Should You Use a Store Card to Buy Appliances for Your New Home?

Quick Answer

You should research all your financing options before you buy appliances for your new home with a store credit card. Store cards may allow you to save upfront or pay no interest for limited time, but they can also lead you into high-interest debt.

Buying a new refrigerator, dishwasher, range, or washer and dryer for a new home could set you back $10,000 or more, according to HomeAdvisor. That's a lot of money to dish out at once, and if you're in the middle of furnishing your new home, the financing deals offered at big box stores may have caught your eye.

Store credit cards sometimes offer customers a way to save upfront or pay no interest for a limited time, but it's important to understand how they work before signing up. While there are benefits to using a store credit card, there are also downsides. Here's what you need to know.

What Is a Store Card?

A store card is a credit card offered by retailers that may give you special perks like free shipping, shopping rewards or cash back when you use the card in the store. Some store cards also offer deferred interest promotions where you're charged no interest on the purchase as long as it's paid off by a certain date.

There are two types of store cards: closed-loop and open-loop cards. Closed-loop cards can only be used in one store and possibly other partner store brands. Open-loop cards are typically store-branded Visa, Mastercard or American Express cards that offer extra perks at specific retailers but can also be used anywhere the payment network is accepted.

Like other credit cards, the credit check associated with a store card application typically causes a hard inquiry to appear on your credit report, which could potentially impact your credit score.

Pros and Cons of Using Store Cards for Appliances

If cash is tight, using a store card could help you get the appliances you need today and pay off the purchase little by little. That said, there are some potential drawbacks to think about before signing up.

Pros:

- Less stringent qualifying criteria: Store cards are often easier to qualify for than other major credit cards, so you might be able to get approved for financing even if your credit is less-than-perfect.

- Special financing: Some store cards charge no interest if you pay off the card balance during an interest-free promotion period. If you can afford the payments, this could be a good way to save on interest costs when borrowing money for big-ticket purchases.

- Cardholder perks: Opening a card may get you access to other incentives like free delivery for your appliances. Points or cash back you earn when buying appliances could be put toward the purchase of other new household items.

Cons:

- High interest rates: Store cards may charge a higher rate than other credit cards available to you. If you don't qualify for special financing, a store card might not be the cheapest option.

- Deferred interest: With special financing deals, interest may be deferred and not waived entirely like it is with other 0% introductory APR offers. Here's how it works: Interest starts accruing from the date you make the purchase. If you don't pay off the entire balance by the end of the promotional period, you're charged all of that accrued interest in one lump sum. Be very careful to read the fine print so you can avoid a surprise bill.

- Store limits: Closed-loop cards that can only be used at one store can limit your shopping options. Say you find the perfect dishwasher at a good price, but the deals on refrigerators at the same store aren't so great. Having a closed-loop store card could make you less likely to shop around.

- Risk of overspending: When you're swiping plastic instead of using cash, there's a risk you could spend beyond your means. Credit card bills will also be one more bill to keep up with at a time when you could have a bunch of other new home expenses to manage, including your mortgage, utilities and more.

Alternatives to Using a Store Card

Store cards are just one of many ways you can pay for new appliances to install in your new home. Here are some other options:

Save Up the Cash

You may not have the time to wait months or years to save up for new appliances. But putting aside money from a few paychecks before making the purchase could help lower the amount you need to borrow.

Apply for a Personal Loan

Instead of using a credit card to buy appliances, you could take out a personal loan. Installment loans offer a lump sum of cash typically with a fixed interest rate, payment and loan term. If you have great credit, you may be able to qualify for an interest rate on a loan that's much lower than what you'd get with a credit card.

Apply for a Traditional Credit Card

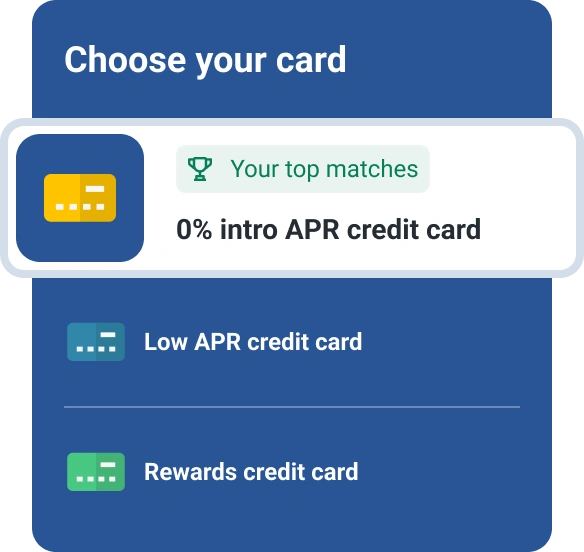

Credit cards that aren't attached to a certain store may offer 0% APR introductory deals on new purchases. Many 0% APR deals last 12 months or more.

These offers typically don't involve deferred interest. After the introductory period ends, interest jumps to the standard rate, but you're only charged interest on the balance from that point forward. Since offers can vary, it's important to read through the terms before signing up. You can get started by exploring 0% APR credit offers through Experian's card comparison tool.

Compare Options Before Buying

Appliances are a major expense, so don't be afraid to consider your options carefully. If you're pitched a store credit card by a salesperson, you don't have to make a decision right away. Shop around to compare prices and see if you can qualify for discounts or deals elsewhere before buying. If you do have to finance these purchases, check your credit to see where you stand. You may want to improve your credit score before borrowing.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Taylor Medine is a personal finance writer who has covered money topics for various media outlets over the past seven years. Her work has been published on USA Today, Business Insider, MSN, Yahoo! and more.

Read more from Taylor