What Is Return on Investment (ROI)?

Quick Answer

Return on investment (ROI) compares an investment’s benefits to its costs. You can compare the ROI of different investments, such as stocks or a house, to preview potential outcomes.

Return on investment (ROI) is a calculation that compares an investment's benefits to its costs and shows the earnings you may be able to expect in the future.

When you're considering an investment—buying a house, for example, or opening a brokerage account so you can invest in stocks—ROI can help you identify likely gains while understanding potential disadvantages. You can compare the ROI of your particular investment to the historical average and consider whether to move forward. You can also compare the ROI of different investments, such as riskier or safer assets, to preview potential outcomes.

Here's what to know about ROI as an investor.

How to Calculate ROI

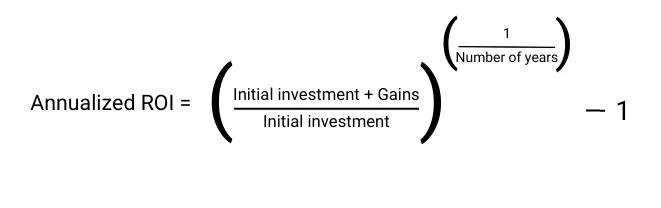

ROI is a prediction of the likely earnings you'll receive upon making an investment, presented as a percentage of how much it costs. It's calculated using net investment gain, or the current value of an investment minus its original cost.

Use this formula to find the ROI of a particular asset or venture:

Here's a simple example. Imagine you'd like to buy Apple stock. One share costs $178.96 as of March 30, 2022, and analysts predict the stock price will hit $193.50 per share in the next 12 months.

If you buy 10 shares of Apple stock today, you'll pay about $1,790. But you stand to earn $1,935 if you sell them one year from now—which is a net investment gain of $145 (subtract $1,790 from $1,935). Using our basic formula, you'd divide $145 by $1,790. Expressed as a percentage, buying Apple stock has an ROI of 8.1% if you buy it now and sell it in one year.

But there are a lot of factors that this simple expression of ROI doesn't consider: how your returns could be affected by taxes, the impact of inflation, the amount of risk involved in the investment and annualized ROI if you hold the stock for longer than a year. More on that below.

Invest Your Money Smarter

Browse top brokerages

Find a brokerage to start investing today. Compare offers with sign up bonuses and low or no fees.

How to Use ROI

ROI matters because it gives investors generalized insight into how rewarding an investment might be down the line. ROI is especially useful when you compare it across investments with the historical average returns of an investment and to the returns you've seen or might see in your overall portfolio.

For example, you might use ROI to consider whether you should buy an investment property. Maybe you'd like to buy a condo and rent it out. Calculate your ROI first by identifying the costs to maintain the property per year and your out-of-pocket expenses to buy the property, and subtracting that total from your likely annual rental earnings. You'll be able to decide whether to buy a condo as an investment, wait it out or choose another opportunity.

What Is a Good ROI?

A good ROI depends on the type of investment you're considering, your risk tolerance and the amount of time you'll allow the investment's earnings to grow. But there are benchmarks you can use to determine where your ROI lies compared to the average.

The S&P 500—a U.S. stock market index that tracks 500 large companies—has seen average annualized returns of about 10% since its inception in the early 1920s. If you're considering investing in stocks, you may decide that an average return higher than 10% per year is a good ROI, and anything less than that is a poor ROI. But this will change depending on the type of asset you're choosing.

If you have a lower risk tolerance, for example, you may choose to invest in assets that have a lower ROI but come with less of a chance that you'll lose money over time. Bonds, for example, had an annualized ROI of 4.8% from 2001 to 2020, according to J.P. Morgan. But bonds, unlike stocks, may come with a fixed interest rate, which means you can count on a predictable return. So you may earn less over time, but you'll avoid exposure to stock market volatility.

Lower-ROI assets are part of a balanced, diversified portfolio no matter your risk tolerance, since they can help your investment strategy ride out wild swings in the market.

How (and Why) to Calculate Annualized ROI

The basic ROI formula doesn't allow you to factor time into the calculation. Annualized ROI, in contrast, lets you figure out an investment's earnings or losses over a one-year period. That's important so that you can accurately compare the performance of your assets and determine the relative strength of their ROI.

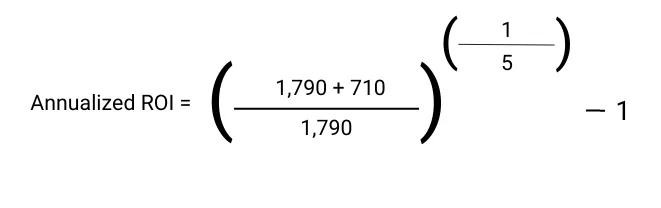

The annualized ROI formula is more complex than the basic formula:

Let's say you ended up investing in Apple stocks, and five years after buying 10 shares, each share was worth $250. You paid $1,790 initially, and you'll sell the shares for $2,500 total. That's a gain of $710. To find the annualized ROI of your investment, you'd use the formula:

The final annualized ROI would be 6.9%. The basic ROI would be about 40%, but that doesn't as easily help you compare the ROI of this investment with, say, bonds or another stock over time.

Considering ROI When Making Financial Decisions

ROI is an essential contributor to your understanding of your investment options. But it's important not to let it dictate every decision you make.

A portfolio with a mix of high-risk and low-risk investments, rather than one that focuses exclusively on high-ROI investments, is likely to withstand market volatility, according to a recent analysis by J.P. Morgan. History shows a diversified portfolio won't fall as low in value as, and will recover faster than, a stocks-only portfolio—making both low-ROI and high-ROI investments worth your time to consider.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna