What’s Not Included in Your Credit Report?

When you apply for a loan or other credit, lenders want to know how you manage debt. Your credit report is meant to provide a detailed record of your relationship with debt—how much of it you carry and how well you pay it off. It also includes personal identifying information that helps to verify that the information in the report is yours.

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score. For a bit more detail, let's unpack a few types of information that don't appear on your credit report.

Financial Information That's Not Related to Debt

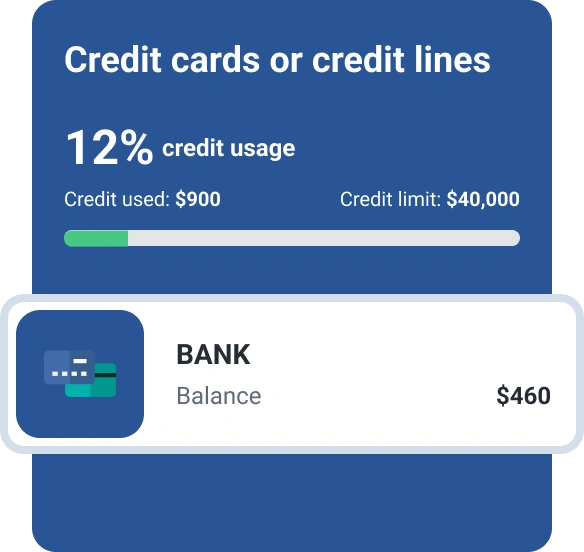

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not. Did you buy a car? Your purchase won't appear on your credit report, but any loan you used to finance it will.

Income and Employment Information

Current and past employers may appear in your credit report as part of your personal identifying information. However, your credit report won't show any information related to your income. Income can play a role in the credit application process: Lenders often ask about your income to help them determine whether you have the financial means to repay a debt. But they generally get this information directly from you (usually in the form of a pay stub or W2 form), not as part of your credit report. Also, since income is not part of your credit report, it is never a factor in calculating your credit scores.

Public Records (Except Bankruptcy)

Previously, credit reports might contain public record information on civil judgments, tax liens, parking tickets and even library fines. But that information is no longer included in your credit file. Today, bankruptcy is the only information from the public record that's included on a credit report from the three national credit reporting companies: Experian, TransUnion and Equifax.

Medical Information

By law, credit bureaus including Experian cannot disclose medical information relating to physical, mental or behavioral health. And while Experian does not collect or display medical information as part of your credit history, you may see the name of a medical provider listed as the original creditor on a collection account (such as "Cancer Center"). Although you can see the name of the original creditor that the collection debt was purchased from, it will display to your lenders and others viewing your credit report simply as "medical payment data."

Expired and Extraneous Information

At some point, even relevant financial information becomes old news. Following are a few examples of when items expire and should automatically drop off your credit report:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection accounts: 7 years

- Late or missed payments: 7 years

- Closed credit accounts in good standing: 10 years

Your credit report also excludes personal information that is irrelevant to your credit. Examples include:

- Marital status

- Disabilities

- Race or ethnicity

- Religious beliefs or affiliations

- Political affiliations

What Is Included in Your Credit Report?

Ultimately, there's much more excluded from your credit report than included. The four basic elements of your credit report are as follows:

- Personal identifying information: This includes your name and aliases (other names you've used), date of birth, Social Security number, current and past home addresses, phone numbers and possibly current and past employers.

- Credit and loan accounts: This includes mortgages, auto loans, personal loans, student loans, credit cards and lines of credit.

- Public records: Chapter 7 bankruptcies within the past 10 years; Chapter 13 bankruptcies within the past seven years.

- Soft & Hard Inquiries: Any companies that have asked to view your credit report.

See for Yourself

Knowing the types of information included in a credit report is important, but the best way to know what's really in your credit report is to review it yourself. Of course, the best way to know what's really in your credit report is to review it yourself. You can get a free copy of your credit report from each of the credit reporting agencies at AnnualCreditReport.com. You can also get a free credit report from Experian anytime. It's a good idea to check your credit report and credit score at least once a year and anytime you're getting ready to apply for a major loan, such as a mortgage or car loan.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle