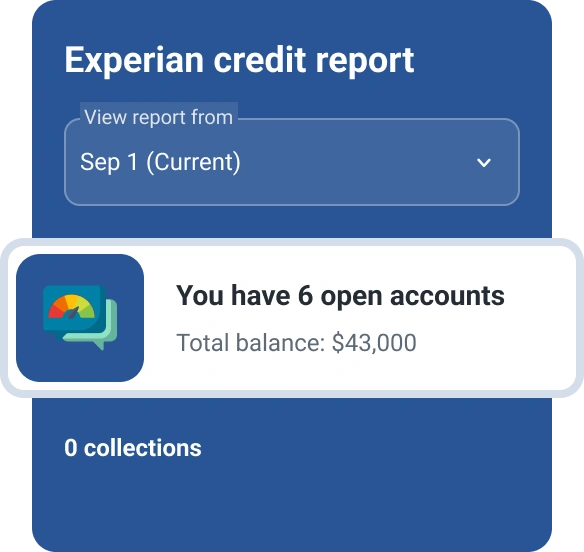

To some extent, the length of your credit history is out of your control—especially when you're younger. But you can take steps to establish and build up your credit history over time. Adopting good credit habits that align with other credit scoring factors, like paying your bills on time and limiting new credit applications, can also help you see steady credit score improvement. To keep tabs on your credit reports and scores, consider using Experian's free credit monitoring tool. You can also get a copy of your credit report and FICO® Score for free from Experian.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Sarah Archambault is a personal finance writer and editor who enjoys helping others figure out how to make smart financial decisions. She’s an expert in credit education, auto finance, banking, personal loans, insurance and credit cards.

Read more from Sarah