Which Store Cards Are Easiest to Get With Bad Credit?

If you have bad credit, getting a store or retail credit card might be easier than a traditional card. Although store cards could come with low credit limits and may only be usable at a specific retailer, you can use them to build your credit and potentially become eligible for general-use credit cards in the future.

Which Store Card Should I Get?

Deciding which store card to get depends on more than your credit. You should also consider the different benefits and fees associated with various cards on the market. Also, make sure you understand the difference between closed-loop cards that can only be used with the associated store, or an open-loop card you can use elsewhere.

If you have poor credit, it may be easier to get a closed-loop store card. Those with better credit may qualify for an open-loop card, which can be used with any merchant that accepts cards within that network (American Express, Mastercard or Visa, for example). Open-loop cards may provide a higher rewards rate or other perks for purchases made with specific merchants, but you're still able to use the card with a wide variety of merchants.

With that in mind, consider where you frequently shop, the available cards and the card's benefits or fees. Fortunately, some of the largest retailers offer the best store cards, and store cards rarely have annual fees.

In some cases, you can apply for the open-loop card and, if you don't qualify, you may be automatically considered for a similar closed-loop card.

How a Store Credit Card Can Impact Your Credit

Just like a traditional credit card, a store card can have positive or negative impacts on your credit, depending on how you use it.

Initially, applying for a card can lead to a hard inquiry. Once you're approved and the account is added to your credit reports, it can also lower your average age of your accounts. Both of these factors can hurt your credit a little, if they have any impact at all. Any impact of these changes will decrease over time, especially as you use the new credit card to build your credit.

If you make at least your minimum payments on time, those on-time payments get added to your credit history and can improve your scores. Your payment history is the most important factor in some of the most widely used credit scoring systems. Missing just one credit card payment can ding your credit scores for a long time.

While you only need to make minimum payments to have your payment count as on-time, it's often wise to pay off as much of your credit card balance each month. Otherwise, you may have to pay interest on what's left over. Store cards often have high interest rates.

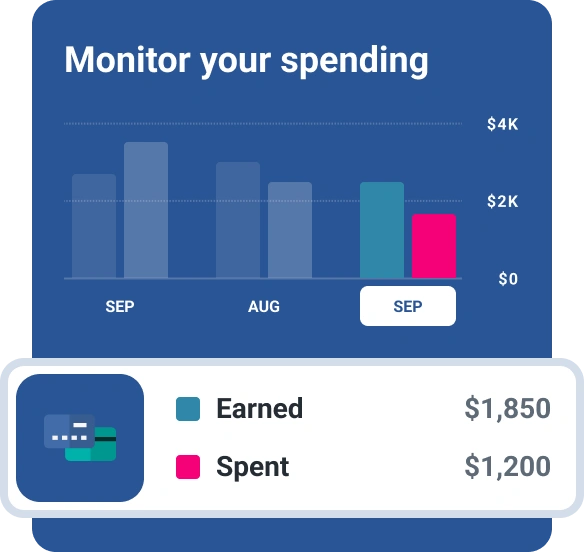

Also, keep an eye on the portion of your card's credit limit that you're using. Carrying a high balance can lead to a high credit utilization ratio. This ratio measures how much of your credit limits you're using, and can contribute to credit score harm if it climbs too high.

If you wind up using a large portion (such as over 30%) of your credit limit, paying down your balance before your bill comes due can help you maintain your scores. Credit card issuers often report balances to the credit bureaus around the end of a billing cycle, and paying down your balance early can lead to the lower balance being reported and a lower resulting utilization ratio.

How to Use Your Store Card Responsibly

Having a store card can make it tempting to spend even more at your favorite stores, but responsible use can help you save money and be good for your credit. Once you have a store card, here are a few things you should try to incorporate into your financial routine:

- Keep track of the fees. Store cards may charge a variety of fees, including annual, cash advance and foreign transaction fees. Know which fees your card charges and learn how to avoid them, when possible.

- Track your credit utilization. Maintaining a low utilization ratio on store cards can be especially difficult when the card has a low credit limit. Make a point of limiting how often you use the card or paying down the balance early to keep your utilization ratio low.

- Pay your balance in full. To avoid interest, it's best to only charge what you can afford to pay off in full by the bill's due date. If you think you may occasionally carry a balance, make sure you understand how much interest you'll pay.

- Continue comparison shopping. While store cards may offer rewards on purchases at the associated store, don't assume that means you're always getting a good deal. Buying a product for $100 and earning 5% cash back is still worse than getting the same item for $90 elsewhere.

Take Additional Steps to Improve Your Credit

Because store cards can be easier to qualify for than general-use credit cards, getting a store card (and using it responsibly) can be a good way to build credit. However, if you're having trouble getting approved for a store card or looking for additional ways to build credit, also look into:

- Secured credit cards: Secured credit cards help you build credit the same way store and non-store cards do, but can be even easier to qualify for. Like store cards, some secured cards don't have an annual fee but do offer rewards. The catch is that you have to send the card issuer a refundable security deposit, which usually determines your card's credit limit.

- Credit-builder loans: Having a mix of revolving accounts (such as credit cards) and installment loans can also be good for your credit. As the name suggests, a credit-builder loan is an installment loan that's specifically designed to help borrowers improve their credit. Often, the loan proceeds are kept in a locked account that's unlocked when you finish paying off the loan. As a result, borrowers may improve their credit and build their savings at the same time. Make sure your lender reports your payment activity to all three credit bureaus.

If you already have other credit cards or loans, managing them well will also be important to improving your credit. In addition to paying your bills on time and working to pay down credit card balances, this may mean bringing past-due accounts current or working with a credit counselor to get on a debt management plan.

Check Your Credit Before Applying

While your credit isn't the only factor that credit card issuers consider, your credit score can impact your ability to qualify for a new card as well as the interest rate and credit limit you receive. If you don't know where you currently stand, you can check your credit score for free on Experian. You can also use the free Experian Boost®ø service to add your cellphone, Netflix® and utility payments to your credit report. These types of bills aren't usually included on your report, but Experian Boost opens up the potential that your history paying for these services can positively impact your score.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis