What Is a Mortgage Broker?

Quick Answer

A mortgage broker works with a broad range of lenders and acts as a middleman to match you with the best home loan. They also help guide you through the mortgage process, from choosing the right loan to handling the paperwork.

Whether you're a first-time homebuyer or someone who's been through it before, the mortgage process can be time-consuming and complicated. Between the numerous loan types, fluctuating rates and lender requirements, it's hard to know where to start—let alone how to find the best mortgage.

That's where a mortgage broker can help simplify the process and take a lot off your plate. A mortgage broker is a go-between who connects you with mortgage lenders and helps you find the best home loan. Let's dive deeper to understand what a mortgage broker does and how working with one may save you time, stress and money.

What Does a Mortgage Broker Do?

As an intermediary who works with numerous lenders, a mortgage broker's primary job is to help you find and secure the mortgage loan for your needs. These professionals, who are licensed with the Nationwide Mortgage Licensing System & Registry, aren't tied to one lender; they work with many. That means they can shop around on your behalf and present you with more choices, and ideally better terms.

Mortgage brokers also help you navigate the mortgage process in many ways, such as:

- Familiarizing themselves with your financial situation and creditworthiness

- Searching for mortgage loan options that best fit your needs

- Collecting the documents you'll need for the mortgage application

- Helping you fill out your loan application

- Going over the fine print and legal disclosures with you

- Submitting paperwork to the lender

- Working to help you save money on your mortgage

Mortgage brokers are regulated by state agencies, the Department of Financial Services, the Consumer Financial Protection Bureau and the Federal Trade Commission.

Learn more: Is It Better to Use a Mortgage Broker or Bank?

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

How Much Does a Mortgage Broker Cost?

Mortgage brokers are paid a commission for their services, usually 1% to 2% of the loan principal. That means the mortgage broker fee can range from $1,000 to $2,000 for every $100,000 you borrow. It's usually paid by the lender but sometimes falls on the borrower. If your lender pays for it, you may pay a slightly higher mortgage rate. If you're responsible for the fee, you can either roll it into your loan or pay it at closing.

The Truth in Lending Act prohibits brokers from collecting commissions from both the borrower and lender. It also requires mortgage brokers to disclose rates and fees upfront so you know exactly what is being charged.

Tip: When you take out a mortgage, you may also incur origination fees that cover the cost of reviewing and processing your loan application.

Mortgage Broker vs. Loan Officer vs. Mortgage Lender

When shopping for a new home loan, you may come across the terms mortgage broker, loan officer and mortgage lender. They sound similar, but these roles are actually quite different. The biggest difference among them is whom they represent and how they're paid.

Here's a quick breakdown of how each differs in their role, loan options and more.

Mortgage Broker vs. Loan Officer vs. Mortgage Lender

| Mortgage Broker | Loan Officer | Mortgage Lender | |

|---|---|---|---|

| Role | Independent licensed agent who connects borrowers with various lenders | Employee representing one bank or lender | Lender or financial institution that provides direct loans |

| Loan options | Matches borrowers with broad variety of lenders and loan options | Exclusively offers loans originated from one lender | Typically offers in-house loan options only |

| Fees | Earns a broker fee, usually 1% to 2% of the loan amount | May earn a commission | May add application and origination fees |

| Education and licensing | Earns state license after passing required training | Holds a state license and has 10 years' experience working in financial services | Requirements vary by state |

Pros and Cons of Working With a Mortgage Broker

A mortgage broker can help you save considerable time and reduce the stress of finding the right loan. But that doesn't mean they're always your best option. Consider these pros and cons to determine whether working with a broker would benefit you.

Pros

-

Saves time and effort: Instead of researching loans, requesting quotes and contacting several lenders yourself, a broker can do it for you and show you several options.

-

Industry knowledge: With their experience and connections, they may know about little-known loan programs and lender options you may qualify for.

-

Potential to save money: Brokers may be able to get lenders to reduce or waive mortgage fees to help you save money.

-

May help bad credit borrowers: Seasoned brokers have experience working with borrowers in different credit score tiers. That means they can align you with the right loan for your financial situation.

-

Avoids bad options: A good broker can filter out loan offers that don't match your financial situation. They can also help you sidestep lenders that charge excessive fees or have a poor reputation.

Cons

-

Includes broker fees: Brokers usually charge a modest commission fee for their services. Ask any broker you consider working with whether you or the lender is responsible for their fee.

-

Not always the best loan match: Brokers can show you the best lenders and loan offers among the banks they work with, but that doesn't guarantee the best deal.

-

Limited lender network: Some lenders don't work with brokers. You may not be able to work with your current bank or a lender who only offers loans directly to borrowers. You might consider getting a quote from your bank or credit union to see how it stacks up against your broker's best loan options.

Should I Use a Mortgage Broker?

Mortgage brokers can be invaluable if you're unfamiliar with mortgage loans and how to quickly find the best offer, but they're not always necessary. Here are some scenarios when it makes sense to use a broker and when you may want to obtain a loan on your own.

When you might consider working with a mortgage broker:

- Your financial situation or credit history isn't what lenders typically look for.

- You're a first-time homebuyer and would like someone to guide you through the mortgage process.

- You don't have the time to shop and compare loans and want a professional to do the legwork for you.

- You're looking for a non-qualified mortgage or need help finding a lender that offers specialized loan programs.

When you might consider forgoing using a mortgage broker:

- You already know the lender you want to use.

- You don't mind researching loans and comparing rates, repayment terms and fees on your own.

- You are confident you can negotiate better mortgage rates or reduced fees on your own.

How to Find a Mortgage Broker

If you want help from a mortgage broker, take steps to make sure you're working with a reputable one. Ask your real estate agent and friends for recommendations and read through online reviews to see how past clients rate them. You might also look up their license number with the NMLS to make sure it's still active and check for any serious complaints on the Better Business Bureau website.

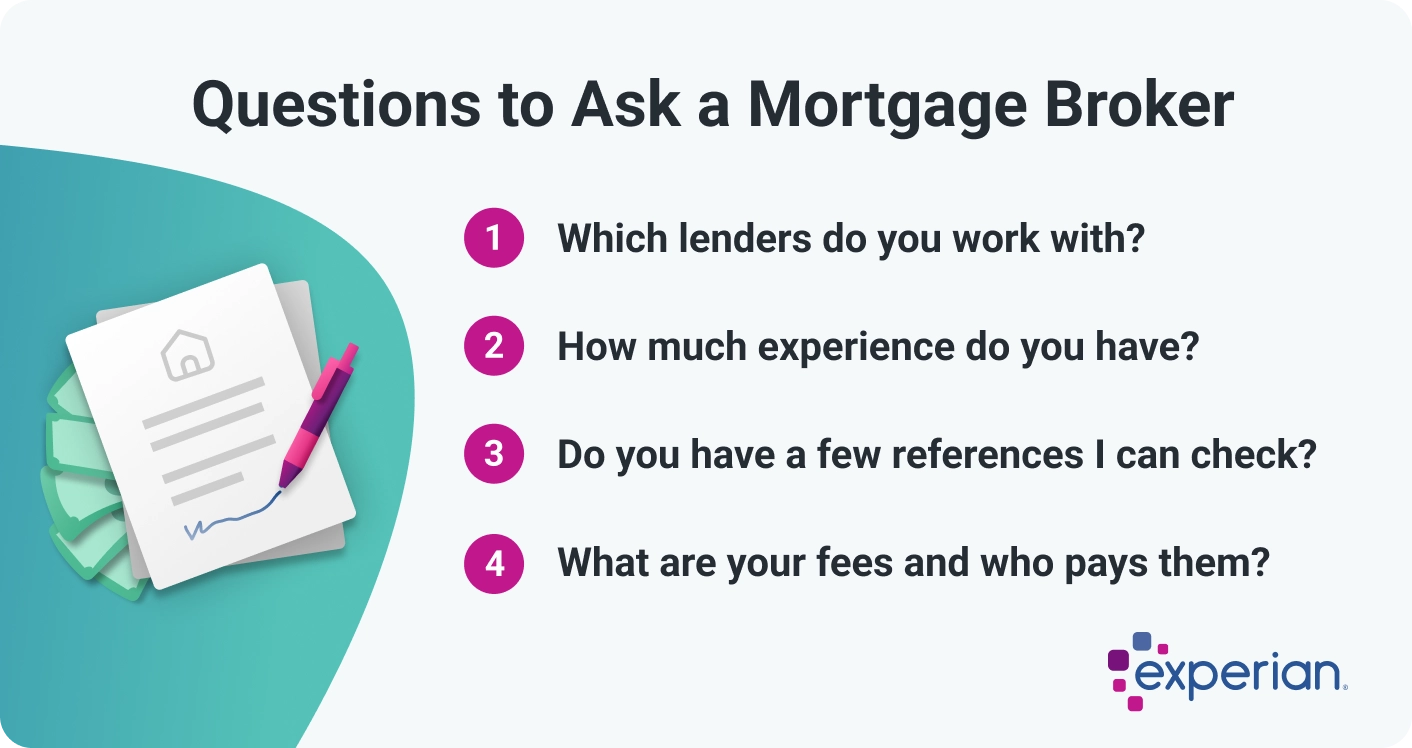

Once you've identified a few brokers you're considering, you'll want to ask some key questions to find out who's the best fit, like:

- Which lenders do you work with? Find how many lenders they partner with and whether that includes both big and small lenders. Many brokers don't work with larger financial institutions. That's not necessarily a bad thing, but it might mean you won't have access to a bank you already have a relationship with.

- How much experience do you have? Any broker you're considering should have at least two or three years of experience, especially if your financial situation is unconventional. A broker with considerable experience likely has worked with many different loan types and borrower profiles.

- Do you have a few references I can check? Contact a few former clients to gauge their experience with the broker, how well they communicated and how smoothly they moved the loan process.

- What are your fees and who pays them? Broker fees can vary, so you might save money comparing your options. You'll also want to know if the lender covers the fees or if you're responsible for them.

Learn more: The Complete Guide on How to Get a Mortgage

Frequently Asked Questions

Bolster Your Credit to Save on Your Mortgage Loan

A mortgage broker can connect you with a broad variety of lenders and help you find the best fit for your financial circumstances. And, according to Freddie Mac, getting several loan estimates could save you $600 to $1,200 a year, which could add up to tens of thousands of dollars over the repayment term.

While a broker could help you secure a home loan if you have less-than-stellar credit, you may save even more money by qualifying for better terms. Keep in mind, lenders typically offer lower rates and more favorable repayment options to those with higher credit scores. Start by checking your free Experian credit report and FICO® ScoreΘ to see what kind of shape your credit is in and, if necessary, take steps to improve it before you apply.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim