Why Is There an Inquiry From the IRS on My Credit Report?

Quick Answer

There are several situations when the IRS might request your credit report, which can lead to a new credit inquiry. But these soft inquiries don’t affect your credit scores. Similarly, owing taxes or using an IRS payment plan doesn’t affect your credit.

You might see an inquiry from the IRS on your credit report if the IRS asked you to verify your identity, you owe back taxes or you're working for the IRS. However, the inquiries will be soft inquiries, which don't affect your credit scores.

Why Is There an IRS Inquiry on My Credit Report?

A credit inquiry is a record of when a credit bureau sends your report to someone. The IRS may request a copy of your credit report or use information from your report for several reasons:

- To verify your identity: The IRS might ask you to verify your identity online. Some identity verification tools work by comparing the information that you submit with the personal information in your credit report.

- To find your contact information: If you owe back taxes, one of the private collection agencies that the IRS hires might pull your credit to try to find your current address or phone number.

- To identify what assets you have: If you owe back taxes, the IRS also might use your credit report to figure out what assets you have, such as vehicles or property. It may be able to seize the property to satisfy part or all of the debt.

- You applied to work or currently work at the IRS: The IRS might pull your credit as part of a background check when you apply to work as an employee or contractor, or if you're a current employee and up for a promotion or reassignment.

All of these requests could result in a soft inquiry, the type of inquiry that doesn't affect your credit scores.

Learn more: Hard Inquiry vs. Soft Inquiry: What's the Difference?

Does the IRS Report to the Credit Bureaus?

The IRS doesn't report to the credit bureaus, and your income and tax-related information won't be included in your credit reports. As a result, your tax payments—or lack of payments—also won't affect your credit scores.

Tax liens—claims on your property to cover past-due tax debt—used to be included in credit reports and affect credit scores. But the credit bureaus removed tax liens from consumer credit reports in 2018.

A tax lien can still affect you if you try to sell the property that the IRS has a lien on or refinance a loan secured by the property. Additionally, creditors can find out about tax liens from other sources, and they may consider the lien when deciding whether to lend you money and the terms on your account.

Learn more: Do Taxes Affect My Credit Score?

Does an IRS Audit Affect My Credit Score?

An IRS audit won't affect your credit report or credit scores. An audit isn't even necessarily a sign that you owe more taxes or did something wrong.

The most common type of audit is a correspondence audit, when the IRS sends you a letter asking for more information. You might receive one of these if you enter a number incorrectly or forget to include information from one of the tax forms you received.

Don't ignore an audit. If you wind up owing money, failing to pay your taxes could result in penalties and interest. The IRS could also send your debt to a collection agency. The agency can contact you to try to collect payment, but unlike collection agencies for creditors, it can't report the collection account to the credit bureaus.

In addition to a tax lien, the IRS can get a levy and take money out of your bank accounts or income. They can also seize and sell your property and then use the proceeds to cover your debt.

Learn more: Can Not Paying My Taxes Hurt My Credit?

What to Do if You Owe the IRS Money

You may have several options if you owe the IRS money. You could look into getting a loan or using a credit card to cover the payment. However, that will likely lead to paying additional interest and can affect your credit.

You could also look into one of the IRS' payment plans:

- Short-term payment plan: You might qualify for a short-term plan if you owe less than $100,000 in taxes, penalties and interest. There aren't any setup fees, and you'll have up to 180 days to pay off what you owe.

- Long-term payment plan: You might qualify for a long-term plan, also called an installment agreement, if you've filed all your tax returns and owe less than $50,000 in taxes, penalties and interest. There may be a $22 to $178 setup fee, but fee waivers are available for low-income taxpayers, and you can pay off the balance with monthly payments.

Unlike trying to get a credit card or loan, applying for a payment plan with the IRS doesn't require a credit check. However, with both plans, penalties and interest continue accruing until you've paid off the balance.

You can also try to reduce what you owe by applying for a penalty relief, although this won't waive the back taxes and interest you owe. Additionally, use the IRS' offer in compromise prequalifier to see if you might qualify for an offer to settle your debt for less than you currently owe.

Learn more: What Happens if You Don't Pay Your Taxes on Time?

Do IRS Payment Plans Affect Your Credit?

An IRS payment plan won't directly affect your credit, although you may have less money for your other bills. If you miss a loan or credit card payment as a result, that could be reported to the credit bureaus and stay on your credit report for up to seven years.

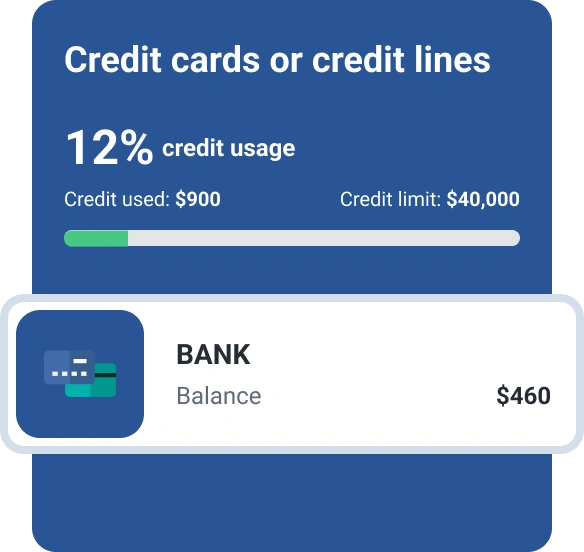

Companies also commonly consider your debt-to-income (DTI) ratio, which compares your monthly income and debt payments, when you apply for a new loan or credit card. If you're on a long-term payment plan, creditors may include your monthly payments in these calculations. So, the payment plan could affect your creditworthiness even if it doesn't affect your credit scores.

Learn more: How to Set Up an IRS Payment Plan

Regularly Review Your Credit

Even if you don't necessarily need to be worried about a soft inquiry from the IRS, keeping an eye on your credit reports can be important. An unexpected hard inquiry could indicate someone is applying for a credit card or loan in your name—a sign of identity theft and fraud. You can get your credit report and FICO® ScoreΘ for free from Experian, and Experian can alert you when there are new inquiries on your report.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis