What Is Voluntary Repossession?

Quick Answer

Voluntary repossession is when you surrender your car back to the lender or leasing company because you can no longer afford your payments. It’s an alternative to your car being repossessed without warning, but it will still affect your credit.

Voluntary repossession is when a borrower returns their car to the lender before their auto loan is paid off. This may be a last resort if you can no longer keep up with your monthly payments. Making this decision will have a negative impact on your credit, but it's often viewed more favorably than an involuntary repossession.

Whether voluntary repossession is a good idea will depend on your financial situation and the options available to you. In some cases, it might be your "best worst option." Here's how it works so you can decide if it's the right choice.

What Is a Voluntary Repossession?

You might consider voluntary repossession if you're tied to an auto loan you can't afford. In a perfect world, you'll make your car payments every month as promised—but things don't always go according to plan. If you fall behind on your payments, your lender can seize your vehicle and sell it to satisfy your loan balance. That's because the car serves as the collateral that secures the loan.

You can surrender the vehicle voluntarily, or your lender could repossess the car without warning. With a voluntary surrender, you'll contact the lender and make arrangements to return your vehicle. Any type of loan default will negatively affect your credit, but a forced repossession typically has a more severe impact than a voluntary surrender.

Learn more: How to Get Out of an Auto Loan You Can't Afford

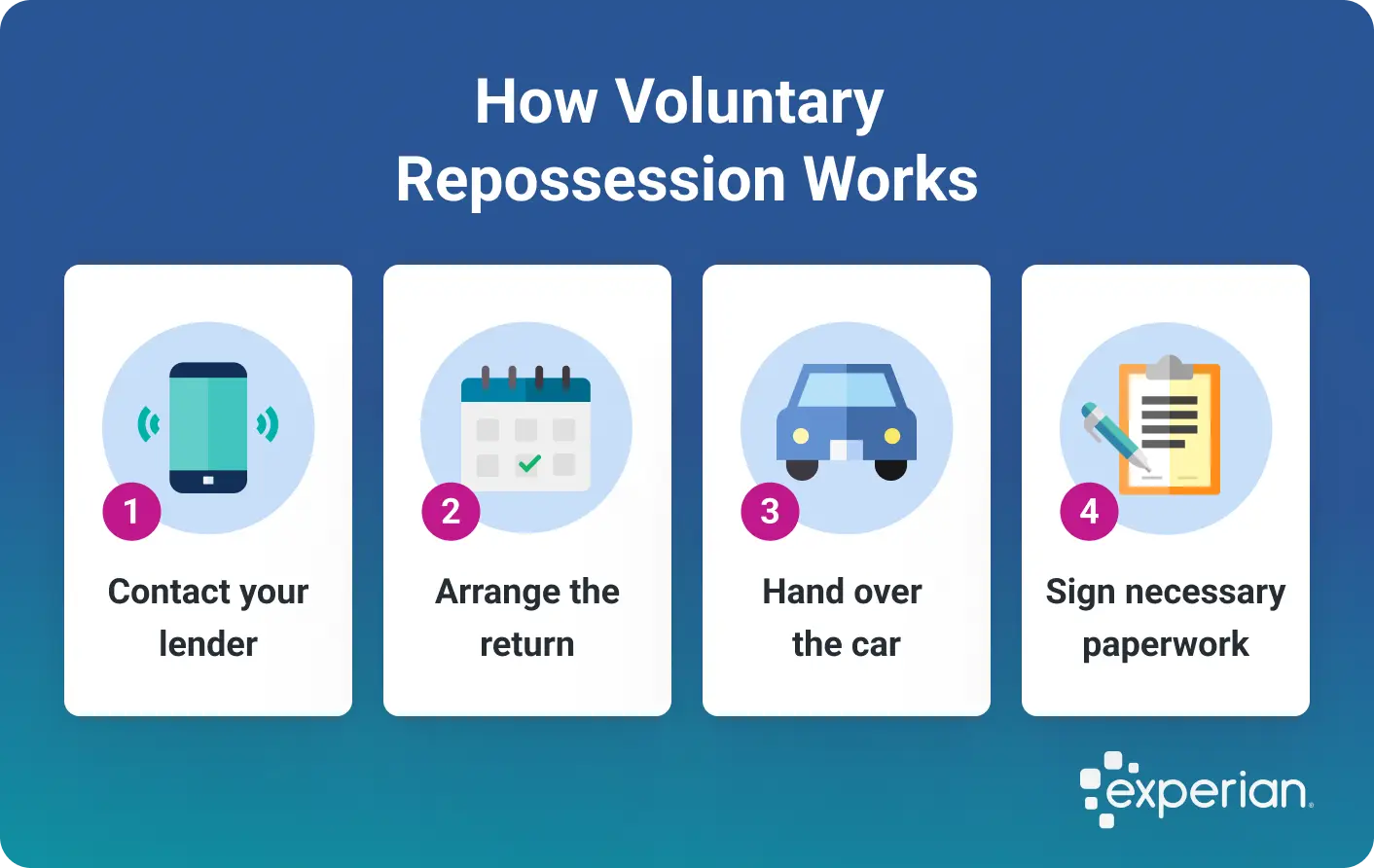

How Does Voluntary Repossession Work?

An involuntary repossession is initiated by the lender and can happen at any time. That means you could wake up one morning to find that your car was repossessed in the middle of the night—or it could happen during the day, leaving you and your loved ones stuck without a ride.

A voluntary repossession, on the other hand, is initiated by the borrower. If you're out of options, here are the steps to return your vehicle before your lender forces your hand.

1. Contact Your Lender

You'll want to reach out to your lender as soon as possible to arrange the return. Laws around repossession vary by state, and auto lenders and leasing companies have their own repossession protocols. If you're behind on your car payments, your auto loan may have been sold to a third-party collection agency. In this case, you'll need to contact them to clarify your next steps.

2. Arrange the Return

Next, you'll confirm the date, time and location to return your car. Ideally, you'll be able to drop off the car and avoid towing charges. The lender might decide to keep your car or sell it via public auction. Depending on your state, they may be required to provide the auction details in case you want to bid on it.

3. Hand Over the Car

After ironing out the details, you'll want to clean out your car and remove any personal belongings before surrendering it. Be sure to bring your keys, including any spare sets, to the return.

4. Sign the Necessary Paperwork

You'll sign a surrender agreement, which documents that you've returned your vehicle to the lender as promised. It should also state the reason for the return and may include your outstanding loan balance. It's wise to keep a copy for your records.

Pros and Cons of Voluntary Repossession

A voluntary repossession might be your best option if you can no longer afford your car loan or lease and don't see any other way forward. But there are serious drawbacks to consider, and a voluntary repossession will have a negative effect on your credit score. (We'll unpack this in more detail shortly.)

Pros

-

It will likely be cheaper than a forced repossession. If your lender seizes your car, you could be hit with extra repossession fees, like towing charges and storage costs.

-

It can be less stressful. A voluntary surrender can give you more control over how and when you return your vehicle. By working with your lender, you can select a time and place that feels good for you—and avoid the stress and embarrassment of a surprise repossession.

Cons

-

You might still owe money on the car. The lender will likely sell your car in the hopes of satisfying your loan balance, but you may be left with a deficiency balance. For example, if your auto loan is $12,000 and they sell the car for $10,000, you'll be responsible for covering that $2,000 gap. If you don't, the lender might be able to take you to court.

-

Your car insurance rate may go up. After a repossession, there's a chance that car insurance companies will consider you more risky to insure. That could translate to higher insurance premiums.

Does Voluntary Repossession Impact Your Credit?

A repossession, even if it's voluntary, will affect your credit. It will be noted on your credit report, along with any remaining balance and missed payments, and stay there for seven years from the date you stopped paying your loan. Its effect on your credit will lessen over time, and the account will be deleted (and no longer affect your credit) after seven years.

Having a voluntary repossession on your credit report could impact your ability to get approved for financing in the future. If you do get approved, you might get stuck with higher interest rates and less favorable terms.

However, the credit impact of a voluntary surrender may be less severe than a forced repossession because it shows that you cooperated with your lender and initiated the return yourself. Having a forced repossession on your credit report could deter lenders from working with you at all.

Alternatives to Voluntary Repossession

Voluntary repossession should be a last resort when you're struggling to pay your car loan. The good news is you might be able to avoid it with one of these alternatives:

- Negotiate with your lender. Have an honest conversation with your lender and see what your options are. If you're experiencing financial hardship, they might allow you to temporarily put your payments on hold while you get on your feet. Some lenders may have an auto loan hardship program that could reduce your monthly payment. You won't know unless you ask.

- Refinance your loan. This involves taking out a new auto loan and using that to pay off your existing balance. If you have a good credit score, refinancing may lead to a lower interest rate and more reasonable monthly payment. You might also opt for a longer repayment term, which can also bring down your payment. However, you will pay more interest over the life of the loan. You can find current auto loan rates on Experian's website.

- Sell the car yourself. If your only other option is voluntary repossession, you may consider selling your vehicle. The money you make on the sale might be enough to pay off your loan balance. From there, you can buy a more affordable car, or temporarily go without a vehicle. It isn't ideal, but you'll avoid the hit to your credit score. Another option is trading your car in for a cheaper model.

- File for bankruptcy. This last-resort option can have major financial repercussions, but it might be worth exploring if you're buried in debt and can't afford to cover your obligations. Whether you can keep your car during bankruptcy depends on the value of your car, the type of bankruptcy you're filing, and whether you're up to date on your payments. Your state's exemption rules will also come into play.

Learn more: How to Defer a Car Payment

How to Rebuild Your Credit After Voluntary Repossession

If you decide that voluntary repossession is your best option, you'll want to take steps to improve your credit as soon as possible. That includes the following:

- Review your credit reports and get clear on all your debts. You can check your credit report and FICO® ScoreΘ for free with Experian.

- Make good on any past-due accounts, including accounts that are in collections.

- Create a plan for paying down your debt. You might opt for the debt snowball or debt avalanche method.

- Open a new credit account—and use it responsibly. If you must carry a balance, keep it below 30% of your credit limit to avoid damage to your credit scores.

- Consider getting a secured credit card or credit-builder loan. Both use deposits as collateral to reduce risk and make it easier to get approved.

- Become an authorized user on someone else's credit card. If the primary user manages their account responsibly, your credit scores could benefit.

- Get credit for paying regular bills, including eligible rent, phone, utilities and streaming services, using Experian Boost®ø. With Experian Boost, your positive payment history can be included on your Experian credit report, which could provide an instant boost to your FICO® Score powered by Experian data.

The Bottom Line

Nobody wants to go through a voluntary repossession, but it may be the best path forward if you're unable to make your car payments. It's usually a better option than having your car repossessed without warning. If you go this route, know that it will negatively affect your credit health—but it's always possible to rebuild. You might also find an alternative option that allows you to avoid repossession altogether.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne