Latest Posts

First-time homebuyers (FTHBs) represent a significant portion of the homebuying market across the United States, particularly in Texas where we see the largest proportion. While an overall diverse market segment, affordability is paramount to all. Experian Housing recently examined the mortgage landscape, looking at who is buying, where, and why, uncovering both expected and surprising insights. Texas at a glance Eight of the top ten fastest-growing US cities are in Texas. Lately, Texas business growth has included large employers, such as Amazon, Oracle, Caterpillar, Chevron, and Schwab, moving or expanding to the state. Looking for a more affordable life, consumers have also made the move. No state income tax, no corporate taxes, overall lower business taxes, business incentives, and a generally favorable cost of living make it very attractive to individuals and businesses. Recent research by Experian Housing revealed Texas accounts for the largest percentage of FTHBs in the US at nearly 10.5%, based on those getting a mortgage. Among these buyers, ~72% are Generation Y (Gen Y) and Generation Z (Gen Z), meaning they are in their early 40s and younger. Defining and measuring affordability Affordability often tips the scale for prospective first-time homebuyers, particularly younger buyers, deciding to rent or buy. Texas mortgage lenders familiar with the geography of their local markets will likely have an advantage with these consumers if they understand affordability from a citywide perspective and at a hyper-focused neighborhood or zip code level. What determines affordability? Affordability can be assessed through various metrics. For the purposes of this study, Experian Housing defined affordability by calculating the rent-to-mortgage ratio. This involves comparing monthly rent payments to monthly mortgage payments. A higher rent-to-mortgage ratio suggests renters may find mortgage payments more feasible, potentially making home buying a more appealing option. According to Experian’s latest 2023 rental market report, Gen Z and Gen Y made up nearly 70% of the U.S. rental sector. When considered with their first-time homebuyer numbers in Texas and across the U.S., their importance in defining the market trend stands out. The rent-to-mortgage analysis provides important insights into whether these buyers may look to buy now or continue renting. Texas by the numbers Experian Housing examined affordability at the city and more granular, localized levels. Among those analyzed for affordability, Experian findings included: Lubbock is the most affordable city with a rent-to-mortgage ratio of 67%. Following Lubbock were Fort Worth (64%), San Antonio (63%), andEl Paso (62%) are the next cities. Among metro areas, Houston (58%), Arlington (56%), Dallas (52%) and Austin (49%). In these cities, the low to high average current home sales price rankings tracked the rent-to-mortgage ratios except for El Paso, with the 2nd lowest average sales price, but coming in 4th in the affordability metric. Lubbock had the lowest average home sales price at $212,812. El Paso had the next lowest average sales price ($216,424), then San Antonio ($269,232) and Fort Worth ($312,579). Next came Houston ($317,882), Arlington ($345,077), Dallas ($402,830), and Austin ($598,431). Is the city center or are the suburbs more affordable? A look at the city level only tells part of the story. Examining the area by zip code reveals more insights into where loan officers might direct first-time buyer prospects. In general, based on the median rent-to-mortgage payment ratio, the farther away from the city center (outer suburbs), the more affordable buying is for first-time buyers. San Antonio proved to be the notable exception where prices trended higher in the suburbs. Mortgage lenders who are savvy about these inner-market differences, set themselves up for a greater likelihood of attracting first-time homebuyers and keeping them as loyal customers. For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online. Download white paper Learn more

With more consumers online, bad actors are taking the opportunity to commit more financial crimes, such as account takeover fraud. This online scheme resulted in nearly $13 billion in losses in 2023, up from $11 billion in 2022.1 So, what do organizations need to know about this form of identity theft? And how can they prevent it? Let’s explore one type of account takeover fraud: email account takeover. What is email account takeover? Email account takeover occurs when a fraudster gains access to a legitimate user’s email account through data breaches that expose credentials, purchasing from the dark web, or phishing scams. It's usually one of the first steps in a broader account takeover scheme. Once fraudsters have access to a consumer’s email or social media account, they have access to the private information in that consumer’s inbox: financial statements, health records, and other forms of PII. Fraudsters can also now use the consumer’s email to impersonate them with friends, family, financial institutions or other businesses they interact with. They can also gain access to other accounts and here’s where email account takeover becomes more dangerous. In this attack, the fraudster gains access to an email or mobile account. Once they have an email, they start by trying to guess the user’s password, commonly called a brute force attack, or through password spraying, where they use commonly used passwords, i.e. ‘password’ or ‘123123. A recent Google survey found that 65% of people use the same password for some or all of their online accounts. This, along with a corresponding email address can give fraudsters further entre into a consumer’s other accounts. If unsuccessful, they’ll then execute a ‘forgot password’, password reset, or one-time password. Then, they take over the victim’s account with their financial institution to facilitate the transfer of funds from the compromised account. 57% of businesses are experiencing rising fraud losses associated with account opening and account takeover.2 While email account takeover can be quickly executed, detecting it can take time. Unlike credit card fraud, where an individual may soon notice suspicious activity, an email account takeover can go undetected for longer. The owner may not realize until later that their account has been compromised, especially with a dormant account or secondary account they use less. As a result, criminals have more time to facilitate additional attacks. LEARN MORE: Explore 2024 fraud trends listed by Experian. How does it affect your organization? Account takeover fraud doesn't just impact consumers, it can result in significant financial losses for organizations. For example, if your organization offers credit products, you might have to cover the costs of disputing chargebacks, card processing fees, or providing refunds. In the case of a data breach, you may have to pay fines against your organization for not properly protecting consumer information. Nearly two-thirds of consumers say they’re very or somewhat concerned with online security.3 But email account takeover isn't just costly — it can damage your organization's reputation. Consumers expect organizations to have proper security measures in place to protect their information. If a data breach occurs, your security can seem weak, leading consumers to lose trust in your organization. As a result, they may potentially take their business elsewhere. The importance of prevention While consumers listed identity theft as their top concern when conducting activities online, they’re still interacting, opening new accounts, and transacting digitally.4 Coupled with the rise of account takeover fraud and associated losses, it’s more crucial than ever for organizations to accurately detect and prevent these attacks. To do this, they must have a proactive fraud prevention strategy in place. Account takeover fraud prevention requires your business to maintain and continuously reaffirm confidence in the identity data you collect. Your team can monitor, segment, and proactively act on customer identities that display a higher risk of fraud than was determined at account origination through risk-based fraud detection models, machine learning, and advanced analytics. Experian offers many flexible solutions, including: CrossCore® Solutions are best practice-based groupings of fraud and identity products that enable organizations to solve common to complex issues. For example, our fraud risk solutions include email and phone intelligence to improve verification for thin-files and other challenging populations. Experian offers phone/carrier-based matching capabilities with address validity and occupancy data for >95% of U.S. households. FraudNet is a device intelligence solution that analyzes hundreds of device attributes and prevents fraud on all digital channels. Combining contextual data, behavioral data, and device data, it bridges the gap between physical and digital identity to achieve fraud capture rates that exceed industry averages. To further alleviate account takeover fraud, your organization can offer educational resources for fraud prevention. Using various, strong passwords across their accounts, and changing them regularly, is a foundational way consumers can help ensure their accounts are secure. Leveraging user names that are different from your email can also help. If a fraudster is able to takeover an account and initiate a lost password request, and that password is used for other accounts, that fraudster now has the credentials they need to further defraud that consumer. By spreading awareness about identity fraud risks and providing best practices for prevention, you can better protect your organization and consumers. LEARN MORE: Building a multilayered fraud and identity strategy with CrossCore Solutions Partnering with Experian Email account takeover, along with other types of fraud, can be detected and prevented with the right partner. Experian’s fraud management solutions can help your organization accurately verify customers and assess risk with our account takeover and fraud management solutions. Explore Experian’s account takeover solutions and watch an on-demand recording of our Fraud Risk and Identity Verification Solutions tech showcase. Learn more Watch tech showcase 1 Identity Fraud Cost Americans $43 Billion in 2023, AARP. 2-4 2023 U.S. Identity and Fraud Report, Experian.

Rising balances and delinquency rates are causing lenders to proactively minimize credit risk through pre-delinquency treatments. However, the success of these types of account management strategies depends on timely and predictive data. Credit attributes summarize credit data into specific characteristics or variables to provide a more granular view of a consumer’s behavior. Credit attributes give context about a consumer’s behavior at a specific point in time, such as their current revolving credit utilization ratio or their total available credit. Trended credit attributes analyze credit history data for consumer behavior patterns over time, including changes in utilization rates or how often a balance exceeded an account’s credit limit during the previous 12 months. In a recent analysis, we found that credit attributes related to utilization were highly predictive of future delinquencies in bankcard accounts, with many lenders better managing their credit risk when incorporating these attributes into their account management processes. READ: Find out how custom attributes and models can help you stay ahead of your competitors in the "Build a profitable portfolio with credit attributes" e-book. Using attributes to manage credit risk An enhanced understanding of credit attributes can be leveraged to manage risk throughout the customer lifecycle. They can be important when you want to: Improve credit strategies and efficiencies: Overlay attributes and incorporate them into credit policy rules, such as knockout criteria, to expand your lending population and increase automation without taking on more credit risk. Better understand customers' credit trends: Experian’s wide range of credit data, including trended credit attributes, can help you quickly understand how consumers are faring off-book for visibility into other lending relationships and if they’ll likely experience financial stress in the future. Credit attributes can also help precisely segment populations. For example, attributes can help you distinguish between two people who have similar credit risk scores — but very different trajectories — and will better determine who's the least risky customer. Predicting 60+ day delinquencies with credit attributes To evaluate the effectiveness of credit attributes during account review, we looked at 2.9 million open and active bankcard accounts to see which attributes best predicted the likelihood of an account reaching 60 days past due. For this analysis, we used snapshots of bankcard accounts that were reported in October 2022 and April 2023. Additionally, we analyzed the predictive power of over 4,000 attributes from Experian Premier AttributesSM and Trended 3DTM. Key findings Nine of the top 20 most predictive credit attributes were related to credit utilization rates. Delinquency-related attributes were predictive but weren’t part of the top 10. Three of the top 10 attributes were related to available credit. Turning insight into action While we analyzed credit attributes for account review, determining attribute effectiveness for other use cases will depend on your own portfolio and goals. However, you can use a similar approach to finding the predictive power of attributes. Once you identify the most predictive credit attributes for your population, you can also create an account review program to track these metrics, such as changes in utilization rates or available credit balances. Using Experian’s Risk and Retention Triggers℠ can immediately notify you of customers' daily credit activity to monitor those changes. Ongoing monitoring of attributes and triggers can help you identify customers who are facing financial stress and are headed toward delinquency. You can then proactively take steps to reduce your risk exposure, prioritize accounts, and modify pre-collections strategy based on triggering events. Experian offers credit attributes and the tools to use them Creating and managing credit attributes can be a complex and never-ending task. You need to regularly monitor attributes for performance drift and to address changing regulatory requirements. You may also want to develop new attributes based on expanding data sources and industry trends. Many organizations don’t have the resources to create, manage, and update credit attributes on their own. That’s where Experian’s 4,500+ attributes and tools can help to save time and money. Premier Attributes includes our core attributes and subsets for over 50 industries. Trended 3D attributes can help you better understand changes in consumer behavior and creditworthiness. Clear View AttributesTM offers insights from expanded FCRA data* that generally isn’t reported to consumer credit bureaus. You can easily review and manage your portfolios with Experian’s Ascend Quest™ platform. The always-on access allows you to request thousands of data elements, including credit attributes, risk scores, income models, segmentation data, and payment history, at any time. Use insights from the data and leverage Ascend Quest to quickly identify accounts that may be experiencing financial stress to limit your credit risk — and target others with retention and up-selling opportunities. Watch the Ascend Quest demo to see it in action, or contact us to learn more about Experian’s credit attributes and account review solutions. Watch demo Contact us

This series will dive into our monthly State of the Economy report, providing a snapshot of the top monthly economic and credit data for those in financial services to proactively shape their business strategies. During their June meeting, the Federal Reserve continued to hold rates steady and released an updated Summary of Economic Projections. In this update, the committee reduced 2024 rate cut projections from three to one and increased their year-end inflation expectations. Both of these updates were likely driven by a lack of downward progress in inflation in Q1. But as the Federal Reserve extends the period of restrictive rates, it places more weight on each monthly economic data release to inform the Fed’s next move. Data highlights from this month’s report include: Job creation exceeded economists’ expectations with 272,000 jobs added in May. Inflation cooled in May, with annual headline inflation down from 3.4% to 3.3% and annual core inflation down from 3.6% to 3.4%. Auto loan amounts decreased in Q1 as inventories continue to stabilize. Check out our report for a deep dive into the rest of this month’s data, including the latest trends in delinquencies, spending, and the new housing market. Download June's report To have a holistic view of our current environment, it’s important to view the economy from different angles and through different lenses. Watch our experts discuss the latest economic and credit trends in the recording of our latest macroeconomic forecasting webinar and listen to our latest Econ to Action podcast. For more economic trends and market insights, visit Experian Edge.

The Experian Vision conference is an annual event hosted by the leader in global information services. Vision 2024, held in Scottsdale, Arizona, from May 20-23, gathered industry leaders, data experts, and business professionals to discuss the latest trends and innovations in data and analytics. Aligned with the theme of “Powering Opportunities,” Vision 2024 featured breakout sessions offering attendees valuable insights and strategies for using data to drive business growth and success. Here are the highlights from three of the sessions focused on housing topics. Two industry experts, Sam Khater, Chief Economist at Freddie Mac and Susan Allen, SVP of Product, Experian Housing, engaged in a lively and thought-provoking discussion. The program covered the current state of the mortgage market. Susan and Sam took turns presenting their findings, exchanging ideas, and sharing their perspectives about where lenders could see opportunity in the current challenging mortgage market. They identified these current challenges and opportunities for lenders and borrowers. The economy continues to expand at a solid growth rate. Consumer spending remains firm, and the labor market is tight. The healthy economy is causing inflation and interest rates to remain higher for longer. Home purchase demand is coming off cyclical lows, but home sales remain low with mortgage rates remain above 7%. Inventory is improving modestly, but it remains very low due to chronic undersupply. The dynamic of low home sales, and even lower supply will continue to pressure home prices to increase, especially given many borrowers are moving to more affordable markets more frequently than in the past. There are 46 million likely qualified non-homeowner consumers, of which 7 million appear ready for first time homeownership. Although affordability remains a significant challenge, there are geographic regions where aspiring first-time homeowners are finding better success. Lenders are pursuing data-driven, nuanced approaches to identify and successfully reach these consumers. Three recognized industry professionals headlined this panel discussion. Eric Czajka, VP of Governance and Oversight at Rocket Companies, Experian Housing’s Susan Allen, and Product Manager for Experian Housing, Angad Paintal, shared their insights with a review of recent innovations from Rocket, including specific Experian solutions that are supporting Rocket’s consumer engagement strategy. Lenders in attendance also learned the next steps they can take to win borrowers that ready to consider a refinance. Experian showcased what’s possible with the combination of multiple data sources in a user-friendly interface to help lenders prepare for a rate reduction, including the potential triggers for conventional refinance, VA refinance and FHA refinances. Each segment needs to move 50 basis points to make the possibility of a refinance reasonable for the borrower. Vision 2024 continued with a casual conversation between Newrez COO Joshua Bishop and Chris Travis, Software Sales Expert at Experian. Participants experienced a glimpse into recent developments in mortgage technology from the Newrez leader and how these advancements reflect the industry. The program featured an exchange of questions and answers centered around three crucial topics that have significant implications for housing industry growth and development. These include economic uncertainty (interest rates, refinances, and delinquency trends), government regulations and policies (Basel III, CFPB) and technology (big data and generative AI). The key takeaway from this session was that the mortgage industry is undergoing a tech revolution. Lenders and servicers are utilizing predictive models to assess risk and personalize communication, while generative AI streamlines document processing and provides a cleaner experience for internal and external users alike. Deep analytical tools provide a clearer picture of borrower finances and hardship resolutions. This technological embrace is transforming the mortgage process, making it faster, more efficient, and more accessible. Be part of the future at Vision 2025 Vision 2024 was a resounding success, bringing together our valued clients to share innovative ideas and forge new connections. We were thrilled by the thought-provoking discussions and the collaborative spirit that permeated the event. As we look ahead to next year's conference, we eagerly anticipate even more groundbreaking conversations and opportunities for growth. Don't miss out - secure your spot now and be part of the future at Vision 2025. Register now

As more consumers lean towards adaptable and efficient vehicles that fit their everyday lifestyle, it’s no surprise to see the nuanced shifts in consumer preferences over recent years. For instance, compact utility vehicles (CUVs) have resonated with those seeking versatility—emerging as the most registered new vehicle segment in the first quarter of 2024 at 51.1%, according to Experian’s Automotive Consumer Trends Report. When exploring the depths of CUV registrations, data showed Toyota led the market share for the non-luxury segment at 14.9% in Q1 2024. They were followed by Chevrolet (12.1%), Honda (11.4%), Subaru (10.4%), and Hyundai (10.0%). On the luxury side, Tesla accounted for 28.0% of the market share this quarter and Lexus trailed behind at 14.1%. Rounding out the top five were BMW (12.2%), Audi (8.6%), and Volvo (6.2%). CUV registration trends by generations It’s notable that different generations are drawn to CUVs for a multitude of personal preferences that align with their respective lifestyles. For example, Baby Boomers made up 32.3% of new retail registrations for CUVs and Gen X was close behind at 30.4% in Q1 2024. They were followed by Millennials (23.6%), Gen Z (7.9%), and the Silent Generation (5.4%). While some generations seek a vehicle that strikes a balance between practicality and comfort, others may prefer smaller and more maneuverable vehicles. Nonetheless, CUVs making up just over half of new retail registrations is something that should be watched closely. By leveraging multiple data points such as who is in the market for a CUV as well as the types of makes and models they’re interested in, professionals have the opportunity to strategize new ways to effectively reach shoppers. To learn more about CUVs, view the full report at Automotive Consumer Trends Report: Q1 2024. Or

Dealing with delinquent debt is a challenging yet crucial task, and when faced with economic uncertainties, the need for effective debt management and collections strategies becomes even more pressing. Thankfully, advanced analytics offers a promising solution. By leveraging data-driven insights, you can enhance operational efficiency, better prioritize accounts, and make more informed decisions. This article explores how advanced analytics can revolutionize debt collection and provides actionable strategies to implement treatment. Understanding advanced analytics in debt collection Advanced analytics involves using sophisticated techniques and tools to analyze complex datasets and extract valuable insights. In debt collection, advanced analytics can encompass various methodologies, including predictive modeling, machine learning (ML), data mining, and statistical analysis. Predictive modeling Predictive modeling leverages historical data to forecast future outcomes. By applying predictive models to debt collection, you can estimate each account's repayment likelihood. This helps prioritize your efforts toward accounts with a higher chance of recovery. Machine learning Machine learning algorithms can automatically identify patterns in large datasets, enabling more accurate predictions and classifications. For debt collectors, this means better segmenting delinquent accounts based on likelihood of repayment, risk, and customer behavior. Data mining Data mining involves exploring large datasets to unearth hidden patterns and correlations. In debt collection, data mining can reveal previously unnoticed trends and behaviors, allowing you to tailor your strategies accordingly. Statistical analysis Statistical methods help quantify relationships within data, providing a clearer picture of the factors influencing debt repayment and focusing on statistically significant repayment drivers, which aids in refining collection strategies. Benefits of advanced analytics in delinquent debt collection The benefits of employing advanced analytics in delinquent debt collection are multifaceted and valuable. By integrating these technologies, financial institutions can achieve greater efficiency, reduce operational costs, and improve recovery rates. Enhanced prioritization and decisioning With data and predictive analytics, you can gain a complete view of existing and potential customers to determine risk exposure and prioritize accounts effectively. By analyzing payment histories, credit scores, and other consumer behavior, you can enhance your collectoins prioritization strategies and focus on accounts more likely to pay or settle. This ensures that resources are allocated efficiently, and decisions are informed, maximizing your return on investment. Watch: In our recent tech showcase, learn how to harness the power of our industry-leading collection decisioning and optimization capabilities. Reduced costs Advanced analytics can significantly reduce operational costs by streamlining the collection process and targeting accounts with higher recovery potential. Automated processes and optimized resource allocation mean you can achieve more with less, ultimately increasing profitability. Better customer relationships With debt collection analytics, digital communication tools, artificial intelligence (AI), and ML processes, you can enhance your collections efforts to better engage with consumers and increase response rates. Adopting a more empathetic and customer-centric approach that embraces omnichannel collections can foster positive customer relationships. Implementing advanced analytics: A step-by-step guide Step 1: Data collection and integration The first step in implementing advanced analytics is to gather and integrate data from various sources. This includes payment histories, account information, demographic data, and external data such as credit scores. Ensuring data quality and consistency is crucial for accurate analysis. Step 2: Data analysis and modeling Once the data is collected, the next step is to apply advanced analytical techniques. This involves developing predictive models, training machine learning algorithms, and conducting statistical analyses to identify notable patterns and trends. Step 3: Strategy development Based on the insights gained from the analysis, you can develop targeted collection strategies. These may include segmenting accounts, prioritizing high-potential recoveries, and choosing the most effective communication methods. It’s essential to test and refine these strategies to ensure optimal performance continually. Step 4: Automation and implementation Implementing advanced analytics often involves automation. Workflow automation tools can streamline routine tasks, ensuring strategies are executed consistently and efficiently. Integrating these tools with existing debt collection systems can enhance overall effectiveness. Step 5: Monitoring and optimization Finally, continuously monitor the performance of your advanced analytics initiatives. Use key performance indicators (KPIs) to track success and identify areas for improvement. Regularly update models and strategies based on new data and evolving trends to maintain high recovery rates. Putting it all together Advanced analytics hold immense potential for transforming delinquent debt collection and can drive better return on investment. By leveraging predictive modeling, machine learning, data mining, and statistical analysis, financial institutions and debt collection agencies can perfect their collection best practices, prioritize accounts effectively, and make more informed decisions. Our debt collection analytics and recovery tools empower your organization to see the complete behavioral, demographic, and emerging view of customer portfolios through extensive data assets, advanced analytics, and platforms. As the financial landscape evolves, working with an expert to adopt advanced analytics will be critical for staying competitive and achieving sustainable success in debt collection. Learn more *This article includes content created by an AI language model and is intended to provide general information.

In this article...What is fair lending?Understanding machine learning modelsThe pitfalls: bias and fairness in ML modelsFairness metricsRegulatory frameworks and complianceHow Experian® can help As the financial sector continues to embrace technological innovations, machine learning models are becoming indispensable tools for credit decisioning. These models offer enhanced efficiency and predictive power, but they also introduce new challenges. These challenges particularly concern fairness and bias, as complex machine learning models can be difficult to explain. Understanding how to ensure fair lending practices while leveraging machine learning models is crucial for organizations committed to ethical and compliant operations. What is fair lending? Fair lending is a cornerstone of ethical financial practices, prohibiting discrimination based on race, color, national origin, religion, sex, familial status, age, disability, or public assistance status during the lending process. This principle is enshrined in regulations such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA). Overall, fair lending is essential for promoting economic opportunity, preventing discrimination, and fostering financial inclusion. Key components of fair lending include: Equal treatment: Lenders must treat all applicants fairly and consistently throughout the lending process, regardless of their personal characteristics. This means evaluating applicants based on their creditworthiness and financial qualifications rather than discriminatory factors. Non-discrimination: Lenders are prohibited from discriminating against individuals or businesses on the basis of race, color, religion, national origin, sex, marital status, age, or other protected characteristics. Discriminatory practices include redlining (denying credit to applicants based on their location) and steering (channeling applicants into less favorable loan products based on discriminatory factors). Fair credit practices: Lenders must adhere to fair and transparent credit practices, such as providing clear information about loan terms and conditions, offering reasonable interest rates, and ensuring that borrowers have the ability to repay their loans. Compliance: Financial institutions are required to comply with fair lending laws and regulations, which are enforced by government agencies such as the Consumer Financial Protection Bureau (CFPB) in the United States. Compliance efforts include conducting fair lending risk assessments, monitoring lending practices for potential discrimination, and implementing policies and procedures to prevent unfair treatment. Model governance: Financial institutions should establish robust governance frameworks to oversee the development, implementation and monitoring of lending models and algorithms. This includes ensuring that models are fair, transparent, and free from biases that could lead to discriminatory outcomes. Data integrity and privacy: Lenders must ensure the accuracy, completeness, and integrity of the data used in lending decisions, including traditional credit and alternative credit data. They should also uphold borrowers’ privacy rights and adhere to data protection regulations when collecting, storing, and using personal information. Understanding machine learning models and their application in lending Machine learning in lending has revolutionized how financial institutions assess creditworthiness and manage risk. By analyzing vast amounts of data, machine learning models can identify patterns and trends that traditional methods might overlook, thereby enabling more accurate and efficient lending decisions. However, with these advancements come new challenges, particularly in the realms of model risk management and financial regulatory compliance. The complexity of machine learning models requires rigorous evaluation to ensure fair lending. Let’s explore why. The pitfalls: bias and fairness in machine learning lending models Despite their advantages, machine learning models can inadvertently introduce or perpetuate biases, especially when trained on historical data that reflects past prejudices. One of the primary concerns with machine learning models is their potential lack of transparency, often referred to as the "black box" problem. Model explainability aims to address this by providing clear and understandable explanations of how models make decisions. This transparency is crucial for building trust with consumers and regulators and for ensuring that lending practices are fair and non-discriminatory. Fairness metrics Key metrics used to evaluate fairness in models can include standardized mean difference (SMD), information value (IV), and disparate impact (DI). Each of these metrics offers insights into potential biases but also has limitations. Standardized mean difference (SMD). SMD quantifies the difference between two groups' score averages, divided by the pooled standard deviation. However, this metric may not fully capture the nuances of fairness when used in isolation. Information value (IV). IV compares distributions between control and protected groups across score bins. While useful, IV can sometimes mask deeper biases present in the data. Disparate impact (DI). DI, or the adverse impact ratio (AIR), measures the ratio of approval rates between protected and control classes. Although DI is widely used, it can oversimplify the complex interplay of factors influencing credit decisions. Regulatory frameworks and compliance in fair lending Ensuring compliance with fair lending regulations involves more than just implementing fairness metrics. It requires a comprehensive end-to-end approach, including regular audits, transparent reporting, and continuous monitoring and governance of machine learning models. Financial institutions must be vigilant in aligning their practices with regulatory standards to avoid legal repercussions and maintain ethical standards. Read more: Journey of a machine learning model How Experian® can help By remaining committed to regulatory compliance and fair lending practices, organizations can balance technological advancements with ethical responsibility. Partnering with Experian gives organizations a unique advantage in the rapidly evolving landscape of AI and machine learning in lending. As an industry leader, Experian offers state-of-the-art analytics and machine learning solutions that are designed to drive efficiency and accuracy in lending decisions while ensuring compliance with regulatory standards. Our expertise in model risk management and machine learning model governance empowers lenders to deploy robust and transparent models, mitigating potential biases and aligning with fair lending practices. When it comes to machine learning model explainability, Experian’s clear and proven methodology assesses the relative contribution and level of influence of each variable to the overall score — enabling organizations to demonstrate transparency and fair treatment to auditors, regulators, and customers. Interested in learning more about ensuring fair lending practices in your machine learning models? Learn More This article includes content created by an AI language model and is intended to provide general information.

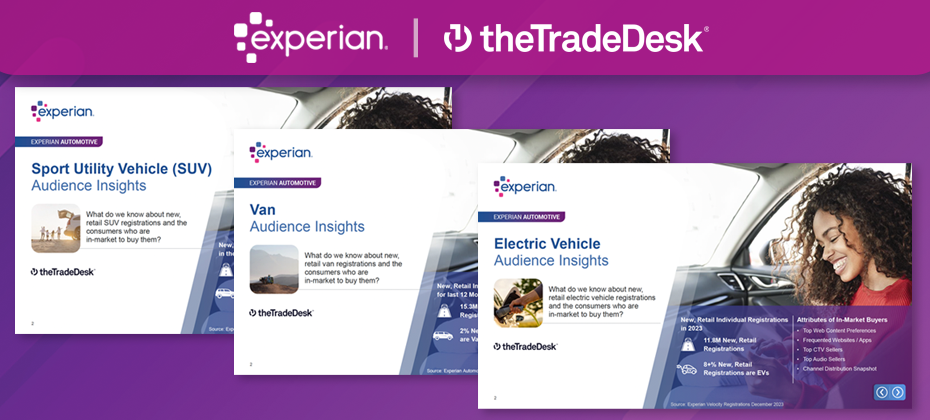

Experian's Automotive Consumer Trends Quarterly Report goes beyond understanding general car-buying trends. Each quarter, we delve deeper into a specific vehicle segment, analyzing the demographics (who's buying) and psychographics (why they're buying) of those consumers. New eBrochures help turn insights into action Although valuable, what can you do with this information? That's where The Trade Desk comes in. They leverage the insights from our report to create a comprehensive omnichannel strategy for reaching in-market car buyers. This strategy goes beyond demographics, revealing: Top web content preferences: Where are these consumers spending their online time? Frequented websites and apps: What digital platforms are most relevant to them? Top CTV and audio examples: Which streaming services and audio channels should be targeted? A Consolidated Snapshot The Trade Desk provides a clear picture of channel distribution, ensuring your advertising reaches the right audience across the most effective platforms. This combined approach empowers you to target car shoppers with laser precision, maximizing your advertising impact. Experian Automotive and The Trade Desk are committed to developing solutions that balance advertiser needs with consumer privacy. The Trade Desk’s clients can access Experian’s over 2,400 syndicated audiences across eight verticals, including over 750 automotive audiences by make, model, fuel type, price, vehicle age, and more. Accessing the insights: To view the latest Experian Automotive Consumer Trends Quarterly Report, visit us at: www.experian.com/automotive/auto-consumer-trends-form. You can review Experian and The Trade Desk’s collaborative eBrochures for the following vehicle segments:

In this article...What is a TOAD attack?How TOAD attacks happenEffective countermeasures Keeping TOADS at bay with Experian Imagine receiving a phone call informing you that your antivirus software license is about to expire. You decide to renew it over the phone, and before you know it, you have been “TOAD-ed”! What is a TOAD attack? Telephone-Oriented Attack Deliveries (TOADs) are an increasingly common threat to businesses worldwide. According to Proofpoint's 2024 State of the Phish Report, 10 million TOAD attacks are made every month, and 67% of businesses globally were affected by a TOAD attack in 2023. In the UK alone, businesses have lost over £500 million to these scams, while in the United States the reported monetary loss averaged $43,000 per incident, with some losses exceeding $1 million.TOADs involve cybercriminals using real phone numbers to impersonate legitimate callers, tricking victims into divulging sensitive information or making fraudulent transactions. This type of attack can result in substantial financial losses and reputational damage for businesses. How TOAD attacks happen TOAD attacks often involve callback phishing, where victims are tricked into calling fake call centers. Before they strike, scammers will gather a victim's credentials from various sources, such as past data breaches, social media profiles, and information bought on the dark web. They will then contact the individual through applications like WhatsApp or call their phone directly. Here is a common TOAD attack example: Initial contact: The victim receives an email from what appears to be a reputable company, like Amazon or PayPal. Fake invoice: The email contains a fake invoice for a large purchase, prompting the recipient to call a customer service number. Deception: A scammer, posing as a customer service agent, convinces the victim to download malware disguised as a support tool, granting the scammer access to the victim's computer and personal information. These techniques keep improving. One of the cleverer tricks of TOADs is to spoof a number or email so they contact you as someone you know. Vishing is a type of phishing that uses phone calls, fake numbers, voice changers, texts, and social engineering to obtain sensitive information from users. It mainly relies on voice to fool users. (Smishing is another type of phishing that uses texts to fool users, and it can be combined with phone calls depending on how the attacker works.) According to Rogers Communication website, an employee in Toronto, Canada got an email asking them to call Apple to change a password. They followed the instructions, and a “specialist” helped them do it. After receiving their password, the cyber criminals used the employee's account to send emails and deceive colleagues into approving a fake payment of $5,000. Artificial intelligence (AI) is also making it easier for TOAD phishing attacks to happen. A few months ago, a Hong Kong executive was fooled into sending HK$200m of his company's funds to cyber criminals who impersonated senior officials in a deepfake video meeting. Effective countermeasures To combat TOAD attacks, businesses must implement robust solutions. Employee training and awareness: Regular training sessions and vishing simulations help employees recognize and respond to TOAD attacks. Authentication and verification protocols: Implementing multi-factor authentication (MFA) and call-back verification procedures enhances security for sensitive transactions. Technology solutions: Bots and spoofing detection and voice biometric authentication technologies help verify the identity of callers and block fraudulent numbers. Monitoring and analytics: Advanced fraud detection and behavioral analytics identify anomalies and unusual activities indicative of TOAD attacks. Secure communication channels: Ensure consumers have access to verified customer service numbers and promote secure messaging apps. A strong strategy should also involve using advanced email security solutions with AI fraud detection and machine learning (ML) to effectively defend against TOAD threats. These can help identify and stop phishing emails. Regular security audits and updates are necessary to find and fix vulnerabilities, and an incident response plan should be prepared to deal with and reduce any breaches. By integrating technology, processes, and people into their strategy, organizations can develop a strong defense against TOAD attacks. Keeping TOADS at bay with Experian® By working and exchanging information with other businesses and industry groups, you can gain useful knowledge about new or emerging threats and defense strategies. Governments and organizations like the Federal Communications Commission (FCC) have a shared duty to defend the private sector and public consumers from TOAD attacks, while many of the current rules and laws seem to lag behind what criminals are doing. By combining the best data with our automated ID verification processes, Experian® helps you protect your business and reputation. Our best-in-class solutions employ device recognition, behavioral biometrics, machine learning, and global fraud databases to spot and block suspicious activity before it becomes a problem. Learn more *This article includes content created by an AI language model and is intended to provide general information.

In the ever-evolving landscape of automotive marketing, insight and measurement are paramount. Recognizing this, Strategus and Experian Automotive have joined forces to help improve digital automotive marketing campaign measurement. The Challenge The case study unfolds against a backdrop familiar to many advertisers: a regional advertising agency representing an OEM sought to evaluate the performance of their CTV automotive marketing campaign. Their objectives were clear: Assess digital and TV campaign performance, attributing actual vehicle sales accurately. Pinpoint top-performing audience segments and offers, factoring in demographic and psychographic variations. Adapt marketing strategy based on real-time campaign performance metrics. The Solution Strategus took the helm, leveraging Experian’s OmniImpact for Automotive solution to navigate these goals. They crafted a programmatic campaign targeting previous buyers of a specific vehicle model within a targeted geographic region. Through CTV advertising, they heightened awareness among the targeted audience, ensuring maximum engagement. Joel Cox, co-founder and EVP of Innovation and Strategy at Strategus summarizes the value of this collaboration perfectly: “Strategus is thrilled to collaborate with Experian to offer this novel auto sales attribution solution. While we know the positive influence CTV advertising can play in driving auto sales, the measurement and attribution of those sales can be a murky and incongruent snapshot heavily reliant on assumption and incomplete first-party datasets. While Experian’s OmniImpact for Automotive campaign measurement solution has been available to the largest auto advertisers, this relationship between Strategus and Experian Automotive democratizes this comprehensive measurement solution to all auto-selling clients of Strategus, regardless of size or sales volume.” Click here to learn more about the specific results and how Strategus and Experian Automotive work together to optimize campaign focus. Conclusion In a digital age where data reigns supreme, collaborations like that between Strategus and Experian Automotive showcase the power of leveraging precise insights to drive campaign results and automotive sales. By combining innovative strategies with advanced analytics, advertisers can not only measure campaign performance accurately but also adapt in real-time to maximize impact. As automotive marketing continues to evolve, relationships such as these that prioritize precision and insight will undoubtedly shape the industry's future. Or

Over the past few years, we’ve seen in-market shoppers lean into the used vehicle space; however, with new vehicle inventory continuing to rebound, we’re starting to see a reversal of fortune. Data in the first quarter of 2024 shows how the resurgence of new vehicle inventory is reshaping the automotive landscape.

Mortgage lenders looking to attract first-time homebuyers must understand their needs, wants, and finances, especially as the economic environment and evolving generational trends shift. Understanding who this buyer segment is and what they buy unlocks growth potential for today’s attentive mortgage lenders. Financial diversity defines first-time homebuyers First-time homebuyers are searching for the attainable, which is not easy today. High interest rates, low housing inventory, and individual financial circumstances contribute to the hardships the housing market presents. Even with ups and downs and difficulties in the marketplace, first-time homebuyers continue to show their grit. Over two-thirds of first-time homebuyers have an annual household income over $90k, with 27% having household income over $180k. Additionally, Experian Housing research shows that 85% of first-time homebuyers have prime or super-prime credit scores. While credit and income play critical roles in evaluating borrower risk, they're not the only factors. The mortgage lending market is slowly leaning into the use of alternative credit data, such as rental payment information, to determine a borrower's creditworthiness. These changes are crucial in our industry's effort to support consumers on their journey towards homeownership. Financial realities impact property choices Experian Housing’s recent white paper looking at first-time purchasers shows over 85% buying single-family homes, with roughly 70% of these buyers belonging to Generation Y (Gen Y) and Generation Z (Gen Z). While starter homes suggest impermanence, Gen Y and Gen Z buying habits reflect their values and overall desire for stability. These motivated buyers that understand the economic woes, are adjusting and looking for options. More than three-fourths of first-time purchases are older homes, built before 2000. However, Experian’s same research showed sales of new construction homes (2021-2023) increased over the prior two years, particularly among first-time buyers. Builder credits and other incentives make new builds more appealing, and lenders leveraging their mortgage market expertise will be able to discuss options customized to the borrower, helping them make the decision best fitting their needs. Especially among younger generations, first-time homebuyers are considering different housing options in their path to homeownership. From multigenerational housing and co-owning a home with friends and family to smaller homes and moving further away for affordability reasons, options are on the table.1 Untapped potential for savvy lenders The modern mortgage landscape offers thoughtful lenders opportunities to drive growth. Diversity in the first-time homebuyer profiles means that lenders who distinguish themselves by tailoring their services to the borrower’s needs. This may include, but is certainly not limited to: Drawing on their knowledge of first-time homebuyer programs, grants and loans appropriate to the borrower. Improving their overall financial well-being with financial literacy education. Expertly guiding them through the complex lending process. Ensuring as swift and smooth a transaction as possible with timely and responsive communications. For more information about the lending possibilities for first-time homebuyers, download our white paper and visit us online. Download white paper Learn more 1 “Several Generations Under One Roof,” census.gov; “What to Know About Co-Buying A House,” myhome.freddiemac.com

In the previous episode of “The Chrisman Commentary” podcast, Joy Mina, Director of Product Commercialization at Experian, talked about the misconceptions associated with verifications and what organizations can do to enhance their strategies. In the latest episode, Experian's Ken Tromer and Jamie Norris discuss ways mortgage companies can optimize their business expenses and protect prospects. "The market has been asking for solutions to help with cost mitigation and lead protection for quite some time," said Jamie. "We've listened to the market and Power Profile Plus™ does just that." Listen to the full episode for all the details and learn more about Power Profile Plus™ for Mortgage. Listen to podcast Learn more

The morning kicked off with the buzz of innovation. Shri Santhanam, Financial Services and Data General Managers Platforms and Software, and leaders from Experian debuted the latest enhancements for the Experian Ascend Technology PlatformTM. The demo touted faster automation, seamless data integration, security and compliance, and simplified experience. Resiliency, security and gen AI capabilities are all core components and outputs of the new platform. Keynote speakers: Steffi Graf and Andre AgassiTennis icons Steffi Graf and Andre Agassi captivated the audience with stories of their memorable matches, how they met and their foray into pickleball. From notorious rivals to the pivotal moments that were part of their weeks at seeding in the number 1 position – 377 weeks and 101 weeks respectively. Keynote speaker: Jason SudeikisEmmy-award winning actor, comedian, writer and producer – and also known as the affable Ted Lasso – Jason Sudeikis had the crowd laughing reminiscing his favorite skits from his time at Saturday Night Live and outtakes from his numerous films. He talked about the impact of Ted Lasso and the origin of the “Believe” sign, as well as what’s ahead. Sessions – Day 2 highlights The conference hall was buzzing with conversations, discussions and thought leadership. Some themes definitely rose to the top — the increasing proliferation of fraud and how to combat it without diminishing the customer experience, leveraging AI and transformative technology in decisioning and how Experian is pioneering the GenAI era in finance and technology. Alternative dataAlternative data can be used to holistically measure a consumer's creditworthiness. Property data to banking insights to consumer-permissioned data and more can be a critical part of your strategies to segment, analyze and underwrite unbanked and new-to-credit consumers. EngagementEconomic headwinds and fierce competition in the banking industry have acquisition costs soaring, making it more important than ever to be critical of your organization’s advertising spend. Meanwhile, consumers are trending back toward the convenience of banking bundles, and they expect their financial institutions to help them improve their financial health. These conditions create a unique opportunity to extract value from digital experiences. CollectionsData, advanced analytics and machine learning are transforming all aspects of collections during a time when consumer debt pressure is building. Organizations can harness the power of data-driven insights, predictive modeling, enhanced segmentation and optimized decisions to ensure they have the strongest contact data and best collections strategy to reduce delinquencies and boost recovery rates. See you next year for Vision 2025!