There is a broad consensus that Basel III regulation will have a major impact on the average profitability for many banks.

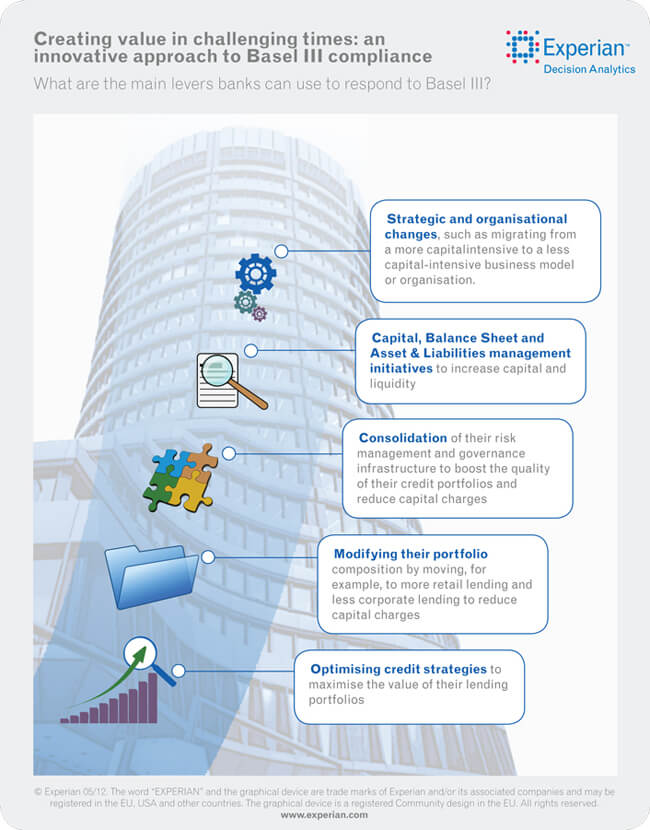

In the aftermath of the financial crisis of 2007 to 2010, there was general agreement that the global financial system needed reform. Under the Basel III framework, banks are forced to change the way they do business by keeping more capital on-hand and re-tooling its composition to ensure resilience under adverse economic conditions. Financial organizations are expected to react in several different ways to offset the negative impact of the regulation. Many of them will employ a top-down approach; however, an alternative, bottom-up approach focused on improving and optimizing their credit strategies is just as effective and can help banks create more value out of their existing portfolios.

Find out how to balance a complex array of business and regulatory drivers at the strategic and operational levels. Click here to download the white paper.