What Is a Routing Number?

Quick Answer

A routing number is a nine-digit number that helps identify your bank account, so a payment you make with a check or through a financial transaction online can be easily tracked and paid. You can often find your routing number on a check, your bank statement or via your online account.

A routing number is a nine-digit number that identifies a specific financial institution in the U.S. In a transaction, the routing number helps direct funds to the correct bank or credit union. You may be asked to provide this number with certain digital transactions. Here's what to know.

What Is a Routing Number?

A routing number is a nine-digit code that identifies a bank or credit union. It acts as a digital address to ensure money moves to the correct place. The routing number tells the bank specifically which bank and branch should handle the transaction. Then, the account number identifies the specific account in which to withdraw or deposit funds.

You may hear a routing number referred to as an ABA bank routing number, routing transit number or just a transit number. They all refer to the same concept that the American Bankers Association (ABA) devised back in 1910.

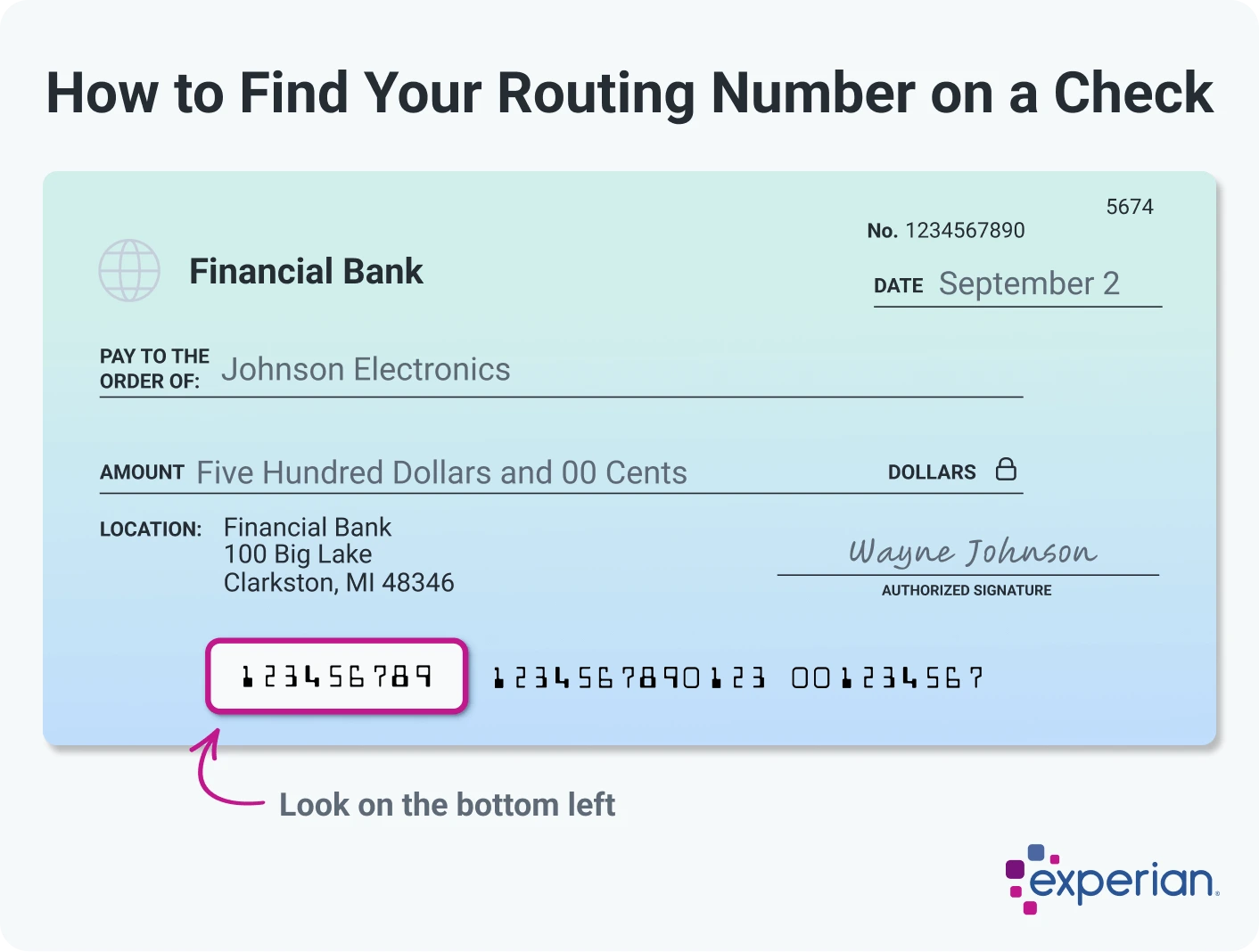

Each routing number is a unique sequence of nine digits. Some financial institutions have multiple routing numbers—which typically map out to each region within its footprint—while other institutions may have one. On a check, the routing number is typically listed in the bottom left-hand corner. This is followed by your account number at the institution and then the check number.

While you should keep your account number private for security reasons, routing numbers are public and don't need to be kept confidential.

Learn more: Routing Number vs. Account Number: What's the Difference?

When Do You Need Your Routing Number?

Routing numbers were originally designed to ensure paper checks were "routed" to the correct location. Today, you may need your routing number for a variety of reasons. Some of those scenarios include:

- Paying bills individually online

- Setting up recurring online bill payments

- Ordering new checks

- Setting up direct deposit for your paychecks

- Opening a brokerage account

- Making a wire transfer

- Setting up an electronic funds transfer

- Connecting your bank account to a peer-to-peer payment app

Where Is the Routing Number on a Check?

When you look at a check, the routing number is typically the first number listed at the bottom left-hand corner. It is the first nine digits in the string of numbers.

Other Ways to Find Your Routing Number

You can find your bank's routing number in a variety of places:

- Your bank's app: Once you log in to your account, the routing number should be listed among your account information.

- Your bank statement: The routing number may also be listed on your paper or digital bank statement, often near the account number and possibly in the upper corner.

- Your bank's website: Banks generally have a routing number for each part of the country they are located in. If your bank has branches in multiple locations, its website likely has a routing number directory where you can find your specific routing number.

- Your bank's customer service: Reach out to your bank via phone call, live chat, secure message or social media to ask for help locating your routing number.

- The ABA's Routing Number Lookup: The ABA's search tool helps you find a bank or credit union's routing number. Just remember that your routing number may be connected to the location you originally opened the account—so you can't always rely on location-based lookup services.

The Bottom Line

Routing numbers are an important part of the banking system, as they help banks and credit unions send money to the right place. While you don't have to memorize yours, you may need to provide it when you set up online recurring payments. Knowing where to locate your bank's routing number makes managing your financial life easier.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

Kim Porter began her career as a writer and an editor focusing on personal finance in 2010 and has since been published everywhere from Yahoo! Finance to U.S. News & World Report, Credit Karma, USA Today, Fortune and more.

Read more from Kim