What Are Tradelines and How Do They Affect You?

Quick Answer

A tradeline is another name for an account listed on your credit reports. Tradelines include several pieces of information that can indicate how you manage your debt.

A tradeline is a term used by credit reporting agencies to describe credit accounts listed on your credit reports. For each credit card, loan and other type of credit account you have, you'll have a separate tradeline that includes key information about the creditor and the debt.

Understanding how tradelines work can give you a better idea of how to read your credit report and what lenders consider when they check your credit.

What Are Tradelines on Your Credit Report?

Your credit report provides a history of your dealings with different types of accounts, including the following:

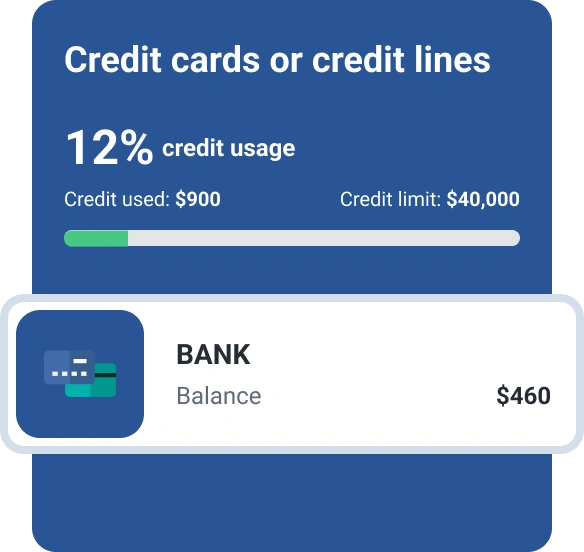

- Revolving credit: Revolving tradelines include credit cards and lines of credit, which don't have fixed repayment terms and allow you to pay down and reuse your available credit in a revolving manner.

- Installment credit: Installment tradelines are loans with fixed disbursements and repayment terms. They include mortgage loans, auto loans, student loans and personal loans.

- Collection accounts: If a lender sells a revolving or installment credit account to a collection agency, it'll show up as a separate tradeline.

It's important to note that you'll have tradelines on your credit reports for accounts where you're the primary borrower, as well as accounts where you're a cosigner or an authorized user.

Lenders and collection agencies regularly report information about credit accounts to the credit bureaus, which then add the information to your report. This allows you and others, such as prospective lenders, employers and landlords, to view relevant information about all of your debts in one place.

Tradelines typically include the following information:

- Lender's name and address

- Type of account

- Partial account number

- Current status

- Date the account was opened

- Date the account was closed, if applicable

- Date of last activity

- Current balance

- Original loan amount or credit limit

- Monthly payment

- Recent balance (for credit cards only)

- Payment history

Keep in mind, however, that lenders may differ in how they report your information, so you might see some variations in information across tradelines.

What Are Tradelines Used For?

The information included in your tradelines can be used for a variety of purposes:

- Calculate credit scores: Credit scoring companies like FICO and VantageScore® use tradeline data to assign you a credit score. Credit scores can be helpful because they provide a snapshot of your overall credit health.

- Evaluate creditworthiness: If you apply for a loan, credit card, apartment lease or even some jobs, the lender, landlord or employer may review one or more of your credit reports to assess your creditworthiness. Even if you have a decent credit score, for instance, you could have difficulty getting a loan if a lender finds negative information, such as late or missed payments, in one or more of your tradelines.

- Self-evaluation: As you take steps to build and maintain good credit, you can use tradeline information to pinpoint areas where you can take steps to improve your credit, such as paying down credit card debt or minimizing credit applications.

What Happens When You're Removed From a Tradeline?

If you're an authorized user on a credit card, the tradeline could potentially help you build credit. However, both you and the primary cardholder have the right to remove you from the account. If this happens, the tradeline will no longer appear on your credit report.

This can also happen if you cosigned a loan application for a loved one and they later qualified to have you released from your cosigner obligation.

If the tradeline had positive information that was helping your credit score, the removal could cause your scores to drop. On the flip side, it could improve your credit score if the credit card account has a high credit utilization rate or a negative payment history.

Keep in mind that you have the right to request to have a tradeline removed if the account was created fraudulently by filing a dispute with the credit bureaus.

What Happens if You Close or Pay Off a Tradeline?

Paying off debt can help improve your financial well-being and your credit score, but in some cases, your scores may take a temporary hit. Here's why:

- Paying off a credit card: If you pay off a credit card balance and keep the account open, your credit score may improve, especially if the balance was high relative to your credit limit.

- Closing a credit card: Canceling a credit card means you no longer have access to its available credit, which could cause your overall utilization rate for your remaining credit cards to spike. As a result, paying off a credit card and closing the account could cause your credit score to dip, at least until you pay down your other balances.

- Paying off a loan: Unlike credit cards, installment loans are typically closed once they're paid in full. As a result, your credit mix will be slightly less diversified, which could result in a temporary dip in your credit score.

It's important to note, however, that the damage to your credit from paying off a loan or closing a credit card is generally temporary in nature. As you focus on paying your bills on time, keeping your credit card balances relatively low and avoiding unnecessary credit, your scores will typically rebound.

How Tradelines Affect Your Credit Score

Tradeline information is the basis of your credit score, so it directly affects your credit health in several ways. Here's how based on the main credit score factors:

- Payment history: Your payment history is the most important factor in your FICO® ScoreΘ, so having a credit report full of tradelines with on-time payments is crucial.

- Amounts owed: Credit scoring models will look at your current and original loan balances, as well as the utilization rate on your revolving accounts.

- Length of credit history: Scoring models will use open and closed dates to calculate the age of each account, as well as the average age of all of your accounts.

- New credit: This credit score factor will consider how long it's been since you opened your newest account, which will be listed in the tradeline. New credit also incorporates recent hard inquiries, but those are listed separately from your tradelines.

- Credit mix: Each tradeline will list the type of credit account—for example, credit card, student loan or auto loan. In general, having a good mix of different types of credit can help improve your score.

How Long Do Tradelines Stay on Your Credit Report?

The length of time a tradeline remains on your credit report will vary depending on the account's status, such as whether the account is open or closed and if an account was in good standing when it was closed:

- Open tradeline: Indefinitely

- Closed tradeline in good standing: 10 years

- Closed tradeline in poor standing: Seven years

Note, however, that while negative tradeline information can stay on your reports for seven years, their impact can diminish over time as you take steps to practice good credit habits.

Review Your Credit Reports Regularly

Maintaining a good credit score is crucial for a strong financial foundation, so it's a good idea to check your credit reports regularly to evaluate your credit health, identify inaccuracies and determine whether you need to make adjustments to how you manage your debt.

Start by checking your free FICO® Score and Experian credit report to get insights and ongoing alerts. You can also get a copy of your Equifax and TransUnion credit reports for free weekly through AnnualCreditReport.com.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben