What Does “Closed Account” Mean on Your Credit Report?

Quick Answer

A “closed account” is a revolving account, such as a credit card or line of credit, that you can no longer use for new charges. Closed accounts are listed on your credit report along with open accounts.

A closed account on your credit report is generally a credit card, loan or another form of credit that can no longer be used to make new charges. A card may be closed by the cardholder or the issuer. Depending on the circumstances of its closure, an account can remain on your credit report for up to 10 years after the closure date.

What Does "Closed Account" Mean on Your Credit Report?

Closed accounts are not necessarily accounts that have been paid in full, though they may be. A closed account on your credit report indicates that you once had a credit account, but it is no longer valid for making charges.

The reasons for that could be:

- You opened a credit card to get a welcome bonus and decided you didn't want to keep the card, so you closed it.

- You closed the account for another reason.

- You seldom used the card, and the issuer closed it.

- You frequently missed payments, paid late or exceeded your credit limit, and the issuer closed your account.

- Your credit score dropped significantly, and the issuer closed your account.

If you close an account hoping that the account and its blemished payment record will disappear from your credit report, you will be disappointed. Late payment records will remain on your credit report even after the account is closed. As more time passes, however, the impact of late payments on your credit scores will lessen, until the account is eventually removed from your credit report.

Closing an account also does not mean you no longer owe the balance, though a card issuer may transfer a past-due account to a collection agency.

How Long Do Closed Accounts Stay on Your Credit Report?

Closed accounts in good standing—meaning without any payments 30 days late—may stay on your credit reports for up to 10 years.

If you had some credit missteps before you closed the account, the negative information falls off after seven years, but the account itself can remain on your report for up to 10 years, depending on the account's status at the time it was closed.

Are Closed Accounts on Your Credit Report Bad?

A closed account can be good or bad for your credit scores, depending on the account's payment history before it was closed. Because a positive payment history stays on your credit report for up to 10 years, even a closed account can help you maintain good credit scores.

If your record of on-time payments was spotty, closing the account will not erase that history, and the late payments can be reported for seven years, even though the account is closed.

The act of closing an account can also potentially hurt your credit score. Although on-time payments are the biggest single factor in credit scores, scores are also affected by:

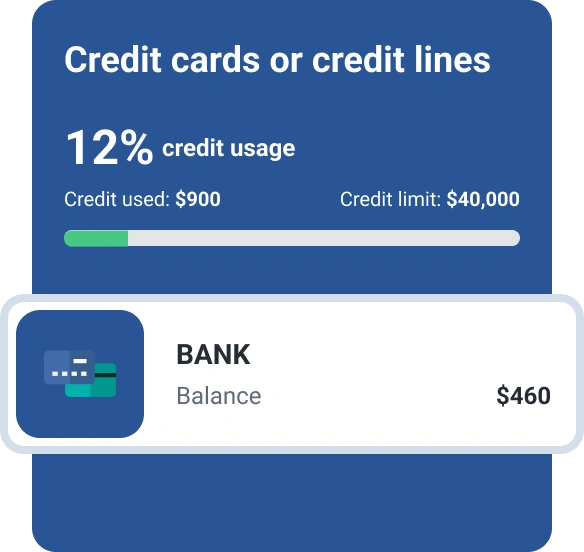

- How much you owe, and the amount of credit you use relative to your credit limits

- How long you have had credit, and the average age of your credit cards

- Credit mix, meaning whether you have both revolving credit, like credit cards, and installment debt, with level payments over a set term, such as an auto loan

- How recently you have applied for new credit

Closing an account could potentially damage your credit score, particularly if you close one of your oldest credit cards, or one with a high credit limit. It could also result in credit score harm if it leaves you without revolving credit or if you apply for new credit to replace the closed credit card.

How to Remove Closed Accounts From Your Credit Report

You can't get a closed account removed from your credit report if the information is accurate and timely. But if you believe the information is wrong or too old to be reported, you have the right to dispute the information on the credit report maintained by any of the three credit bureaus—Experian, TransUnion or Equifax.

Scenarios in which you may be able to get the information removed include:

- Requesting that the creditor remove the account from your credit report (the creditor is not required to do so, though)

- Disputing the account information with every credit bureau that includes it in your credit report

- Waiting for the account or negative history to fall off over time

The Bottom Line

A closed account on your credit report does not directly affect your credit score, but it can indirectly affect it. If closing an account results in a higher credit utilization because your overall credit limit drops, it can hurt your credit score. If the closed account affects credit mix or results in a shorter credit history or new applications for credit, your credit score could be affected.

However, if a closed account has a positive payment history, those on-time payments may continue to be reported for up to 10 years.

The best way to know what's in your credit reports is to look at them. You can check your credit report for free through Experian. Plus Experian offers free credit monitoring, along with free access to your credit reports and scores. You can get alerts when something changes on your credit reports, which can be especially useful when you're working on building or rebuilding your credit.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Bev O'Shea is a Georgia-based freelance journalist specializing in personal finance and consumer credit. Most recently, she was a staff writer at personal finance website NerdWallet, where she was an authority on credit reports, credit scores and identity theft.

Read more from Bev