Checking Your Credit Report Won’t Hurt Your Score

Quick Answer

Checking your own credit report or score won’t affect your credit scores. It’s an example of a soft inquiry—a request for credit info that does not affect credit scores.

Checking your own credit reports, or credit scores based on them, won't have any impact on your credit scores. Learn how you can check your credit report, the difference between a soft inquiry and a hard inquiry, and how inquiries affect your credit score.

How to Check Your Credit Report

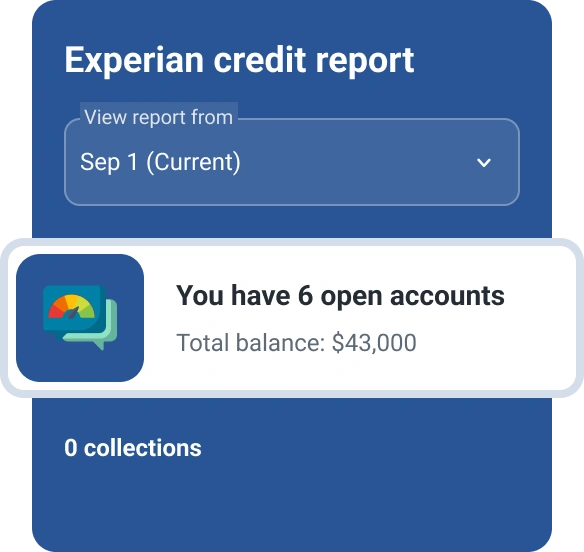

You can check your credit report for free anytime by getting a free Experian Basic membership. Upgrading to a paid Experian Premium membership also gives you access to your TransUnion and Equifax credit reports, and provides a number of additional benefits for protecting your credit.

Under federal law, you have the right to check your credit reports from all three national credit bureaus (Experian, TransUnion and Equifax) for free at AnnualCreditReport.com.

How Do Inquiries Impact My Credit Scores?

Requests to view your credit reports (or credit scores derived from them) are known as inquiries, and categorized as "hard" or "soft" inquiries according to their potential impact on your credit scores:

Soft Inquiry

When you check your own credit report or request your own credit score, or when a monitoring service you authorize does so, that request is noted on your credit report as a soft inquiry. A soft inquiry never has any impact on your credit scores.

Aside from self checks, other examples of soft inquiries include the checks performed by lenders with whom you have existing accounts (for account management purposes) and credit checks by lenders for purposes of marketing credit products to you.

Hard Inquiry

A hard inquiry, by contrast, is added to your credit file when a lender requests your credit report or a score based on it for purposes of processing a credit application, and it can affect your credit scores.

Credit scoring systems such as the FICO® ScoreΘ and VantageScore® typically lower your scores slightly in response to each hard inquiry. These reductions are typically by less than five points and short-lived; as long as you keep up with timely debt payments, your scores will usually rebound within a few months.

Why Do Inquiries Have an Impact on Credit Scores?

The appearance of a hard inquiry on your credit report can be of concern to lenders because it could indicate you've taken on new debt that hasn't yet been added to your credit report. Credit scoring systems acknowledge that uncertainty by deducting a few points from your scores. Scores typically rebound within a few months if you keep up with on-time payments on all your accounts, old and new.

The Bottom Line

It's wise to review your credit reports regularly to spot and correct inaccuracies and to check for unauthorized activity that could be a sign of credit fraud or identity theft. Doing so will never hurt your credit score and, in fact, checking your Experian credit report can help you protect your credit and promote long-term credit score improvement.

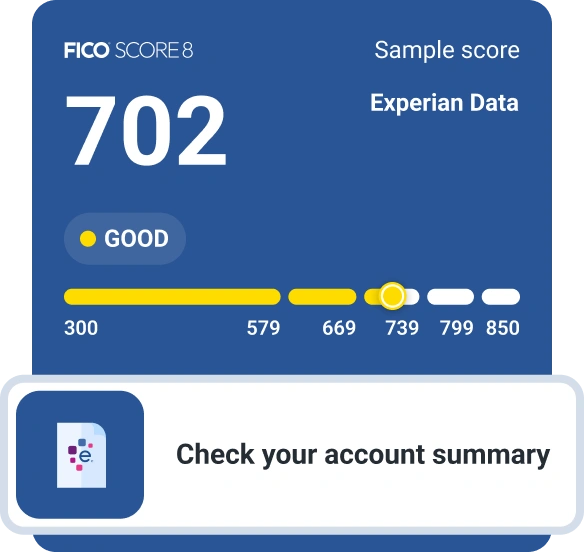

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim