How Does Credit Counseling Work?

Quick Answer

Nonprofit credit counseling provides one-on-one consultations about your finances and workshops on a range of financial topics. Nonprofit credit counseling services are typically low-cost and they can help you create a definite plan for getting out of debt.

When your finances are under strain, a credit counseling service, or debt counseling service, can advise you on budgeting, paying off debt and managing your money. A credit counselor can also help you create a plan to help make unsecured debt payments more affordable and help you avoid bankruptcy.

If your debts are beginning to feel overwhelming, or you need help getting a handle on your finances, here's how credit counseling can help.

What Does a Credit Counselor Do?

Credit counselors provide a variety of services that range from basic budgeting advice to debt management plans. Credit counseling agencies are often nonprofit, but they may also operate as for-profit businesses that focus on debt settlement.

Here, we're focusing on nonprofit agencies, many of which belong to the National Foundation for Credit Counseling or the Financial Counseling Association of America. These agencies are accredited and adhere to industry standards. Here's some of what you can expect if you decide to work with one.

Personalized Advice

Credit counselors can meet with you to discuss your financial situation and help develop a personalized plan to improve your money management.

Areas of focus can include:

- Developing a budget

- Managing bills and debts

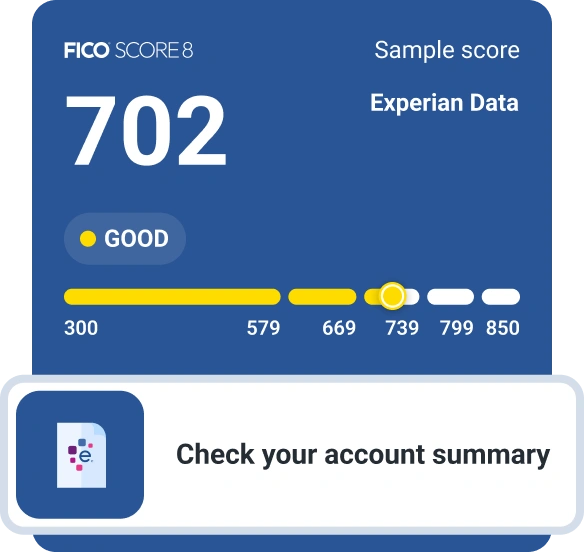

- Gaining access to your credit reports and scores

- Improving financial literacy

- Escaping a paycheck-to-paycheck lifestyle

- Avoiding bankruptcy

- Creating a financial plan

If you're thinking about filing for bankruptcy, the courts require you to complete a pre-bankruptcy credit counseling session.

Financial Workshops

In addition to one-on-one consultations, credit counseling services also offer workshops on a variety of topics, including:

- Homebuyer education

- Budgeting

- Credit card management

- Maintaining a healthy credit history

- Bankruptcy

- Student loan counseling

Debt Management Plans

If you're behind on your monthly debt payments or you're concerned about falling behind, a credit counselor may be able to help you create a debt management plan (DMP).

With this arrangement, a counselor can negotiate lower interest rates and monthly payments on your unsecured debt—primarily credit cards—and may even get late charges waived and bring your account back to current status.

In exchange, you'll typically need to close your credit card accounts and make a monthly payment to the agency for all of your debts, which it'll distribute to your creditors on your behalf. DMPs typically last three to five years.

How Does Credit Counseling Work?

Credit counseling typically begins with a free or low-cost consultation. You provide information about your income, expenses, financial goals and debts, and the counselor offers objective feedback on how to improve your finances. Alternatively (or in addition), you may participate in workshops to improve your financial skills and knowledge.

If you decide to move forward with a debt management plan, you'll pay an upfront setup fee and agree to ongoing monthly payments. Going forward, you'll make one monthly payment to the credit counseling agency that includes all of your debt payments plus a monthly fee. Your agreement continues until your debts are paid.

A DMP is optional. Before you sign onto one, make sure you understand how your plan will work and how it might impact your credit.

Debt Management vs. Debt Settlement

As you navigate this process, note that a debt management plan is not the same thing as debt settlement. In a debt settlement arrangement, a debt settlement company negotiates with creditors to pay less than the full amount of your debt. As part of the negotiation, the settlement company may ask you to stop making payments, which causes late payments to appear on your credit report and damages your credit. If the settlement process is successful, the account appears as "settled for less than originally agreed" on your credit report, which can also harm your credit score. Late payments and settled accounts stay on your credit report and affect your credit scores for up to seven years.

How Much Does Debt Counseling Cost?

Nonprofit credit counseling agencies typically offer free or low-cost consultations and workshops. Debt management plans generally require a one-time setup fee, plus monthly fees for as long as the plan is in force.

Fees vary from one organization to the next and from state to state, according to state regulations. The IRS oversees nonprofit credit counseling organizations at the federal level. It requires nonprofits to "charge reasonable fees and provide waivers if [a] consumer is unable to pay."

The setup cost for a DMP might be as high as $99, but is often less. Monthly service fees often range from $20 to $50, but some agencies may charge more. In all cases, you should ask for a clear explanation of related fees before you sign a DMP agreement.

Learn more:How Does Credit Card Interest Work?

Does Credit Counseling Hurt Your Credit?

Meeting with a credit counselor or attending a workshop won't have any impact on your credit. And, ideally, a DMP may help you avoid credit score harm. Your counselor can negotiate a lower interest rate or lower minimum monthly payments that make it easier for you to repay your debts—but without settling your debt for less than its original value. In this way, you may save your credit score and report from a negative hit.

Debt management plans can have direct and indirect impacts to your credit. Here are a few examples:

- Closing credit card accounts can increase your credit utilization rate, which can lower your credit score.

- Missing a payment by 30 days or more while you're getting your DMP into place will show up on your credit report for up to seven years. Try to make sure none of your payments are delayed or skipped during this process.

- Placing a note in your credit report that you're on a DMP or working with a credit counseling service could affect how future lenders view a credit or loan application.

Ultimately, debt counseling should improve your ability to repay your debts on time and manage your credit successfully. Assistance with budgeting may also help you stay away from unmanageable debt in the future.

Pros and Cons of Credit Counseling

Going through credit counseling to establish a debt management plan is one way to wrangle your debt. Consider these pros and cons when you're deciding whether a DMP is right for you.

Pros

-

Personalized help: Working with a credit counselor can give you individualized insight into your finances. You'll also get support, so you don't have to face your financial challenges alone.

-

Better skills: Learning more about managing your finances and dealing with credit gives you a better skillset going forward.

-

Lower costs and monthly payments: By negotiating with your creditors for reduced interest rates, waived late fees or longer payback schedules, credit counselors may lower your overall costs and get you lower monthly payments.

-

No settlement issues: A DMP typically doesn't involve settling your debt for less than you owe. This allows you to bypass the credit issues that can arise from debt settlement and the tax consequences of debt forgiveness.

-

Fewer collections calls: Once a DMP is in place, participating creditors may halt collection efforts. If they do call, you can ask them to contact your credit counseling agency.

-

Simpler payments: You'll make a single monthly payment to your credit counselor instead of multiple payments to various creditors.

-

No new loan: A DMP does not require a new loan or credit account, which also means you don't need a qualifying credit score or debt-to-income ratio.

Cons

-

Potential scams: While many legitimate credit counseling organizations exist, any service that involves collecting personal financial information has the potential to attract scammers. Before working with any credit counselor, do a thorough check of their credentials and background. Beware of organizations that ask for payment upfront.

-

Closed accounts: Implementing a DMP may involve closing your existing credit accounts. This could affect your credit utilization and credit score. It will also eliminate your access to your existing credit going forward.

-

Future loans and credit: As part of your DMP, you may have to agree not to open new credit or loan accounts. Additionally, a note in your credit report showing that you're on a DMP may affect how lenders view your loan or credit application.

-

DMP fees: Credit counselors typically charge setup fees and ongoing monthly fees for debt management plans. Although you can request a fee waiver if you can't afford to pay, and nonprofit credit counseling agencies are low-cost, DMPs are not generally cost-free.

-

Time and commitment: A DMP is not a fast fix, and it only works when you follow through with your budgeting and payoff plan for as long as is necessary to pay back your debt.

-

Limited scope: If your debt is overwhelming or you've lost your income, a DMP may not be a realistic choice.

Is Credit Counseling a Good Idea?

Credit counseling might be a good idea if you're ready and able to make changes to your finances and stick to a payment plan. Though debt counseling can benefit a range of people, you might get the most out of this approach if the following apply to you:

- You have a substantial amount of unsecured debt, including credit card debt or personal loans.

- You have reliable income, so you'll be able to make regular monthly payments.

- You're prepared to adjust your spending in order to free up money to pay down your outstanding debt—and to avoid adding to your debt in the future.

- You're open to outside help. If you feel overwhelmed or at the end of your rope, having additional support might help you end the paralysis.

How to Choose a Debt Counselor

Choosing the right credit counselor is key. While working with a nonprofit agency is recommended, nonprofit status doesn't guarantee that you'll get free, inexpensive or even legitimate services. Here are some steps you can take to find a good credit counselor:

1. Check Referrals and Resources

Get an online list of accredited nonprofit credit counseling organizations from the National Foundation for Credit Counseling and the Financial Counseling Association of America. The U.S. Trustee Program offers a search tool you can use to find agencies that offer pre-bankruptcy counseling, among other services. You can also use these resources to check up on referrals you get from friends or colleagues.

2. Ask About Certifications, Qualifications and Costs

Before you provide any financial information, set up a preliminary meeting with a few credit counselors and ask questions about their certification, nonprofit status, services, costs and other factors that are important to you.

3. Beware of Scams and High-Pressure Sales

In addition to checking a credit counselor's certification and/or accreditation, you may want to check references to make sure you aren't turning financial information over to a scammer. Also ask how your privacy will be protected and how sensitive documents are handled. Nonprofit credit counseling organizations don't engage in high-pressure sales tactics. If you're being told a DMP is your only option, be skeptical. Also, be wary of for-profit "credit repair" companies that promise to fix your credit or erase negative information in exchange for payment. These companies could be scams, and they won't do anything for you that you can't do yourself for free.

Alternatives to Credit Counseling

Credit counseling and a debt management plan aren't the only options you have. Consider these alternative strategies for tackling debt:

- Budgeting and expense cutting: For some, better budgeting may be all that's needed to stop accumulating debt and start paying it down effectively. If you haven't already tried this, there's almost no downside to starting here. You can always move on to additional measures if budgeting alone is not enough.

- Debt consolidation: Consolidating your revolving debt into a single loan with a fixed payoff and a lower interest rate might give you the structure (and the money savings) to pay off your debt. You generally need good credit to qualify for a debt consolidation loan or credit card balance transfers.

- Debt payoff strategies: Pay down your debt methodically using the debt snowball or debt avalanche method. With either strategy, you focus on eliminating one balance at a time—smallest first with the snowball method and highest-interest first with avalanche—until you're debt-free.

- Negotiating with creditors directly: You don't have to work with a credit counseling agency to reach out to your creditors yourself. Consider asking creditors for forbearance (skipped or lower payments), a workout agreement (renegotiated terms) or your own DMP.

If your debt is truly unmanageable, you may want to consider alternatives like bankruptcy or debt settlement. However, both of these options are considered measures of last resort, with lasting damage to your credit for up to 10 years.

Learn more:How Does Bankruptcy Affect Your Credit?

The Bottom Line

Working with a debt counseling agency can help you better understand your finances—and the choices you have for improving your financial health. If you're thinking about a debt management plan, weigh the pros and cons, and consider your alternatives. If you're considering a debt consolidation loan, Experian's free comparison tool can help you get matched with offers based on your credit profile.

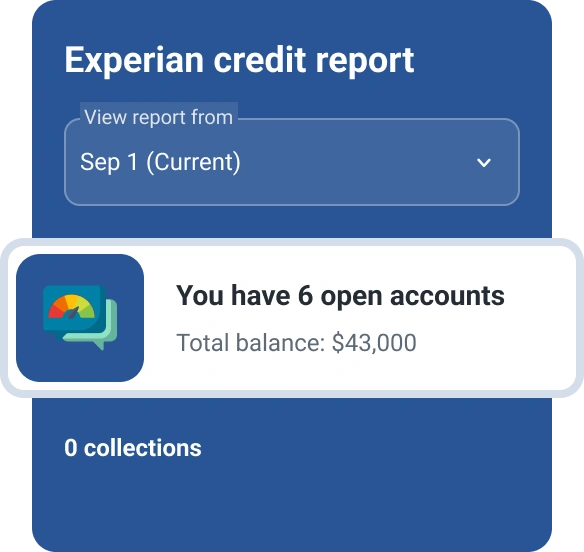

As you work on paying off your debts and improving your credit, you can always access your Experian credit report and score to track your progress, or consider free credit monitoring to help you stay on top of changes as they occur.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle