Fewer Subprime Consumers Across U.S. in 2021

While the most commonly used credit scoring systems range from 300 to 850, many lenders categorize borrowers into broad groups that identify where their score lands on the spectrum—prime and subprime. These designations indicate whether a consumer's score meets a certain threshold, with prime used to describe scores above that cutoff, and subprime meaning the opposite.

In the U.S., nearly 1 in 3 consumers have a subprime score—but this population has shrunk by 12% since 2020, according to Experian data. Among the consumers who have subprime scores, many improved aspects of their credit over the past year.

As part of our ongoing review of consumer credit in the U.S., Experian reviewed credit report data from the past year to see how the number of subprime consumers has changed. This analysis compares data from the first quarter (Q1) of 2020 with data from the same period in 2021. Read on for our insights and analysis.

Nearly a Third of U.S. Consumers Have Subprime Credit

Subprime is a term used by lenders and others in the financial space to describe credit scores that fall below a certain threshold. This threshold isn't universal, and can vary based on the organization that's making the distinction. For the purposes of this analysis, we considered all consumers with scores of less than 670—or those in the "poor" and "fair" FICO® ScoreΘ ranges ranges—to be subprime.

Nearly 1 in 3 U.S. consumers—30% of those included in our analysis—have a credit score in the subprime range, according to Experian data from Q1 2021. Though this represents a substantial portion of the population, 2021's numbers show a healthy improvement from the prior year, when 34% of the nation had a score under 670.

With the population divided into two credit groups—subprime and prime—a reduction in one means an increase in the other. Accordingly, prime consumers saw their base grow by 6%.

| 2020 | 2021 | Change | |

|---|---|---|---|

| Subprime consumers | 34% | 30% | -12% |

| Prime consumers | 66% | 70% | +6% |

Source: Experian

Because borrowers' score ranges can be factored into lending decisions, prime and subprime consumers typically have different debt characteristics. When comparing the number of accounts and average balances between prime and subprime consumers, a few trends stand out:

- Subprime consumers and prime consumers tend to rely on different types of debt. Looking at the average number of accounts each group holds, the differences are stark. Prime consumers tend to have more mortgage and credit card accounts, while subprime consumers have more student loans and personal loans. In only two instances—auto loans and home equity lines of credit (HELOCs)—do subprime consumers have a similar number of accounts, on average, as prime borrowers. Differences in the types of accounts held is significant, because they indicate which forms of credit each group relies on or frequently gets. It can also illustrate differences in how lenders issue credit to those populations.

- Subprime consumers have twice as many personal loan accounts as prime consumers on average. That said, their average balance is less than half of prime consumers' average balance. Subprime consumers carry over $8,000 in personal loan debt across an average of 1.4 accounts, while prime consumers carry over $20,000 in personal loan debt across an average of 0.7 accounts. This shows that while subprime consumers seem to be taking out more personal loans, they are either purposely taking out smaller loans or being approved for smaller amounts.

- Despite having fewer mortgage accounts on average, subprime consumers have higher balances on HELOCs. Mortgages are one area where prime consumers in the U.S. have more accounts and higher average account balances than subprime consumers. But while prime borrowers have more mortgage accounts, subprime consumers have higher HELOC balances on average. This shows that despite having lower mortgage debt and fewer mortgage accounts, they seem more likely to utilize their home's equity through a HELOC.

| Subprime | Prime | |

|---|---|---|

| Avg. credit card debt | $4,592 | $5,107 |

| Avg. number of credit card accounts | 2.6 | 4.2 |

| Avg. auto debt | $19,106 | $20,458 |

| Avg. number of auto accounts | 0.7 | 0.7 |

| Avg. personal loan debt | $8,756 | $21,359 |

| Avg. number of personal loan accounts | 1.4 | 0.7 |

| Avg. student loan debt | $37,669 | $40,558 |

| Avg. number of student loan accounts | 1.2 | 0.8 |

| Avg. HELOC debt | $52,110 | $39,718 |

| Avg. number of HELOC accounts | 0.4 | 0.5 |

| Avg. mortgage debt | $162,385 | $220,858 |

| Avg. number of mortgage accounts | 1.6 | 2.5 |

Source: Experian

Subprime Consumers Reduced Debt, Utilization in Past Year

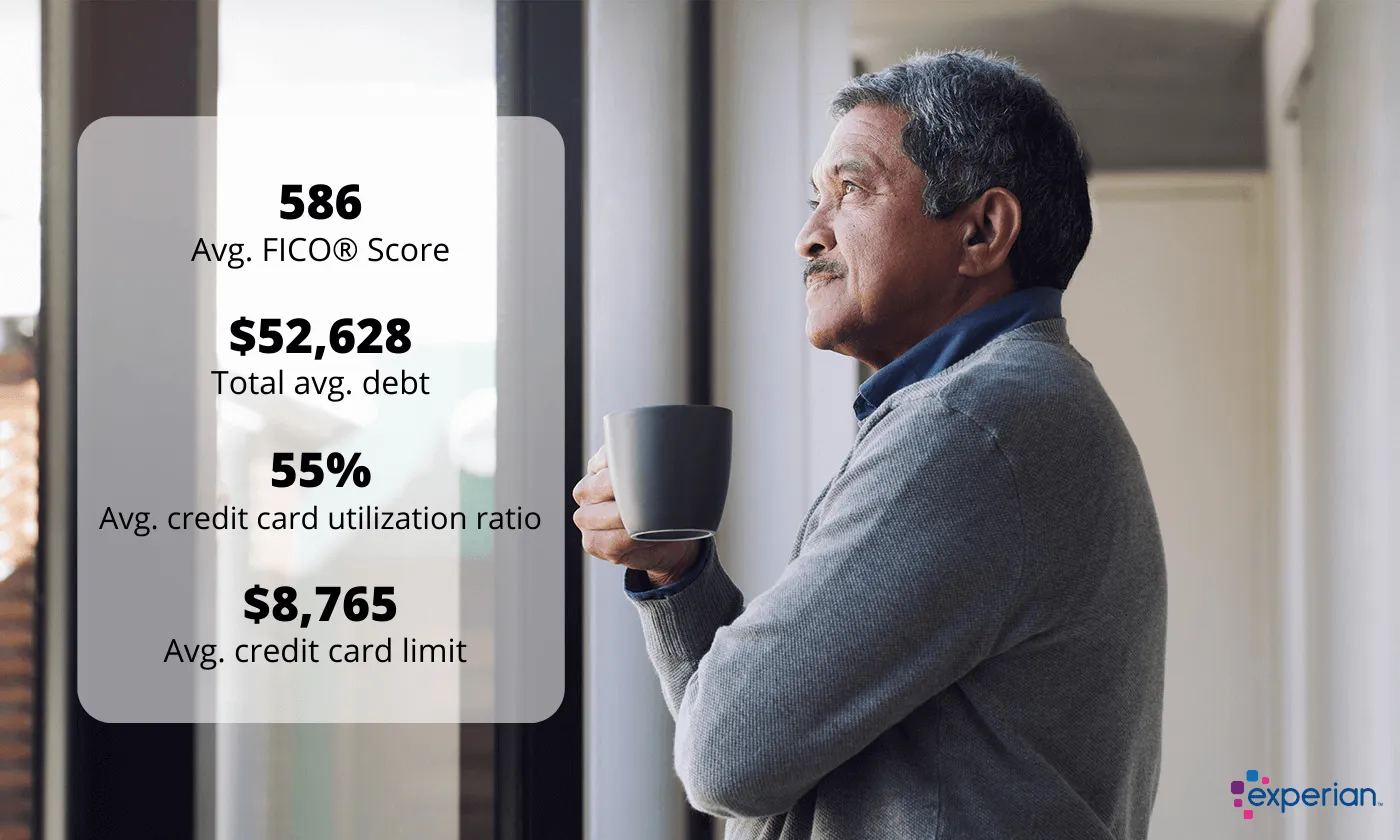

Since Q1 2020, the population of subprime consumers has not only gotten smaller, but the credit usage characteristics of subprime consumers has improved. The average FICO® Score for this group increased by eight points in Q1 2020.

Subprime consumers also improved several of their core credit characteristics, such as credit card utilization, which decreased by 6 percentage points from 61% to 55% in Q1 2020. And while their average utilization ratio is still quite high, this reduction may have been the incremental improvement some of these consumers needed to qualify as a prime scoreholder.

| 2020 | 2021 | Change | |

|---|---|---|---|

| Avg. FICO® Score | 578 | 586 | +8 points |

| Total avg. debt | $55,135 | $52,628 | -5% |

| Avg. credit card utilization ratio | 61% | 55% | -6 percentage points |

| Avg. credit card limit | $10,314 | $8,765 | -15% |

Source: Experian

Alongside the changes in utilization, average credit card limits also dropped in the past year—with limits for subprime consumers falling 15% by Q1 2021. Overall, subprime consumers were also able to reduce their total average debt, shrinking their outstanding balance across all accounts from an average of $55,135 to $52,628—a reduction of 5% between Q1 2020 and Q1 2021.

While subprime consumers have seen improvements in certain areas since last year, a wide gap in credit usage characteristics between prime and subprime borrowers still exists. In Q1 2021, the gap between the average subprime FICO® Score and the average prime FICO® Score was 181 points.

Subprime consumers carried less than half the total average debt that prime consumers did, and their average credit card utilization ratios were nearly four times as high, according to Experian data.

| Subprime | Prime | |

|---|---|---|

| Avg. FICO® Score | 586 | 767 |

| Total avg. debt | $52,628 | $107,956 |

| Avg. credit card utilization ratio | 55% | 16% |

| Avg. credit card limit | $8,765 | $35,667 |

Source: Experian

Subprime Consumers Held Back by Delinquencies, Derogatory Marks

There are many factors that impact consumer credit scores, and derogatory marks can be the most devastating. Things like late payments, bankruptcies and collection accounts can severely affect a consumer's credit and remain in their credit reports for up to seven years.

Between prime and subprime consumers, there is a clear divide when it comes to derogatory marks and their severity. Subprime consumers show a higher frequency of late and missed payments—with the ratio of their accounts 30 or more days past due (DPD) reaching 18%, according to Experian data from Q1 2021. Comparatively, only 0.2% of prime consumers' accounts were 30 or more DPD.

| Subprime | Prime | |

|---|---|---|

| % of accounts 30+ DPD | 18% | 0.2% |

| % of accounts 60+ DPD | 1% | 0.003% |

| % of accounts 90+ DPD | 0.8% | 0.001% |

| Avg. total balance in collections | $1,804 | $30 |

| Avg. number of bankruptcies | 0.23 | 0.01 |

Source: Experian

Bankruptcies are one of the worst marks a consumer can have in their credit report, and subprime consumers carry an average of 0.23 bankruptcy records in their credit reports as of Q1 2021. That's compared with an average of 0.01 records listed in prime consumer reports.

Finally, subprime consumers also owe significantly more to collection agencies, with their average balance in collections totaling just over $1,800 in Q1 2021. Prime consumers had an average collection account balance of just $30.

Subprime Populations Reduced Across All States

In line with the reduction in the subprime population at the national level, the number of subprime consumers decreased in each state. Some states—such as Maryland and Oregon—saw reductions of 15%, while most others saw smaller declines of anywhere from 7% to 14%, according to Experian data from Q1 2021.

Subprime Consumer Ratio by State

| State | 2020 | 2021 | Change |

|---|---|---|---|

| Alabama | 42% | 39% | -7% |

| Alaska | 31% | 28% | -10% |

| Arizona | 36% | 32% | -11% |

| Arkansas | 41% | 38% | -7% |

| California | 30% | 26% | -13% |

| Colorado | 27% | 24% | -11% |

| Connecticut | 28% | 25% | -11% |

| Delaware | 35% | 31% | -11% |

| District of Columbia | 32% | 28% | -13% |

| Florida | 37% | 33% | -11% |

| Georgia | 42% | 39% | -7% |

| Hawaii | 25% | 22% | -12% |

| Idaho | 29% | 25% | -14% |

| Illinois | 31% | 28% | -10% |

| Indiana | 35% | 31% | -11% |

| Iowa | 27% | 24% | -11% |

| Kansas | 30% | 27% | -10% |

| Kentucky | 38% | 35% | -8% |

| Louisiana | 44% | 41% | -7% |

| Maine | 29% | 26% | -10% |

| Maryland | 34% | 29% | -15% |

| Massachusetts | 25% | 22% | -12% |

| Michigan | 32% | 28% | -13% |

| Minnesota | 22% | 19% | -14% |

| Mississippi | 48% | 44% | -8% |

| Missouri | 35% | 32% | -9% |

| Montana | 27% | 24% | -11% |

| Nebraska | 26% | 23% | -12% |

| Nevada | 40% | 35% | -13% |

| New Hampshire | 25% | 22% | -12% |

| New Jersey | 29% | 25% | -14% |

| New Mexico | 40% | 37% | -8% |

| New York | 29% | 25% | -14% |

| North Carolina | 37% | 34% | -8% |

| North Dakota | 24% | 22% | -8% |

| Ohio | 33% | 30% | -9% |

| Oklahoma | 42% | 38% | -10% |

| Oregon | 26% | 22% | -15% |

| Pennsylvania | 30% | 27% | -10% |

| Rhode Island | 29% | 26% | -10% |

| South Carolina | 42% | 39% | -7% |

| South Dakota | 24% | 22% | -8% |

| Tennessee | 38% | 35% | -8% |

| Texas | 43% | 39% | -9% |

| Utah | 27% | 24% | -11% |

| Vermont | 24% | 21% | -13% |

| Virginia | 31% | 27% | -13% |

| Washington | 25% | 21% | -16% |

| West Virginia | 40% | 37% | -8% |

| Wisconsin | 25% | 22% | -12% |

| Wyoming | 30% | 27% | -10% |

Source: Experian

Millennials Make Up the Largest Number of Subprime Consumers

Debt and credit scores tend to vary when comparing members of different generations, and this trend is no different when looking at prime and subprime populations. Overall, millennials represent the highest ratio of subprime consumers of any generation. In 2021, 40% of millennials had a score in the subprime range, according to Experian data. The subprime millennial population has seen an 11% reduction since Q1 2020.

The silent generation, which has the highest average credit scores, also has the lowest ratio of subprime consumers. Members of the silent generation benefit from the duration of time they've been using credit, which members of younger generations cannot replicate.

| 2020 | 2021 | Change | |

|---|---|---|---|

| Generation Z (18-23) | 43% | 39% | -9% |

| Millennials (24-39) | 45% | 40% | -11% |

| Generation X (40-55) | 40% | 35% | -13% |

| Baby boomers (56-74) | 24% | 22% | -8% |

| Silent generation (75+) | 14% | 13% | -7% |

Source: Experian; ages as of 2020

Borrowing Opportunities Expand as Subprime Population Shrinks

An increase in the number of U.S. consumers moving from the subprime to prime group is a positive phenomenon. Not only does it show that consumers are improving their scores, but it shows they are improving them enough to move to higher score tiers.

Some lending decisions are based on which score group an applicant is in, and those in the subprime category may face challenges in being approved and face higher costs in borrowing. As these consumers transition into the prime tier, it's possible they're able to expand their borrowing opportunities.

In addition to more consumers moving into the prime range, the data shows that consumers in the subprime group are also improving their underlying credit factors. There will always be newcomers to the credit space who start out with lower scores, and those who see their credit scores decrease for one reason or another, but this movement from subprime to prime is generally promising. This trend could lead to expanded borrowing opportunities for a larger growing portion of Americans.

Considering Credit Changes During the COVID-19 Pandemic

Though the trends in subprime credit have been promising over the past year, it's important to remember this data is a snapshot taken during a turbulent period. Average credit scores rose across the U.S. in 2020, fueled in large part by a shift in consumer spending and saving and changes to how lenders worked with borrowers during the COVID-19 pandemic.

Since the onset of the pandemic, certain COVID-19 relief programs have ended or will before long, which could mean that consumer finances might change markedly in the months to come. As time goes on and consumers continue to manage the impacts of the COVID-19 pandemic, Experian will continue to monitor the data and provide updates as they become available.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

FICO® is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Stefan Lembo-Stolba leads Experian Consumer Service's data research on Ask Experian, publishing insights based on Experian's credit data of over 220 million U.S. consumers.

Read more from Stefan Lembo