In this article:

An installment loan is a type of credit that's disbursed in a lump sum and repaid over a fixed repayment term. Most types of debt are a form of installment credit.

As with other credit accounts, how you manage your installment loans can impact your credit scores. Here's what you need to know about installment loans, how they work and how they affect your credit.

What Is an Installment Loan?

An installment loan involves a set principal amount that you pay off over a fixed period of time, usually in monthly installments. In contrast, a revolving credit account allows you to borrow up to a certain limit, pay it back over time and borrow again as needed. In some cases, the limit can also go up or down over time.

The most common types of installment credit are mortgage loans, auto loans, personal loans and student loans. That said, even some credit cards, which are a form of revolving credit, offer installment plans for certain purchases.

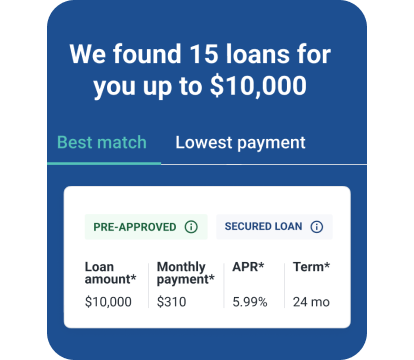

Find a personal loan matched for you

How Does Installment Credit Work?

When you take out an installment loan, the terms will vary depending on the type of loan and the lender. That said, here are some general characteristics to know:

- Principal: With an installment loan, you borrow a fixed sum of money, which is typically disbursed upon approval. You generally can't change the principal loan amount after you agree to the loan terms.

- Term: After your installment loan is disbursed, you'll pay it back over a set repayment term, which can be anywhere from a couple of weeks to a few decades, depending on the loan type. In most cases, you can't change the term of a loan, but some lenders may be willing to modify loan terms for struggling borrowers. You may also be able to refinance the debt using a loan with a different set of terms.

- Interest: Interest is the primary cost of borrowing money. Each time you make a monthly payment, a portion of it will pay the interest that's accrued since your last payment, with the remaining amount paying down your principal balance. If your rate is fixed, your monthly payments will remain the same for the life of the loan. If it's variable, your rate—and, therefore, your monthly payments—may fluctuate over the life of the loan.

- Fees: Some installment loans come with fees, which can increase the cost of borrowing. For example, some loans charge upfront origination fees to cover the cost of originating the loan. Others may charge late fees if you miss a payment or prepayment penalties if you pay off the loan early.

Before you take out an installment loan, it's crucial to review the loan agreement carefully to fully understand the terms and cost.

Pros and Cons of Installment Loans

There are both advantages and disadvantages to using an installment loan, especially compared to revolving credit options. Here's what to keep in mind before you apply.

Pros

- Large loan amounts: While loan amounts will vary by loan type and lender, you can often borrow more with an installment loan than a credit card or line of credit, and you'll get all the money upfront. Financing for some of the largest purchases consumers make—particularly houses and vehicles—is typically done with installment loans.

- Fixed repayment term: Unlike credit cards, which require a minimum monthly payment but don't have a fixed repayment period, an installment loan provides more certainty about when your debt will be paid off.

- Generally lower interest rates: While there are some exceptions, you can generally get a lower interest rate on an installment loan than a revolving credit account, especially if you have good credit. Also, while some installment loans have a variable-rate option, most offer fixed interest rates. In contrast, most revolving credit accounts have variable rates.

Cons

- Little payment flexibility: Because your repayment term is fixed, there's little to no flexibility with your monthly payments. On the flip side, while not paying off your credit card balance in full every month will result in costly interest charges, having a low minimum payment can give you a bit more wiggle room if you need it.

- Potentially higher interest charges: While installment loan interest rates can be lower, you may end up paying more interest overall. That's because revolving credit accounts only charge interest on the amount you borrow, not the total available credit. And if you pay off your credit card balance in full every month, you can avoid interest charges entirely.

- Fees: It's possible to get and use an installment loan without paying any fees, but some loans may charge hundreds of dollars in origination fees or prepayment penalties. With a mortgage loan, closing costs can amount to thousands of dollars.

Types of Installment Loans

Depending on your situation and financing needs, here are some of the most common types of installment loans you can use.

Mortgage Loan

You can use a mortgage loan to buy a home, using the property as collateral. Repayment terms typically range from 10 to 30 years, with both fixed and variable interest rate options. In general, though, mortgage loans often have the lowest interest rates of all types of installment and revolving credit.

That said, you'll also need to pay closing costs and a down payment, and possibly private mortgage insurance if your down payment covers less than 20% of the purchase price of the home. If you default on your payments, the lender can foreclose on the home.

Auto Loan

Similar to a mortgage, you can use an auto loan to buy a car, using the vehicle as collateral to secure the debt. If you fail to keep up with your payments, the lender can repossess the car. Loan terms typically range from three to seven years, with relatively low fixed interest rates compared to unsecured loan options.

Auto loans typically require a down payment, and your loan agreement may also come with a prepayment penalty.

Personal Loan

A personal loan can be used for many purposes, including consolidating debt or financing a home renovation. Personal loans are usually unsecured, meaning they don't require collateral.

As a result, their interest rates can be higher—up to 36% or more—depending on your creditworthiness. You can generally take out a personal loan between $1,000 and $100,000, with repayment terms of one to seven years. Some lenders charge origination fees of up to 12% of your loan amount.

Student Loan

Student loans are designed specifically to cover secondary education expenses. The amount you can borrow depends on the loan program, and repayment terms may range anywhere from five to 30 years.

While federal student loans typically have low interest rates that are standardized for all borrowers, private student loans may charge higher rates based on your creditworthiness. That said, federal student loans come with an upfront loan fee, while private loans generally don't charge one.

How Do Installment Loans Affect Your Credit?

Installment loans can help or hurt your credit, depending on several factors:

- Payment history: Your payment history is the most influential factor in your credit score, so when you make installment loan payments on time, it can help improve your credit score. That said, missing a payment by 30 days or more can have a significant negative impact on your score.

- Amounts owed: The more you borrow, the more difficult it may be to keep up with your monthly payments. As a result, high loan balances could potentially hurt your credit score. As you pay down your loan balances, though, it could have a positive effect.

- Length of credit history: Unlike credit cards, which you can keep open perpetually, installment accounts are closed when you pay off the balance in full, which can have a temporary negative impact on your credit. Also, if you open multiple loans in a short period, it could lower your average age of accounts and hurt your credit.

- New credit: Each time you apply for a loan, the lender will run a hard inquiry on your credit reports, which can have a small negative impact on your credit score. That said, if you apply for an installment loan with multiple lenders in an effort to compare interest rates, those multiple inquiries may be combined into one for credit-scoring purposes.

- Credit mix: Having different types of installment loans—as well as revolving credit accounts—can help improve your credit score.

Frequently Asked Questions

Can I Get an Installment Loan With Bad Credit?

Yes, some lenders specialize in working with borrowers with bad credit. That said, your options may be limited, and you can generally expect high interest rates and fees.

Is a Credit Card an Installment Loan?

Credit cards are a form of revolving credit. However, some credit card issuers allow you to put certain purchases on an installment plan, allowing you to pay off the debt over a set period with interest or a monthly fee.

The Bottom Line

Installment loans can help you achieve some of the most common and sought-after financial goals, like owning a house or car, by allowing you to pay back a purchase over a long period of time. Making installment loan payments on time and paying off the loan as agreed will help your credit.

But like any type of credit, only seek out loans you really need, and check your FICO® Score☉ before applying to see what interest rates you'll likely qualify for. If needed, take some time to improve your credit score before you apply to ensure you get the best rate and terms possible.