Why Did My Credit Score Change When I Didn’t Do Anything?

There are any number of reasons your credit score can change even if you don't take any specific action, including routine updates to the credit reports that are used to calculate your scores, progress paying down loans and even just the passage of time.

What Affects Your Credit Scores?

The primary factors that influence your FICO® ScoreΘ are:

- Payment history: Making debt payments on time every month according to your loan agreements does more than any other single factor to promote strong credit scores. By the same token, payments made more than 30 days late can seriously harm your scores. Payment history is responsible for about 35% of your FICO® Score.

- The amount you owe: Your total debt, and the extent to which you are using available credit card borrowing limits (known as credit utilization), determines about 30% of your FICO® Score. As the outstanding balances on your credit cards approach and exceed 30% of their borrowing limits, your credit scores could suffer. Scoring companies like FICO have found that when a person's utilization rate exceeds 30% of their credit limit, the likelihood they will default on their payments increases substantially. As a result, scores drop faster when you cross that threshold.

- The length of your credit history: All other factors being equal, your credit scores can improve over time simply due to the fact that you're becoming more experienced managing and repaying debt as time passes. The age of your accounts and the length of time you've been using credit is responsible for about 15% of your FICO® Score.

- Credit mix: Lenders have learned that those who are able to successfully manage multiple types of debt at once are more reliable borrowers. For that reason, credit scores can improve if you have a blend of installment loans such as mortgages and auto loans and at least one revolving credit account, such as a credit card. Credit mix accounts for about 10% of your FICO® Score.

- New credit: When you apply for a loan or credit card, the lender usually performs a credit check by requesting a copy of your credit report and, often, a credit score based on that report. Each request is known as a hard inquiry, and can cause your credit score to drop a few points. This drop is typically minor and short-lived, but if you apply for many different credit products over a short time, that can do cumulative damage to your credit scores. The appearance of the new account can also have a negative effect on your scores temporarily. Scores tend to rebound quickly as soon as it becomes clear that you are keeping up with bill payments and managing your new account well. This factor makes up 10% of your FICO® Score.

How Often Do Credit Scores Update?

Each credit score is calculated using the information compiled in your credit report at one of the three national credit bureaus (Experian, TransUnion or Equifax). Creditors, including credit card issuers and lenders such as banks and credit unions, typically supply the bureaus with monthly updates on your credit usage and payments, but each creditor follows its own schedule for doing so. One creditor might send updates out to the bureaus in the first week of every month, while another might do so on the 15th of each month, for instance.

A credit score is calculated at the moment it's requested, whether that's by you, a lender or another organization that has the legal right to request them. If information has been added to your credit report since the last time your credit score was calculated, it's possible that your credit score will differ from the last time it was checked.

Frequent updates mean your credit reports are continuously changing. Differences in timing for when creditors report an account to each bureau also mean the credit report at one bureau may not be identical to the report at another bureau, even though each reflects your credit usage at the time the last update was received. This is one of the reasons why your credit score can vary based on the credit report that's used to calculate it as well as the credit scoring model being used..

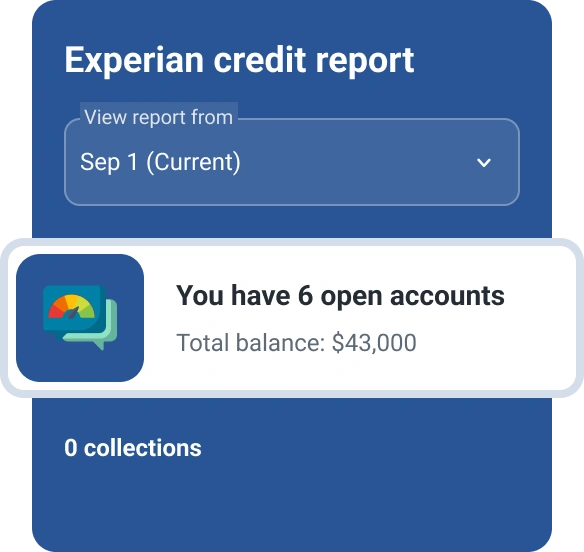

You can check your credit report from all three bureaus for free through AnnualCreditReport.com. When you use the Experian mobile app or website to check your credit reports, the "What's changed" feature makes it easy to spot updated information that can affect your credit scores.

Reasons Why Your Credit Score Changed

Understanding factors that affect credit scores, and the continual way those factors can change can help you see how your credit scores can vary even if you aren't using your credit any differently. Here are some cases when your scores can change without direct action on your part:

- Reduced overall debt: Paying down installment loans such as mortgages or auto loans may feel like "doing nothing" because it's part of your monthly routine, but each payment reduces the amount you owe. As long as you make your payments on time, your credit scores will tend to increase, even if you do nothing else.

- Reduced borrowing limit: If you go a long time without using a credit card, the lender could close the account or lower its borrowing limit. This in turn reduces your total available credit and can increase your overall credit utilization—all your outstanding credit card balances expressed as a percentage of your total borrowing limit. This could have a negative effect on your credit scores, especially if your overall utilization exceeds about 30%.

- Paid-off installment account: It may seem paradoxical, but when you finish paying off an installment loan such as a student loan, auto loan or mortgage, your credit scores can decrease a small amount. That's because when a loan is paid off and closed, the variety of accounts in your credit portfolio is diminished, and your score reflects a reduction in the credit mix factor. Additionally, the account's on-time payment history isn't factored as heavily in your scores once the account is closed. However, scores any decrease tends to be short lived and scores rebound relatively quickly if you continue to manage other open accounts well.

- A negative event expires: If a negative event such as a bankruptcy or a home foreclosure appears on your credit report, it will remain there for a fixed amount of time—10 years for Chapter 7 bankruptcy and typically seven years for other bankruptcy proceedings, foreclosures and collection accounts. These entries tend to lower your credit scores as long as they appear on your credit reports. Their influence diminishes over time, and your scores can tick upward once they're finally removed from your credit report.

- The passage of time: Once you've established credit reports by taking out your first loan or credit card, the passage of time will tend to help your credit scores improve. As long as you keep your accounts active, make your payments on time and keep your balances low, your score can change for the better. Inactive accounts may be excluded from credit score calculations even though they appear on your credit report. It's a good idea to make a small purchase from time to time and then pay it in full so that your credit history shows activity in the account.

- Suspicious activity: While minor changes in credit scores are par for the course for all credit users (even during interludes when they aren't actively using their credit), unexpected large shifts in credit score can be an indicator of credit account fraud or identity theft. If there's a major credit score change you don't understand, review your credit reports carefully. If you see signs of unauthorized accounts or credit applications you don't recognize, take action to address potential identity theft.

Monitor Your Credit

Credit scores can change as a consequence of major actions such as a loan application or simply as a result of your routine use of credit. Understanding how and why your scores can change, and how to track your credit scores and credit reports, can help you roll with the everyday fluctuations that are normal with all credit scores. You may also want to learn how to increase your credit score in the event it decreases in score.

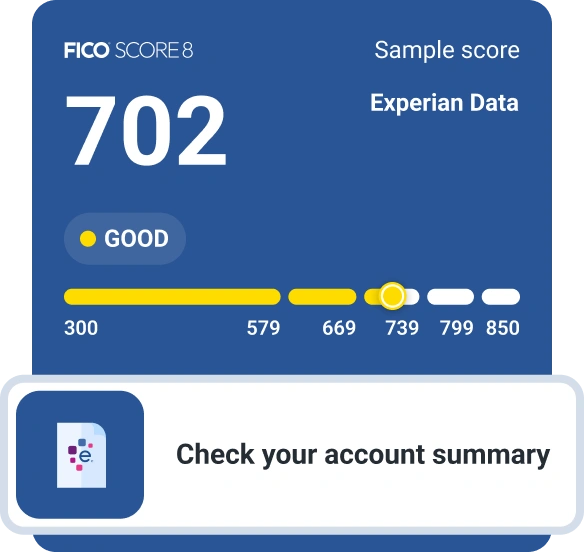

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim