What Is the Best Age to Get a Credit Card?

Quick Answer

The best age to get a credit card is 18, so you can establish a solid credit history as soon as possible. If you don’t have your own source of regular income, however, you may have to get a cosigner or become an authorized user on a loved one’s credit card account to begin building credit.

If you're trying to decide whether now is the right time to get a credit card of your own, there are several things to think about before you do. You must be old enough (usually 18), meet the issuer's credit requirements, earn enough to pay your bill every month and have the money management skills to use it responsibly. Here's how to know if the time is right to get your first credit card.

Why You Should Get a Credit Card at 18

Getting a credit card when you turn 18 starts the clock ticking on your credit history, which can help you in many areas of your life over time. That's because one of the criteria credit scoring models use is the length of your credit history, which is the amount of time your accounts have been open. In general, the longer your credit history, the better for your credit scores, especially if you pay your bills on time and don't get too close to your credit limit.

Establishing strong credit early on can help you qualify for better rates in the future when you apply for an auto loan, mortgage or other type of credit. Solid credit scores are also important for other things, like getting lower insurance rates and renting an apartment, as landlords may check your credit before approving your application.

The Credit Card Accountability Responsibility and Disclosure Act of 2009 requires credit card applicants under age 21 to prove they earn enough steady income to manage the minimum monthly payment. If you don't earn enough to qualify for a card of your own, you may need to look for other ways to build credit, such as becoming an authorized user on someone else's card. Or, you can wait until you have a reliable income to get a traditional credit card in your name.

Learn more: Credit Card Authorized User: What You Need to Know

Best Credit Cards for Beginners

When you're just starting out and have little or no credit history, it can be difficult for credit card companies to accurately determine your credit risk, so the type of card you can get may be limited. Without a strong credit history, you may not qualify for a top-tier card that offers a boatload of rewards and other perks. However, some cards have less stringent credit requirements and are often easier to qualify for when working to establish a solid credit history.

Student Cards

Student credit cards are designed to help college students build credit. They generally have lower credit limits than other unsecured credit cards to encourage responsible spending, and some even offer rewards.

A key feature of student cards is that they consider income from sources other than traditional employment, such as grants, scholarships, student loans and money from parents when calculating your income for approval.

Secured Cards

Secured credit cards are designed to help people with little, no or poor credit build credit. They work like unsecured cards—with one exception. If you're approved, you must make a security deposit before you can use the card. The deposit is often refundable and usually equal to the card's credit limit.

The deposit acts as collateral, so if you don't make your payments, the issuer can use it to cover your bill. However, you can often get your deposit back if you make a certain number of on-time payments or pay off your balance and close the account. In some cases, if you manage your card well, you may "graduate" to an unsecured credit card from the same company.

Store Cards

If you have a favorite place to shop and won't go overboard with purchases, a store credit card may be a good place to start because their credit requirements tend to be minimal. However, interest rates on store cards are often higher than those on other credit cards, so paying off your balance each month is particularly important. Store cards may offer discounts, free shipping, rewards for store spending and other perks; however, you can't use them everywhere, only at a specific retailer or family of stores.

Store cards often come with deferred interest financing offers on certain purchases. These are 0% annual percentage rate (APR) introductory offers that promise no interest charges for a certain amount of time. However, if you don't pay off your balance before the promotional period expires (typically a number of months, such as 18), the card issuer will tack on interest charges retroactively, going all the way back to the date you made a purchase.

How to Apply for a Credit Card

You can apply for a credit card in a few simple steps.

- Check your credit. If you have other credit accounts like an auto loan or student loan, it's a good idea to check your credit reports before applying for a credit card to ensure all information is accurate. You can also check your credit score and report for free anytime at Experian to get an idea of what cards you may qualify for before applying.

- Do your homework. Compare different types of cards and different card issuers, using credit criteria, interest rates, fees and perks to decide which one is right for you.

- Complete an application. To apply for a credit card, you need to provide information about yourself, such as your address, Social Security number, employment information, income and more.

- Get an application decision. After reviewing your application, the card issuer will approve or deny it. If your application is approved, you can begin using your card as soon as you get it and sometimes before you receive it.

Learn more: How Long Does It Take to Get a Credit Card?

How to Use a Credit Card Responsibly

Having a credit card in your name can either help or hurt your credit, depending on how you use it. Here are some tips for using your card responsibly to establish a positive credit history.

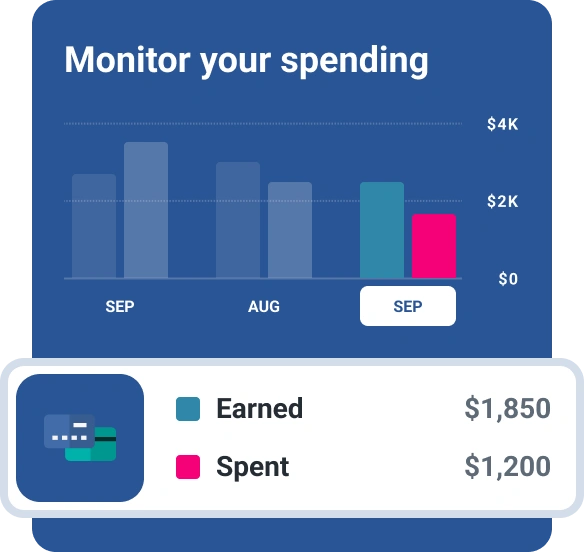

- Make payments on time. Your payment history is the most important factor in determining your credit scores. Making your payments on time can help your scores, and paying late or missing payments can hurt them. Consider setting up autopay so you never miss a payment.

- Don't get too close to your credit limit. Another factor credit scoring models include is your credit utilization ratio, or the amount of credit you use compared to your credit limit. In general, lower ratios may positively affect your credit, and higher ratios may negatively affect your credit. Aim to keep your credit utilization ratio below 10% for optimal scores.

- Pay your balance in full. Charging only what you can afford to pay off when you get your bill will help you avoid interest charges. Not carrying a balance from month to month will help keep your utilization ratio low.

- Set up alerts. Most credit card issuers allow you to set up alerts that help you avoid late payments, track spending and warn you about potential fraud.

Frequently Asked Questions

Are You Ready for a Credit Card?

There's a big difference between being eligible for a credit card and being ready for one. Getting a credit card as soon as you can may start the clock ticking on your credit history, but it may also backfire if you don't have the education, habits and maturity to use it responsibly. Using a credit card for a small, regular payment (such as a streaming service account) and paying the balance off every month could help you start building credit while keeping risk low.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer