What Is a Merged Credit Report?

A merged credit report is one that combines consumer credit report information from multiple credit bureaus. Merged reports are commonly used in mortgage lending, where lenders have to make decisions about large loans. The merged report can give the lender a more complete picture of an applicant's credit, as the credit reports maintained by all three bureaus might not be identical.

How Do Merged Credit Reports Work?

Merged credit reports are also known as tri-merge reports or three-bureau reports. They're generally created by third-party mortgage reporting companies that gather your information from the major consumer credit bureaus—Experian, TransUnion and Equifax.

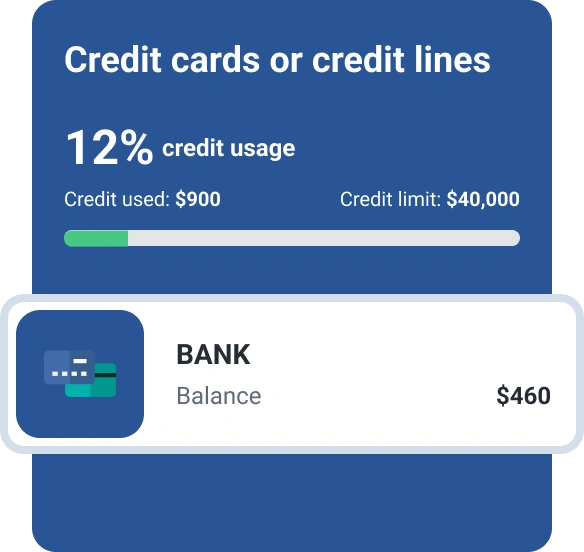

The company sorts and combines the information from your three reports to create the merged report. Duplicate entries may also be removed. There may be a summary near the beginning of the merged report that provides an overview of the consumer's open accounts, balances, disputes, inquiries, late payments and credit utilization ratio. Unlike your personal credit reports, tri-merge reports do not include a summary of soft inquiries.

The lender can also order a variety of add-ons with a merged report. For example, mortgage lenders often get specific types of FICO® ScoresΘ based on each of a consumer's credit reports. The credit bureaus assign brand names to these types of FICO® Scores that indicate which bureau supplies the information used in the calculation:

- FICO® Score 2 (Experian/Fair Isaac Risk Model v2)

- FICO® Score 5 (Equifax Beacon 5)

- FICO® Score 4 (TransUnion FICO Risk Score 04)

Lenders can also request a tri-merge report with other versions of the FICO® Score or VantageScore® credit score, or even multiple credit scores based on a single credit report. And merged reports can include more specialized types of scores, such as bankruptcy scores.

Can You Order a Tri-Merge Credit Report?

Merged reports are primarily created and sold to mortgage professionals, and you can't necessarily order one on your own. However, if you're working with a mortgage lender or broker, they may be able to share a copy of your tri-merge report with you.

They may even be able to request a merged report with a soft inquiry—the type that doesn't impact your credit scores. However, if you want to get preapproved for a mortgage or you're applying for a loan, the creation of the tri-merge report could lead to a hard inquiry on all three of your credit reports.

You may also be able to get a copy of a merged credit report if you're working with a credit counselor. Some counselors offer first-time homebuyer programs, and reviewing your credit may be part of the preparation process.

While you won't get a tri-merge report, you can request a free copy of your credit report from each of the three credit bureaus once a week at AnnualCreditReport.com. You'll receive three individual reports rather than a single merged report, but you'll be able to have a complete picture of the information being reported to Experian, Equifax, and TransUnion. You can use this information to gain a better understanding of your credit reports and review your account information, such as your payment history and balance information.

Why Do You Have More Than One Credit Score?

Don't be surprised if you check your credit scores, or see them on a copy of your merged report, and notice that they aren't all the same. Not only is this common, but it's to be expected.

Credit scores are based entirely on the information in your credit report, and they can vary depending on both the scoring model used to calculate it and the credit report that's being analyzed. For example, Experian gives you a FICO® Score 8 credit score for free, but one of your lenders or card issuers might give you a VantageScore 3.0 credit score. Even when both scores are analyzing your Experian credit report, the differences in the scoring algorithms will likely result in different outcomes.

When the same model is used, the resulting scores can still differ based on which credit bureau provided the report. Much of the information in your credit report is provided by data furnishers, such as lenders and collection agencies. But these furnishers don't have to send information to all three bureaus, and some may choose to only report your account to one or two of the bureaus.

These differences in your credit reports can result in varying credit scores. It's also why some lenders may want to review a merged credit report before agreeing to give you a loan.

Monitor Your Credit Scores for Changes

You might not know which score a lender will use to make a decision. However, while your credit scores may vary, they all depend on the underlying information in your credit reports. With this in mind, checking and monitoring your credit reports for changes can be important.

You can sign up for a free Experian credit report online, which includes free credit monitoring, daily alerts and a FICO® Score 8 for free. If you would like to order both your credit history and credit score from each of the three credit bureaus at once, you can do so online through Experian.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis