Will Paying Off a Loan Improve Credit?

Quick Answer

Paying off a loan early can positively or negatively impact your credit score, depending on the specifics of your credit profile. But paying a loan off early may have other benefits, such as saving on interest and lowering your debt-to-income ratio.

Paying off a loan can positively or negatively impact your credit scores in the short term, depending on your mix of account types, account balances and other factors. In some cases, paying off a loan will actually lead to a credit score drop, despite the positive effect of debt repayment on the rest of your financial life.

The loan's positive and negative payment history—whether or not you paid bills on time while the account was open—will also continue to affect your credit for years after it's paid off. If you paid all your loan bills on time, those payments will factor positively in your scores for 10 years, while negative marks stay on your credit report for seven years.

Here's what you need to know about a loan's impact on your credit history and credit score, while you're paying it off and after it's paid in full.

What Affects My Credit Score?

To understand how paying off a loan can impact your credit, consider the factors that go into calculating your credit score. Here's a breakdown of how FICO® ScoresΘ are calculated:

- Payment history (35%): Your payment history has the single largest impact in determining your credit score. To build a positive payment history, make on-time debt payments every time.

- Amounts owed (30%): This is the amount of debt you have altogether. Your credit utilization (how much of your revolving credit limit you're using, mainly on credit cards) has the largest impact. Keeping revolving balances low can help your score.

- Length of credit history (15%): Having a long credit history can help your score. Your credit history length includes the age of your oldest account, the age of your newest account and the average age of all your accounts.

- Credit mix (10%): Credit mix is the variety of debt accounts you have, such as revolving credit (credit cards, for example) and installment credit (like personal loans and mortgages). Experience responsibly managing diverse types of credit demonstrates creditworthiness and is good for your score.

- New credit (10%): How many new accounts you have, the number of recent inquiries on your credit report and how long it's been since you opened a new account all factor in.

Learn more: What Affects Your Credit Scores?

Will Paying Off a Loan Hurt My Credit?

It's possible that your credit score may go down after paying off a loan if it was the only loan on your credit report. That limits your credit mix, which accounts for 10% of your FICO® Score.

Even so, in general, getting rid of a loan is a win: You'll have more flexibility with your finances, and you'll no longer accrue interest charges on the loan's balance. Also, responsibly using credit with other debt accounts could help your score rebound. So, if paying off a loan makes sense for you, avoiding a brief credit score drop shouldn't be a reason to keep the account open.

Also, reducing debt will lower your debt-to-income ratio, which lenders will be glad to see if your goal is to apply for new credit once you pay off your loan.

Learn more: Why Did My Credit Score Drop When I Paid Off a Loan?

Benefits of Paying Off a Loan Early

Paying off a loan early may be to your benefit, even if it doesn't necessarily lead to an increase in your credit score. Here are some reasons to consider paying off your loan.

Save on Interest

Paying off any high-interest debt as quickly as possible can help you save substantial amounts on interest. The moment you pay off a personal loan that carried an interest rate of 10%, for instance, you'll get access to the money you were previously putting toward your monthly bill. You can allocate the money you were previously paying toward other debt or toward savings.

Lower Your Debt-to-Income Ratio

When you pay off debt, your debt-to-income ratio (DTI) decreases, since you now have smaller monthly debt payments compared with your income. That's one of the primary factors financial institutions use to make mortgage lending decisions, so if you're in the market for new credit in the future, lowering your DTI could be valuable.

Manage Financial Stress

A recent survey from the banking and credit product company Discover found that 4 out of 5 respondents are stressed about money, and 30% cited debt as a source of anxiety.

Debt can feel like a cloud hanging over you, especially when it's keeping you from pursuing goals you're passionate about. Eliminating a monthly debt payment from your budget gives you innumerable new possibilities for making use of that money. Celebrate when you pay off a loan; the flexibility and freedom you'll now feel can be priceless.

Learn more: Ways to Improve Your Financial Health

Should You Pay Off Debt Early or Continue Making Payments?

Because your credit score may not improve if you pay off a loan early, you may be wondering whether paying your loan off early is worth it. Here are some things to consider.

- Other debts: If your goal is to save on interest, it makes sense to prioritize paying off your most expensive debts first. Personal loans often come with lower interest rates than some other types of debt, such as credit cards. Come up with the debt payoff plan that works best for you and helps you pay off high-interest debts more quickly.

- Emergency savings: Before you apply extra funds to pay off your loan faster, be sure you have a financial safety net in place. Without a cushion, an unexpected expense or period of reduced income could lead you into more debt. Aim for an emergency savings fund large enough to cover at least three to six months' worth of basic expenses.

- Other savings goals: Beyond an emergency fund, consider your other long-term goals, such as putting a down payment on a home and saving for retirement. Ideally, aim to balance progress toward these goals with getting out of debt.

- Prepayment penalties: Check to see if your lender charges prepayment penalties. These are fees you owe if you pay off your loan balance before the end of the agreed upon term. Even if your lender does charge a penalty, you may still come out ahead by paying off your loan early because you'll likely save substantial amounts in interest.

More Ways to Build Credit

If your goal is to improve your score, you have options. Here are some good habits and tips to help you meet your credit goals:

- Pay your bills on time. The most important thing you can do for your credit is to ensure you're making on-time payments on all of your debts. If you're worried about forgetting a payment, consider signing up for autopay.

- Don't max out your credit cards. Keep credit card balances to a minimum, ideally charging no more than 30% of your credit limit on each credit card at any point. The lower your credit utilization rate is, the better for your credit score.

- Keep old accounts open. To maintain a healthy account age, it's best to keep old accounts open, even if you use them infrequently. You can keep old credit cards active by charging a small purchase each month then paying it off immediately.

- Limit hard inquiries. Credit applications trigger hard inquiries, which can cause a minor, temporary dip in your score. Having multiple inquiries in a short time period signals greater risk to lenders. Keep inquiries to a minimum by getting prequalified before you formally apply and use rate shopping to your benefit.

Learn more: How to Build Credit: A Comprehensive Guide

Paying Off a Loan vs. Waiting It Out

It's a personal choice whether to keep a loan account open for its full term or to pay it off early. But there are a few circumstances when the decision is relatively clear: If your rate is low enough that your money could go further elsewhere (such as toward higher-interest debts), it may be best to pay the loan over time as agreed and benefit from the positive credit impact.

On the other hand, perhaps you need a low debt-to-income ratio to qualify for a new loan, or you have the means to pay off the loan and you don't plan to take out any new credit in the near future. In these cases, freeing yourself from the loan, and accepting a brief potential credit hit, could be a good bet.

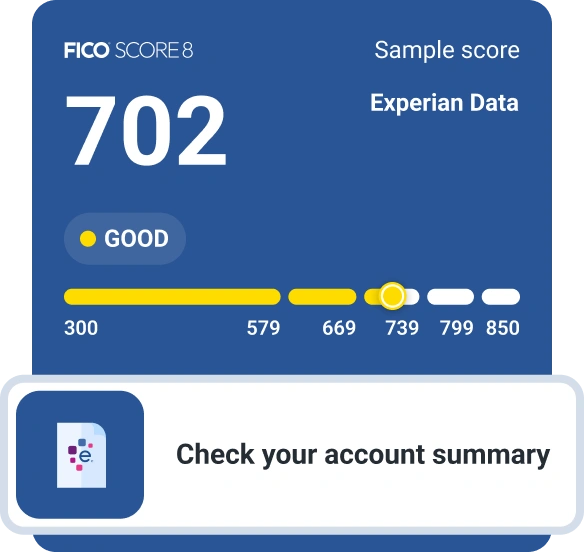

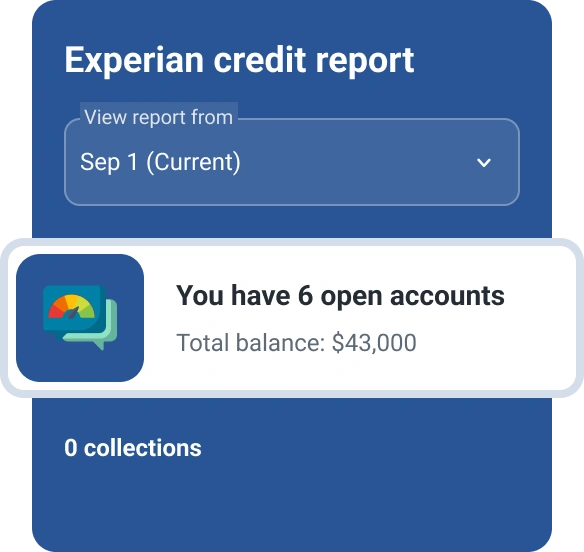

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna