Protect your personal information with an online privacy scan

Your personal data could be at risk. Run a free Experian personal privacy scan to find out if your information is exposed.

No credit card required

Get your free Experian personal privacy scan

Why get a personal privacy scan with Experian?

Exposed personal info can put you at risk of identity theft, hacking, spam and robocalls.

We’ll let you know the next steps you should take to stay in control of your data.

Includes free credit monitoring with customized alerts and a free one-time dark web scan.

What can you do with a personal privacy scan?

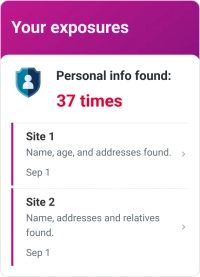

See where your information is exposed

See which people search websites, marketplaces and data brokers expose your private information and how much of your data is exposed.

See what personal information is exposed

Experian’s personal privacy scan can show whether your address, age, phone number, relatives and more are publicly available.

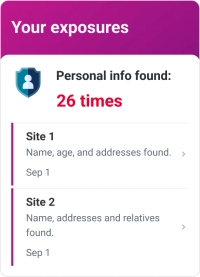

Keep your personal information private

Protect your privacy and security by removing your personal information from sites, when you upgrade your membership.

Reduce the risk of identity theft

Keeping your data off people search websites can safeguard your personal information, helping to protect from financial loss and damaged credit.

Take control of your personal information

The public web is a marketplace for people finder sites that can expose your personal info and sell your data to anyone.

Frequently asked questions

A personal privacy scan is a tool that scans people search sites to check where your information appears online and helps remove it for you. That can help you reduce the amount of information about you that appears online, which is a proactive way to protect your privacy and add a layer of protection against identity theft.

Exposed personal information could include your home address, phone number, email address, relatives, age and much more. This information can be used by robocallers, spammers or even identity thieves and hackers—putting your privacy and security at risk.

With Experian's personal privacy scan, you can see who has your data and what they are exposing about you. If you want greater control over your personal data, you can upgrade to activate recurring scans and get help with data removal for greater peace of mind.

With personal privacy scan, Experian will scan covered people finder sites and in a matter of minutes, present to you who has your information and what they are exposing about you.

Experian's personal privacy scan tool offers a one-time free scan that you can use to see what information may be exposed on people search and data broker sites. From there, you could choose to submit opt-out requests to each of the individual sites your information appears on by yourself. Or, Experian can provide you with assistance by submitting deletion requests on your behalf. Removal assistance requires a premium membership, which comes with additional features and benefits related to protecting your identity, credit and money.

People finder sites, also called people search sites, are websites that collect and sell personal information. People finder sites can be the top result when someone searches your name, which may enable anyone—including robocallers, spammers, hackers and identity thieves—to collect your information. This can leave you more vulnerable to identity theft and fraud.

People finder sites collect and store a surprising amount of information, and what exactly appears on a given person’s results will vary. Here are examples of information about you that could be available, for sale or for free, on people search sites:

- Name, previous names and aliases

- Age and gender

- Current and previous addresses

- Current and previous roommates

- Phone numbers and email addresses

- Marital status and divorce records

- Family members

- Social media profiles and other online activity

- Occupation and estimated income

- Political affiliations

- Education level

- Property records

- Criminal and civil records, including bankruptcies, liens and judgments

People search sites are run by companies that specialize in collecting and selling information. They mine data in a number of different ways, including:

- From local, state and federal public records

- Mining posts on public forums or on social media

- Buying information directly from companies, including other data brokers

There are a couple different ways you can check to see if your information appears on people search sites.

First, you can manually search your name in a search engine and look through the results for people search websites. Since other people searching you name may see similar results, this can give you a list of sites to target if you wish to request these sites delete your data. You can also search for your information on popular people search websites, including BeenVerified, FamilyTreeNow, FastPeopleSearch and PeekYou.

That said, you should be aware that manually searching for your information on people finder sites can take a lot of time. The sites above are only a small sample of the many people finder sites that could be selling your information without your consent. Since the process may be difficult and time consuming, it’s worth considering using an automated people finder site scan instead.

Experian’s personal privacy scan can handle the process of checking for your information on people finder sites for you. After locating where you information appears by scanning sites for your address, age, phone number, relatives and more, Experian will offer you insights on possible next steps to take based on where your data is exposed.

Removing your information from people search sites is a way of claiming control of your security and privacy. Here are some potential benefits:

- Keep your data out of the hands of identity thieves. Data brokers list information including your full name, date of birth and addresses online. Criminals may use this information to impersonate you and commit acts of financial fraud, for instance. Removing this information can boost your security.

- Reduce spam calls and texts. If your phone number appears on a people finder site, you may be burdened by an increase of spam and robocalls. Deleting your contact information from data repositories can help you cut down on unwanted calls and texts and protect yourself from scams.

- Maintain privacy. People search sites may list a slew of private data about you, including your phone number and address. Having this information out there could make anyone uncomfortable, and it’s an especially unwelcome burden if you’re worried about stalking or harassment. Removing this information may make you feel safer.

Removing your information from people search sites is one way to guard your sensitive data. Here are more ways to protect your personal information:

- Don’t post personal information online. Limit what you post on social media. Information that may seem innocent enough to you, such as your full birthday, maiden name, workplace or childhood street, could actually be used to impersonate you if they fall into the wrong hands. When in doubt, don’t post it.

- Review your accounts’ privacy settings. Review your social media accounts' privacy settings to limit who can view your profile information and your posts.

- Delete old accounts. Reduce your digital footprint by looking through old online accounts and deleting those that you no longer use. This can help reduce the odds that your information will be compromised in a data breach.

- Create strong passwords. Use a password manager to create strong passwords for each of your accounts, and avoid reusing the same password for multiple accounts. It’s also a good idea to enable multifactor authentication (MFA) for all of your accounts that offer it. MFA can offer an extra line of defense in the event that a hacker gets their hand on your password.

- Beware of phishing attempts. Scammers use social engineering tactics to attempt to trick victims into revealing sensitive information. To resist criminal attempts to defraud you, learn about signs of phishing and avoid engaging with anyone who asks you to share your personal data.

- Consider identity theft protection. Identity theft protection can help you monitor a range of databases for threats to your personal information. For example, Experian offers identity theft protection services that include a range of features such as dark web and court record monitoring, plus up to $1 million in identity theft protection coverage. Getting alerted to potential vulnerabilities and signs of fraud early can help you take proactive measures to secure your accounts and protect your identity.

Learn more about privacy