Why Is Credit Important?

Having access to credit allows you the flexibility to get something now and pay for it later. Credit can help you do things like buy a house or a car, or finance your education, but it's also a major responsibility that's important to understand before you start to take on debt.

Here's what you need to know about why credit matters and steps you can take now to manage credit responsibly.

What Is Credit?

Credit is the power to borrow money for the things you need now, with a promise that you'll pay back the money later. The two major types of credit are revolving credit and installment credit.

- Revolving credit: Revolving credit is a type of account that can be used to borrow and reborrow indefinitely as long as you continue paying down your balance and remaining within your credit limit. The most common example of revolving credit is a credit card. Another example is a home equity line of credit (HELOC).

- Installment credit: In contrast to revolving credit, an installment loan is a fixed sum of money that you borrow upfront and then pay back (plus interest) in fixed, equal payments over a set number of months. Common installment loans include personal loans, debt consolidation loans, student loans, auto loans and home equity loans.

Before approving you for a loan, lenders want to make sure you have a good track record of paying back your debts. To do this, they'll take a look at your credit report and credit score, which is a three-digit number that helps them determine your creditworthiness. By building a solid credit history, you can help to ensure you qualify for credit when you need it.

Here are the most significant factors that affect your credit score:

- Payment history: How often you make payments on time, late or not at all impacts your credit score and gives lenders insight into how likely you are to repay your debts as agreed.

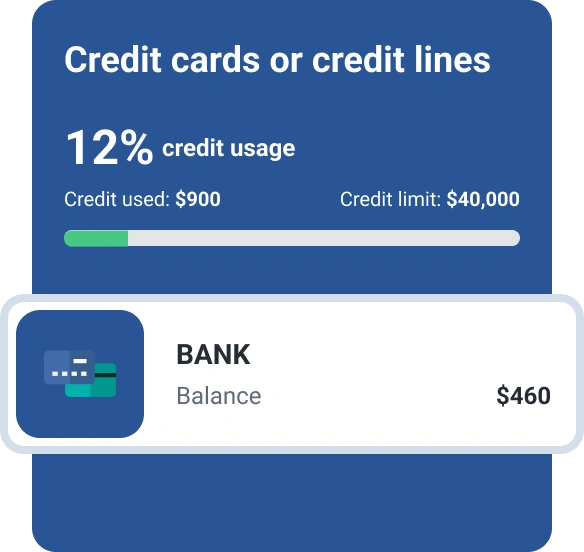

- Credit utilization: Your credit utilization is the amount of revolving debt (credit card debt, for instance) that you carry divided by your total revolving credit limit. For example, if you have just one credit card with a $3,000 credit limit and a balance of $300, your credit utilization is 10%. As far as your credit score is concerned, experts often recommend keeping your utilization below 30%, but the lower, the better.

- Length of credit history: The length of your credit history is a measure of how long you've been using credit products. Generally speaking, a lengthier credit history can help you achieve a higher credit score.

- Credit mix: Using a diverse mix of credit products, such as credit cards, a mortgage, student loans or auto loans, indicates to lenders that you have experience managing a wide variety of credit products.

- New credit: The credit check associated with an application for new debt can result in a hard inquiry on your credit report, which can cause a slight, temporary dip in your score. The appearance of new debt can also affect your score.

Scenarios Where Your Credit Health Is Important

A solid credit history and a good credit score are important because they help determine whether you'll qualify to borrow money for things you may need, like a home or a car. Not only that, your credit health may come into play anytime you apply for housing, set up a new utility or phone service, or even, in some cases, apply for a job.

Here are seven places where credit counts:

- Applying for a credit card: Your credit impacts which credit cards are within your reach. A higher credit score may grant you access to credit cards with competitive terms, such as introductory bonuses, rewards benefits, low interest rates and other perks. Conversely, a lower credit score may disqualify you for many credit cards or limit you to a secured credit card that requires a security deposit or a credit card with a high interest rate and low credit limit.

- Renting an apartment: Your credit score can help or hurt your ability to rent from landlords who require your credit score to be above a certain threshold.

- Buying a house: Mortgage lenders typically require that you have good credit to qualify for a mortgage to buy a home. Lower credit could mean paying higher interest, a higher down payment or not qualifying for a mortgage at all.

- Buying a car: Your credit score can affect your ability to qualify for an auto loan. Since most people don't have the spare cash to pay for a vehicle all at once, many rely on their credit score to qualify for an auto loan with affordable interest.

- Setting up insurance and utilities: Some utility, home and auto insurance companies run a credit check when you apply to determine the likelihood that you'll pay your monthly bill. A service provider may require you to pay a deposit before they'll set up utilities, phone service, cable or insurance if they notice red flags in your credit.

- Applying for a job: Some employers run credit report checks as part of their applicant screening process. Some states don't allow employers to run a credit check, however, and an employer can never run your credit without your written permission in any state.

- Starting a business: If you're considering starting a business and taking out a loan to fund your project, you'll need good credit to qualify for a small business loan.

How to Manage Credit Responsibly

Responsibly managing a mix of credit is integral to achieving a high score. On the other hand, missed payments, default and major setbacks such as foreclosure or bankruptcy can indicate to lenders that you're a risky borrower and make it harder for you to qualify for credit in the future.

Here are four critical tips for managing credit responsibly:

- Make on-time payments. Paying at least the minimum payment on a credit card or installment loan is essential for building and maintaining credit. Late payments can stay on your credit report for seven years and affect your score the entire time they appear. To ensure you never miss a payment, consider setting up autopay or creating reminders for yourself.

- Don't spend more than you can afford to repay. Using credit cards to live beyond your means can lead to a high balance you can't afford to pay off. If you carry a balance over time, the interest you accrue can make it even harder to pay down your debt. If you're overwhelmed by credit card debt, you can get free help from a certified credit counselor.

- Use credit cards to build credit. One smart way to avoid incurring debt while building credit with a credit card is to exclusively use your credit card for regular, small expenses, such as utility and phone bills. Pay off your balance every month on time to avoid paying interest and carrying a balance.

- Keep old accounts open. The average age of your credit accounts has an impact on your score, so it's often in your best interest to leave your oldest accounts open. Doing so can also keep your credit utilization low, as you'll have a higher amount of available credit, and help you to avoid having a thin credit file. You shouldn't unnecessarily keep an account open if it has a high annual fee that's impacting your finances, though.

How Credit Scores Affect Your Ability to Get Credit

It's essential to monitor and improve your credit score to ensure you'll be able to access credit with favorable terms when you need it.

A high credit score indicates to lenders that you have a history of borrowing and repaying credit reliably and can help you qualify for credit with lower interest rates and better terms.

A low credit score can make it challenging to qualify for credit, and the credit products you do qualify for may come with a higher interest rate and other fees.

To see how your score impacts your ability to qualify for credit and areas where you might be able to improve your score, check your credit score for free through Experian.

Work On Your Credit

Understanding and maintaining your credit is a key component of living comfortably. Keeping an eye on your credit score and taking steps to improve your score wherever you can are good habits that help ensure you can borrow money when you need to make a large purchase.

If you haven't already, you may be able to raise your FICO® ScoreΘ instantly using Experian Boost®ø. Experian Boost connects to your bank account to add certain bills you already pay, like utilities and streaming subscriptions, to your credit report. It's completely free, and can increase your score instantly.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Evelyn Waugh is a personal finance writer covering credit, budgeting, saving and debt at Experian. She has reported on finance, real estate and consumer trends for a range of online and print publications.

Read more from Evelyn