What is an Auto Repair Loan?

Quick Answer

An auto repair loan is a personal loan that’s used to cover auto repair costs. It offers relatively quick funding and predictable payments, but may be an expensive way to pay for car repairs.

If your car needs repairs that you can't afford to pay for upfront, an auto repair loan can help you finance the costs. Although it's a commonly used term in marketing, an auto repair loan is actually a personal loan that you use to pay for auto repairs. Loan amounts and repayment terms vary, so it's important to understand how these loans work before you apply.

What Is An Auto Repair Loan?

An auto repair loan refers to a personal loan that's used specifically to cover auto repair expenses. If you can't afford to pay for auto repairs out of pocket, you can apply for a personal loan to cover the costs. Once you're approved, you'll repay the loan over a predetermined term in fixed installments, with interest.

Most personal loans are unsecured, which means you won't need to offer any collateral, like your car or home, to secure the loan. Because unsecured loans are riskier to the lender, however, interest rates may be higher compared with a secured loan. This is especially true for borrowers with lower credit scores.

Loan amounts and repayment terms vary depending on the lender and the loan. Repayment terms can range from a few months to several years. Keep in mind that the loan term will affect your monthly payments and the total interest cost.

Personal loans are versatile, so you can use the funds to cover a wide range of auto repairs, such as:

- Engine and transmission repairs or replacement

- Bodywork and damage repairs

- Windshield repairs or replacements

- Safety feature repairs

- New tires

Compare personal loan rates

Find APRs from 4.99% to 35.99% and flexible terms of 12 to 120 months. Loan amounts range from $1,000 up to $250,000, with funding available the same day or up to 7 days.

Offers from our partners

View all of our Best Personal Loans for 2026 to see what you’re likely to qualify for, and the rates and terms you might get.

Auto Repair Loan Requirements

While requirements vary by lender, here are some general requirements you'll likely need to meet:

- Good credit score: Although there are lenders that provide personal loans for those with bad credit, these typically come with higher interest rates and monthly payments. A good credit score could help you get a lower interest rate and better terms.

- Steady income: You need to show you have consistent income to repay the loan. Lenders may request proof of income, such as a pay stub, tax return or bank statement.

- Low debt-to-income ratio: Lenders will often consider your current debt load, in terms of your debt-to-income ratio (DTI). If your DTI is too high, it may signal that you don't have enough disposable income to take on additional debt.

Learn more: Personal Loan Requirements to Know Before You Apply

Pros of Auto Repair Loans

- Quick access to funding: Once you're approved, you may be able to access funds in as little as one business day, or within a week.

- Flexible loan amounts: While you can borrow anywhere from a few hundred to several thousand dollars, you can opt to borrow just enough to cover repair costs and avoid taking on unnecessary debt.

- No collateral needed: Since personal loans are unsecured, you don't need to offer your assets as collateral to get approved.

- Fixed payments: Personal loans offer fixed interest rates and monthly payments, making it easier to budget over the life of the loan.

Cons of Auto Repair Loans

- Potential fees: Some lenders charge an origination fee, which typically ranges between 1% and 3% of the loan amount.

- Additional interest costs: Paying interest on an auto repair loan increases the overall cost of your repairs.

- Credit requirements: If your credit score is low, it may be difficult to qualify for favorable loan terms. You may end up with a higher interest rate.

- Risk of overborrowing. You may be tempted to borrow more than you need, which can increase your debt burden and make repayment harder.

Alternatives to Auto Repair Loans

Before opting for an auto repair loan, explore a few alternatives that may be more suitable:

- Warranty coverage: If your car is still under a manufacturer's or extended warranty, you may not have to pay for repairs out of pocket. Check your warranty documents or contact the dealership to see if coverage is still valid.

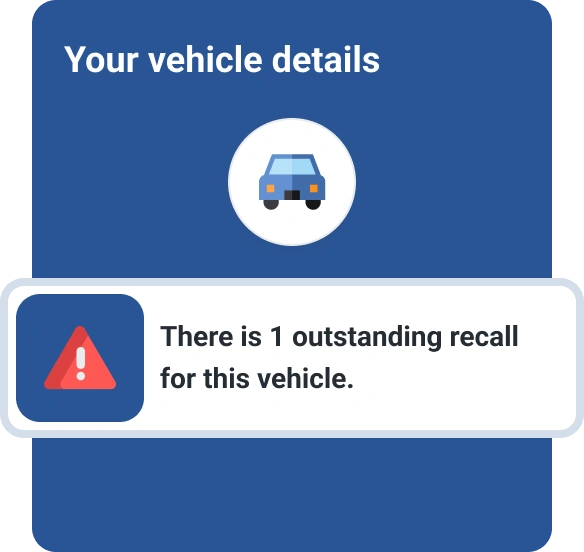

- Active recall repairs: If your vehicle is subject to an active recall, the manufacturer is required to fix the issue at no cost to you. You can check for active recalls using the National Highway Traffic Safety Administration (NHTSA) or your vehicle manufacturer's website.

- Auto insurance coverage: Certain repairs may be covered by your auto insurance policy, depending on the damage and the type of coverage you have. For instance, collision or comprehensive insurance may cover costs of damages related to an accident, theft or weather-related incident (minus your deductible).

- Intro 0% APR credit card: If you qualify for a credit card with a 0% introductory APR, you can finance auto repairs interest-free for a certain period, sometimes up to 21 months. However, you'll need to pay off the balance before the introductory period ends to avoid interest charges.

- Borrowing from family or friends: Borrowing from someone you know can be a low-cost way to cover auto repair costs and repayment terms may be more flexible than working with a traditional lender. Communication and on-time payment are important, otherwise, you could strain your relationship.

- Mechanic financing: Some auto repair shops offer payment plans through third-party financing companies. Be sure to review the financing terms, including interest rates and fees, especially for any interest-free promotional offers.

- Home equity loan: If you own a home, a home equity loan may be an option. Home equity loans often come with lower interest rates than personal loans, but they also involve closing costs and the risk of losing your home if you default on the loan.

To avoid having to borrow in the future, build an emergency fund you can tap to help you cover repairs. Start with what you can; even saving small amounts regularly adds up over time.

The Bottom Line

An auto repair loan can help you pay for urgent car repairs and get your car back on the road quickly. It's important to weigh the pros and cons. Check for existing coverage through your vehicle's warranty, recall status and auto insurance before taking out a loan. If you have to take out a personal loan for auto repairs, comparing offers from multiple lenders can help you land the best deal.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya