What Is Escrow?

Quick Answer

Escrow is a legal agreement in which a third party holds money on behalf of two other parties until a transaction is complete. In real estate, escrow accounts are used to hold money until closing in a home purchase or to hold homeowner funds to pay for property taxes and insurance.

An escrow account is often used during large transactions, such as the purchase of a home or business. This type of account helps protect buyers and sellers from fraud and other issues by keeping valuable funds in a separate account until the transaction is complete.

Escrow arrangements are so common with real estate transactions that the time between when your offer is accepted and when you get the keys is often referred to as being "in escrow."

What Is Escrow?

Escrow is a process where a third party holds money, assets or documents for two parties that are involved in a legal transaction. The escrow service or agent doesn't release them until both parties fulfill their responsibilities.

When you're buying something as valuable as a home, the seller won't want to hand over the keys until they're certain you have the money and will complete the sales transaction as agreed. But you don't want to pay until you take ownership. An escrow service can collect your payment and hold it until the seller is willing to sign the home over to you—or your lender.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

What Is an Escrow Account?

An escrow account is a financial tool that holds a payment between two parties until a transaction is complete. People use escrow services and accounts in two ways when they buy and own a home:

- When you're buying a home: You may need to send an initial deposit after your offer is accepted, and that money is held in an escrow account. The rest of your closing costs will also be held in escrow until the closing is complete.

- After you buy the home: You may want or need to make payments into an escrow account that your mortgage servicer can use to pay property taxes and homeowners insurance on your behalf.

Here's a closer look at how these accounts work.

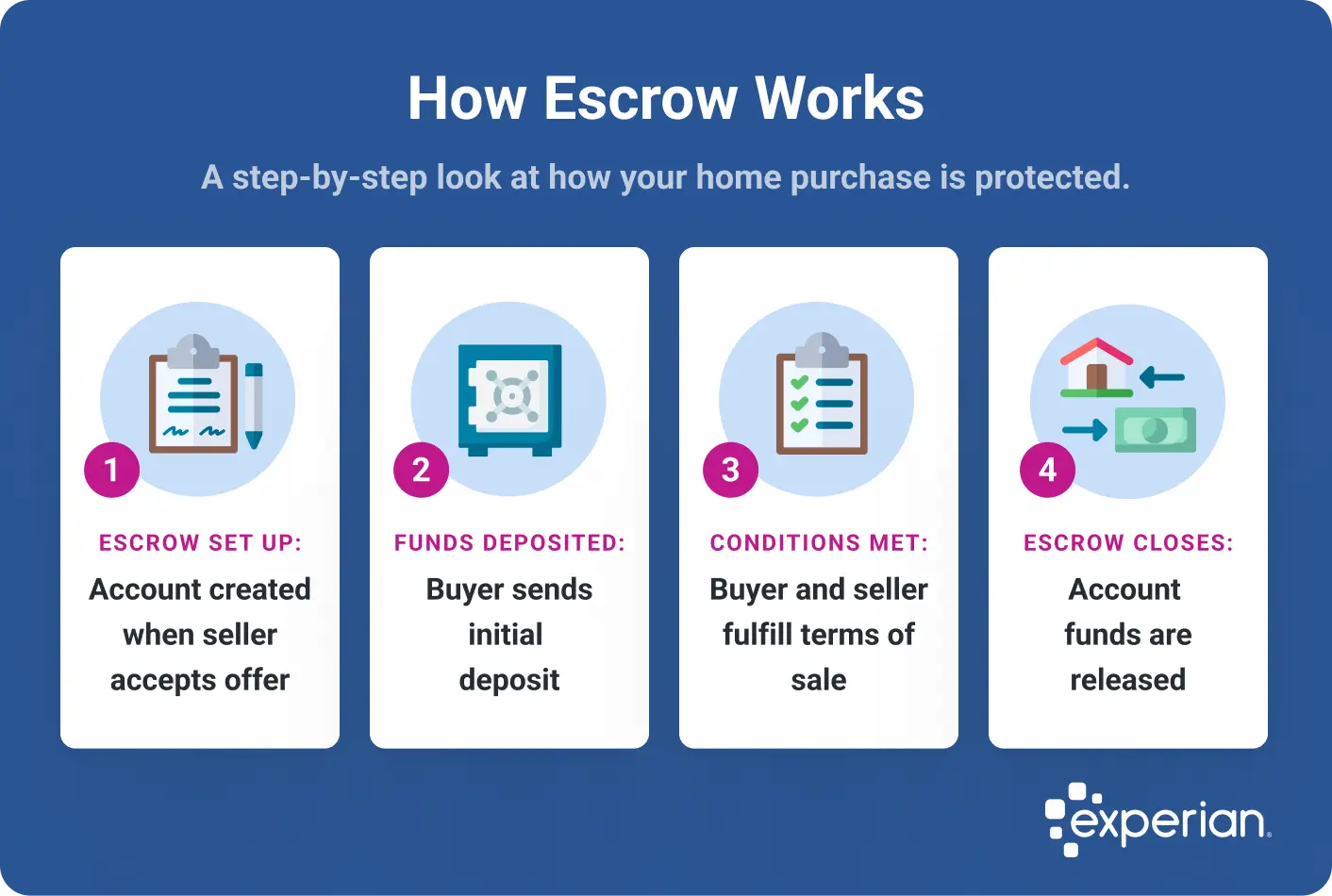

Escrow During the Home Purchase Process

Opening escrow is one of the first steps in the home purchase process after a seller accepts a buyer's offer.

The buyer generally makes an earnest money or good faith deposit, sending a small percentage of their offer amount to be kept in escrow. The sellers might be able to keep the earnest money if the buyer backs out of the deal without a covered reason, such as a low appraisal or undisclosed issues during an inspection.

In addition to holding the earnest money, the escrow agent coordinates between the buyer, seller and lender. They collect and distribute the rest of the money during closing to the respective parties, such as the seller, lender, insurance company and local government.

Often, the title company for the transaction also handles the escrow services.

Learn more: How to Buy a House in 2025: A Step-by-Step Guide

Escrow Accounts for Homeowners

After you buy a home, you might have to use a different type of escrow account—sometimes called an impound account—while paying off your mortgage. The requirement can vary depending on your lender, the type of mortgage you have and how much equity you have in the home.

If you use an escrow account, your mortgage servicer collects approximately one-twelfth the annual cost for your homeowners insurance and property taxes as part of your mortgage payments each month. It then makes the payments on your behalf to ensure you stay current with your taxes and maintain your insurance policy. This is also why you might sometimes see mortgage payments called PITI payments—for principal, interest, taxes and insurance.

Mortgage servicers may also require you to maintain an extra two months' worth of escrow payments in the escrow account in case the estimates aren't right. The mortgage servicer might review your account annually and then require you to deposit more money or give you a refund based on changes in your insurance and tax payments.

Tip: Many homeowners pay their homeowners insurance and property taxes through an escrow account, but it is not a requirement. If you so choose, you could send payments directly to your insurance company and local tax agency.

Pros and Cons of Escrow Accounts for Homeowners

There are advantages and disadvantages to using an escrow account to pay for insurance and property taxes. Some people prefer the arrangement even if they're not required to use an escrow account. Others try to avoid them and pay their premiums and taxes directly.

Pros

-

You don't have to remember to make the payments. Your mortgage servicer will pay your property taxes and homeowners insurance premiums on your behalf.

-

You'll have fewer large expenses throughout the year. Making monthly payments toward an escrow account might be easier than saving up and making several biannual or annual payments each year.

-

You might avoid extra fees. Some lenders might charge you a fee or give you a higher rate when you get a new mortgage and don't want to use an escrow account.

Cons

-

Your closing costs will be higher. Your closing costs will include upfront funding for your escrow account.

-

Your monthly payments might change. If you have a fixed-rate mortgage, your monthly principal and interest payments will never change. But your monthly payments could change if you have an escrow account and your premiums or tax rates change.

-

You have to rely on someone else to pay important bills. Your loan servicer should make the payment on your behalf, but mistakes can happen. You may want to confirm that your bills are paid and you don't get charged any late fees.

-

You might lose out on potential interest income. Some states require banks to pay interest on the money they hold in escrow accounts. But in many places, you won't necessarily earn interest on the money. Either way, you might be able to earn more interest if you keep the money for your insurance and tax payments in a high-yield savings account.

Learn more: How to Pay a Mortgage

How Long Do I Pay Escrow on My Mortgage?

The length of time you need to pay escrow on your mortgage depends on the type of mortgage and your lender's requirements. If your mortgage requires an escrow account, you'll typically pay into the account until your mortgage is paid off. Afterwards, you'll take over making homeowners insurance and tax payments.

However, you might be able to avoid using an escrow account altogether if you put at least 20% down when buying a home. If you put less down, you might be able to request an escrow waiver once you have at least 20% equity and meet the lender's other requirements.

Some types of government-backed mortgages, such as an FHA loan, might require you to use an escrow account until you pay off the loan. Refinancing could be the only way to stop paying escrow.

How to Remove an Escrow Account From Your Mortgage

Contact your loan servicer to find out if and when you might be eligible for an escrow waiver. The eligibility requirements and process can vary, but the lender might consider:

- Whether you have at least 20% equity in the home

- Your FICO® ScoreΘ

- Whether you've missed a loan payment recently

- If your escrow account has a positive balance

- If there are any insurance or tax payments due soon

- If your mortgage is at least six months or a year old

Make a plan to save up and pay your insurance premiums and property taxes if you want to remove your escrow account.

Missing insurance payments could lead to fees and your policy getting canceled. Your lender could also purchase a policy in your name and force you to pay the premium—and the insurance may be more expensive than what you'd find on your own.

Falling behind on property tax payments can also have dire consequences. Tax authorities might be able to place a lien on your home, foreclose on the house and sell it to try to satisfy the debt.

Your loan servicer may also force you to add an escrow account back and increase your mortgage payments.

Frequently Asked Questions

Track Your Credit While Shopping for a Mortgage

Your credit can be an important factor in the interest rate you receive when you buy a home, refinance your mortgage or take out a home equity loan or line of credit. Get your FICO® Score and credit report for free from Experian, and track your score and report to see how they change over time. You can also get insights on what's affecting your score and how to improve your score.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis