What Is a VantageScore Credit Score?

Quick Answer

VantageScore® develops credit scoring models that companies can use to evaluate your creditworthiness. The latest score versions are VantageScore 3.0, 4.0 and 4plus. They work differently, but all range from 300 to 850 and largely depend on the information in your credit report.

VantageScore® is a company that develops consumer credit risk scores. Banks, credit unions, lenders and card issuers can use VantageScore's credit scores to understand the likelihood that someone will miss a bill payment. They might rely on one of these scores when sending out offers of credit, reviewing applications and managing their customers' accounts.

What Is VantageScore?

The three credit reporting agencies, Experian, TransUnion and Equifax, created VantageScore as an independently managed joint venture in 2006. Since then, the company has released five credit scoring models.

The most commonly used scores are the VantageScore 3.0 and VantageScore 4.0 scores. VantageScore announced its VantageScore 4plus™ model in May 2024. All three models have a score range of 300 to 850.

You may see one of your VantageScore credit scores if you check your credit from a personal finance-oriented website or from your credit card issuer or bank. Here's a quick look at some of the ways the models differ.

| VantageScore 3.0 | VantageScore 4.0 | VantageScore 4plus | |

|---|---|---|---|

| Only Considers Data from a Credit Report | X | X | |

| Can Consider Additional Data With Your Permission | X | ||

| Considers Trended Data | X | X |

VantageScore 3.0

VantageScore released version 3.0 of its credit score in 2013. It was the first tri-bureau score—meaning the same model works with a credit report from any of the three bureaus—to use the 300 to 850 score range. Unlike some other scoring models, VantageScore 3.0 doesn't consider paid collection accounts.

Jeff Richardson, senior vice president of marketing and communications at VantageScore Solutions, says it's still the version you'll often receive for free from personal finance websites and financial institutions.

VantageScore 4.0

VantageScore 4.0 was released in 2017 and introduced trended data as a scoring factor. Previous models only considered information from a credit report at a given time, but trended data can consider changes and trends in your credit history, such as the number of times you've paid more than the minimum balance on your credit card (over the past 24 months in the VantageScore 4 version).

One connection between VantageScore 3.0 and 4.0 is that they both can score more people than conventional scoring models. "The difference is that 4.0 built on the success of 3.0," says Richardson. "It scores those with thin files much more precisely." VantageScore 4.0 is also poised to be a required score for many mortgage loans.

Learn more: Which Credit Scores Do Mortgage Lenders Use?

VantageScore 4plus

VantageScore 4plus™ is the latest model, and it's currently being tested by financial institutions. The model allows lenders to ask you to connect your bank or credit card account and it may adjust your score based on information from your account.

For example, if you apply for a loan and get declined, the lender might let you connect your bank account and then use VantageScore 4plus to see if you qualify based on the new score.

"That provides an opportunity to those who have limited credit history," says Richardson. "It does assess the way consumers handle their cash flow and creates predictive insights based upon that."

VantageScore 4plus also does this within seconds, allowing you to find out the results quickly. And it's a one-time permission and result. Using VantageScore 4plus for one application won't affect your VantageScore 4 score or other credit applications.

What Is a Good VantageScore Credit Score?

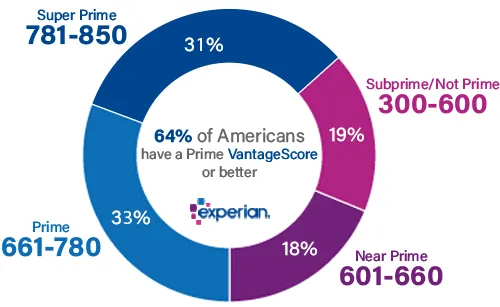

VantageScore suggests separating its credit score range (300 to 850) into different groups, with a score of 661 or higher considered a good score. However, lenders may have their own criteria for what they consider to be a good credit score.

Companies also often consider other factors when making decisions, such as your income, debt-to-income ratio and history with the company. As a result, there's no guarantee that you'll qualify for a loan or credit card even if you have good credit by VantageScore's standards.

Lenders frequently use variations of "prime" to describe consumers' creditworthiness. But you might think of these categories as poor, fair, good and excellent credit scores.

VantageScore Credit Score vs. FICO® ScoreΘ 10

Every VantageScore credit score and FICO credit score is designed to predict the statistical likelihood that a borrower will become delinquent on a financial obligation. And, aside from models that can incorporate banking data, like VantageScore 4plus and UltraFICO™, the credit scores are based solely on the information from one of your credit reports.

But there are similarities and differences between the companies' credit scores.

Score Range and Factors

The three most recent VantageScore credit scores range from 300 to 850. Base FICO® Scores, which are intended to be used by any type of lender, also have a 300 to 850 range. However, FICO creates additional, industry-specific scoring models for auto lenders and credit card issuers that range from 250 to 900.

Both companies' credit scores broadly consider the same types of information—data from your credit report. However, each scoring model may consider slightly different data points and weight information differently.

| Factor | Weight | Factor | Weight |

|---|---|---|---|

| Payment history | 35% | Payment history | Extremely influential |

| Amounts owed | 30% | Total credit usage | Highly influential |

| Length of credit history | 15% | Credit mix and experience | Highly influential |

| New credit | 10% | New accounts opened | Moderately influential |

| Credit mix | 10% | Balances and available credit | Less influential |

Why VantageScore Doesn't Highlight Percentage Breakdowns

You'll often find that FICO® Score factors are broken down into five groups with different percentages showing the importance of each category.

VantageScore sometimes creates similar charts showing different scoring factors and the percentage contribution each one has on a credit score. However, these are a result of specific studies and they can change over time and from one person to another.

"These percentages are calculated on samples of the U.S. population," says Richardson. "But how the scores assess any individual consumer is based on what's in their credit file. What percentage, for example, credit utilization has on a consumer will differ based on the makeup of their entire credit file."

The same is true with FICO® Scores—the percentages are based on an average person and can change depending on a person's overall credit profile. However, FICO prefers to present the average importance of each factor using percentages, while VantageScore prefers to show which factors are generally more or less influential.

Number of Scores

VantageScore creates tri-bureau models that any of the three credit bureaus can use. In total, there are five VantageScore models—1 through 4, and 4plus.

FICO has been developing credit scores for decades, and it creates slightly different models for each of the bureaus—even if the models have the same generational name, such as FICO® Score 9 or FICO® Score 10. In total, there are over 40 versions of the FICO® Score.

Accessibility

To be eligible for a FICO® Score, you must have a credit account in your credit report that's at least six months old and have activity on a credit account within the last six months—they don't need to be the same account.

In contrast, you can get a VantageScore credit score if you have a credit report with a credit account, bankruptcy filing or collection account. There's no requirement for how long you've had a credit account in your credit report or for recent account activity.

Lender Use

According to FICO, 90% of top lenders use FICO® Scores. A 2023 VantageScore Market Study Report found that over 3,400 banks, lenders and other organizations used VantageScore credit scores, including eight of the top 10 banks and the top five credit card issuers.

Why Your VantageScore Credit Score Can Vary

Your VantageScore credit scores can vary depending on which type of VantageScore credit score you check, when the score was generated and which credit report the score analyzes.

- Different score versions: There are five VantageScore scoring models, and some credit score providers may offer you different versions. For example, if you get a free VantageScore 3.0 from a personal finance website and VantageScore 4.0 from your credit card issuer, the resulting scores could be different even if they're analyzing the same credit report.

- When the score was generated: As with any credit scoring model, the VantageScore credit scores are a snapshot of your credit profile at the time the credit score is created. The scores could be different if you check scores at different times or if you receive scores weekly or monthly.

- Varying credit report data: Most VantageScore credit scores are solely based on information in one of your credit reports. But the data at each credit bureau may be slightly different because not all financial institutions report to all three credit reporting agencies, or they may report to the bureaus at different times. This can result in different scores even if the same scoring model is analyzing your credit reports at the same time.

Learn more: Why Do I Have So Many Credit Scores?

Do Lenders Use VantageScore Credit Scores?

Many lenders use VantageScore credit scores, and organizations can use credit scores in different ways.

One is to determine which applicants to approve and the terms on new credit accounts. For example, Synchrony Bank, which claims to be the largest issuer of store credit cards, uses the VantageScore 4.0 model to evaluate card applications. Many mortgage lenders will also start using a VantageScore 4.0 in 2024 to comply with Federal Housing Finance Agency requirements.

Additionally, companies might use a VantageScore credit score before sending firm offers of credit, when reviewing customer accounts and adjusting credit limits and when they want to sell existing loans to investors.

How to Check Your VantageScore Credit Score

Your bank, credit union, lender, loan servicer or credit card issuer may offer you free VantageScore credit score tracking in your account. There are also personal finance websites that offer score tracking as a free benefit to members.

The VantageScore website lists some of these companies that offer free VantageScore 3.0 and VantageScore 4.0 scores.

You can also get copies of your credit reports for free on AnnualCreditReport.com, but the reports won't come with a credit score.

How to Improve Your VantageScore Credit Score

VantageScore's credit scores might consider slightly different information depending on the model, and they differ from FICO® Scores. However, all credit scores are designed to do the same thing. As a result, the same behavior could help increase all your VantageScore credit scores and FICO credit scores.

Here are steps you can take to improve your credit:

- Pay your bills on time. Make it a priority to always pay your bills on time. If you miss a debt payment by 30 days or more, it could damage your credit. If you have past-due payments, try to get caught up as quickly as possible to avoid further damage.

- Keep your credit card balances low. Your credit card balance relative to its credit limit—your credit utilization rate—can have a big impact on your credit scores. A lower utilization rate is best.

- Keep old credit cards open. Keeping credit cards open gives you more available credit, which can make maintaining a low overall utilization rate easier. Unless an old credit card poses a threat to your financial well-being, consider keeping it open.

- Avoid frequent credit applications. Applying for and opening new credit accounts can hurt your credit. Make it a goal to avoid unnecessary credit applications and to space out the necessary ones to limit the impact.

- Use different types of credit. Having open revolving and installment accounts can give you a diverse credit mix and increase your scores. Although you don't want to apply for an account without reason, you might consider opening a fee-free account, such as a lending circle loan or credit card without an annual fee, to build your credit.

- Avoid taking on too much debt. The more debt you have, the harder it can be to stay on top of your payments. Before you apply for credit, make sure you can comfortably afford the new payment along with your other financial obligations.

You can also try to add additional payments to your credit reports, which might improve your credit scores without requiring you to open a new account.

For example, Experian Boost®ø is a free feature that you can use to add rent, utility and streaming service payments to your Experian credit report. These payments could improve VantageScore 3.0 and VantageScore 4.0 scores, and certain FICO® Scores.

Monitor Your Credit Regularly

Monitoring your credit reports for changes and accuracy is important because your credit reports are the basis for all your credit scores. With Experian's free credit monitoring, you'll get access to your Experian credit report, monthly updates with a new report and real-time alerts about important changes. Your Experian account also comes with a FICO® Score for free and score tracking.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis