What Is a Closing Disclosure?

Quick Answer

A closing disclosure is a document that explains a mortgage’s final terms and closing costs. It helps you understand the precise terms of the loan and compare those details with the loan estimate previously provided by the lender.

A closing disclosure is a document that explains a mortgage's final terms and closing costs. Under federal law, if you're financing a home, the lender must give you a copy of your closing disclosure three business days before closing.

The closing disclosure occurs after a lender says you're cleared to close and means your loan is approved. It helps you understand the precise terms of the loan you've been offered, and compare those details with the terms of the loan estimate provided by the lender earlier in the process.

Here's how to use the closing disclosure to make sure you're clear on the details of your mortgage.

What Is a Closing Disclosure?

A closing disclosure is a five-page document that summarizes a mortgage's final terms and charges, including fees and closing costs. Along with other types of loan disclosures, it's mandated by Regulation Z in the federal Truth in Lending Act (TILA) to ensure transparency in the homebuying process. The Consumer Financial Protection Bureau oversees implementation of closing disclosures.

Tip: The lender isn't required to give you a closing disclosure if you're applying for a reverse mortgage, home equity line of credit (HELOC) or a mortgage through specific homebuyer assistance programs. You'll receive other types of disclosures instead.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

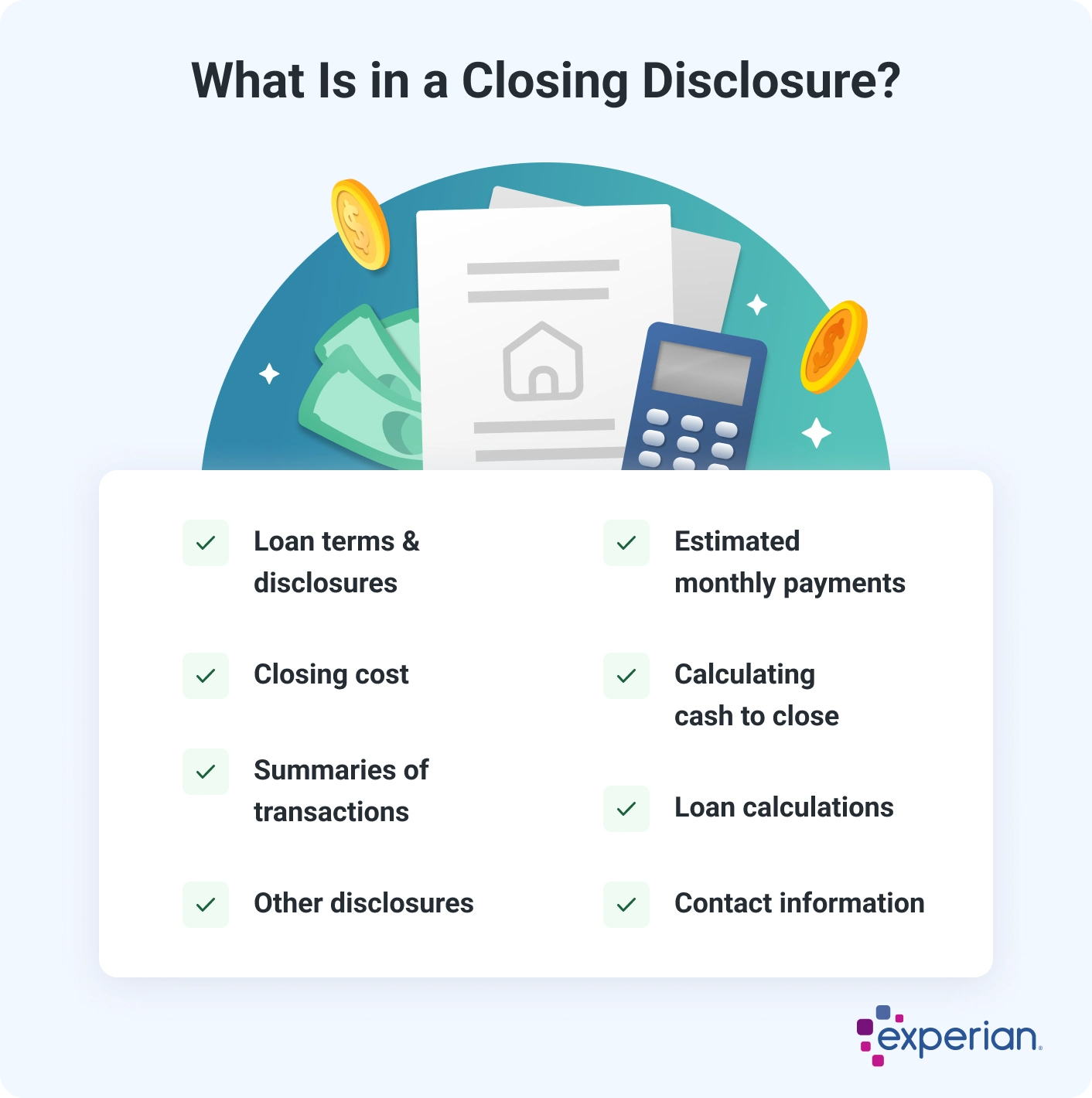

What Is Included in a Closing Disclosure?

A closing disclosure comprises several key pieces of information. They include:

Loan Terms

On page one, you'll find your loan amount, interest rate, projected monthly mortgage payment (including principal and interest) and whether the loan includes a prepayment penalty or balloon payment. If there's a balloon payment, that means you'll pay less per month but make a lump-sum payment at the end of the loan term.

Estimated Monthly Payments

Here you'll see a detailed breakdown of your monthly payment. It includes not just principal and interest to be paid, but mortgage insurance and expected contributions to your escrow account, if applicable.

Learn more: What Is Principal, Interest, Taxes and Insurance (PITI)?

Closing Costs

Next you'll see the total amount you'll need to pay at closing, plus a detailed list of closing costs to be paid by each party (the borrower, the seller and others).

Calculating Cash to Close

In this table, you can compare exactly how your closing costs differ from the preliminary fees listed in your loan estimate.

Summaries of Transactions

This table explains what the borrower and seller have already paid and what's still due at closing.

Loan Disclosures

Next, your lender must share with you details about how the loan will be serviced, including late fees charged, whether you can make partial payments and whether you'll pay into an escrow account to pay certain property costs.

Loan Calculations

This table lists additional mortgage details such as the total amount you'll pay, the amount you'll finance and your annual percentage rate (APR), which incorporates interest, fees and other charges.

Other Disclosures

The lender must explain to you in this section certain rights you have, such as the requirement that your lender give you a copy of your home's appraisal at least three days before your closing date.

Contact Information

Names, addresses and contact information are listed here for each representative at closing, including the lender, mortgage broker and real estate brokers for the buyer and seller.

Why Are Closing Disclosures Important?

A closing disclosure helps you understand exactly how much your mortgage will cost you. It also gives you the opportunity to clarify inaccuracies or deviations from your prior loan estimate.

Here's how: When you apply for a mortgage, you'll receive a loan estimate from the lender within three business days of submitting your application (unless the application is denied in that three-day window). Loan estimates show you what interest rates and terms you may qualify for, based on basic data, and let you compare offers across lenders.

But the loan terms may change once you submit more detailed personal and financial information later in the process. That's where the closing disclosure comes in: It includes final, more personalized information about the loan you've been offered. You can use it to double-check the lender's final offer and ask any questions before closing, especially if the terms you've received differ from the terms in the loan estimate.

Learn more: How to Compare Mortgage Loan Offers

What Is the Three-Day Rule for Closing Disclosures?

The three-day rule, formally known as the TILA-RESPA Integrated Disclosure Rule (TRID Rule), requires lenders to provide borrowers with closing disclosures at least three business days before closing. This means you'll have a few days to compare the data in the closing disclosure with the loan estimate and bring to the lender any questions that come up.

Tip: If you don't receive a closing disclosure three days before closing, reach out to your lender immediately to request one. Don't go to closing until you receive and review your closing disclosure. And remember reverse mortgages, HELOCs or mortgages through specific homebuyer assistance programs don't receive closing disclosures.

How to Check for Errors on a Closing Disclosure

It's critical to make sure all the information on the closing disclosure is accurate. Errors on closing documents could delay closing and add frustration to an already complex process.

Pay special attention to the following details in a closing disclosure:

- The spelling of your name(s)

- The home's address

- Other personal information

- Loan interest rate and fees

- Loan amount and description

- Whether all five mandated pages are included

If there are errors or differences from what you expected, contact your lender or real estate agent as soon as possible. That will ensure you get the terms you planned for and prevent delays from derailing closing.

Frequently Asked Questions

The Bottom Line

Receiving a closing disclosure is a crucial step toward getting a mortgage. It gives you the opportunity to calculate with certainty how much your mortgage will cost and what additional fees and features of the loan to be aware of. You should feel empowered to ask your lender to explain each section of the form you're unsure about. That will protect you from surprise charges and help you start paying your home loan with confidence.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna